Universal Display Corporation (UDC) reported strong second-quarter results for 2024, showcasing significant revenue growth, strategic advancements in OLED technology, and an optimistic outlook for the future. The company achieved a revenue of $159 million, marking an 8% increase year-over-year (YoY) from $147 million in the second quarter of 2023. UDC’s operating profit reached $56 million, reflecting a 36% operating margin, while net income rose to $52 million compared to $50 million in the same period last year.

| Category | 2024 ($ in thousands) | 2023 ($ in thousands) |

| Material sales | 188,726 | 147,297 |

| Royalty and license fees | 127,819 | 119,609 |

| Contract research services | 7,219 | 10,126 |

| Total revenue | 323,764 | 277,032 |

| Category | 2024 ($ in thousands) | 2023 ($ in thousands) |

| Material sales | 188,726 | 147,297 |

| Cost of material sales | 69,587 | 58,058 |

| Gross margin on material sales | 119,139 | 89,239 |

| Gross margin as a % of material sales | 63% | 61% |

Material sales for UDC totaled $95 million, with green emitter sales at $71.6 million and red emitter sales at $22.5 million. Royalty and license fees amounted to $60 million, a slight decrease from $64 million in the prior year’s period. Adesis, a UDC subsidiary, generated revenue of $3.5 million compared to $5.1 million in the second quarter of 2023. The cost of sales stood at $38 million, translating to a gross margin of 76%. Operating expenses, excluding the cost of sales, were $64 million, primarily driven by increased stock-based compensation and investments in personnel and infrastructure. UDC ended the quarter with $879 million in cash and investments.

UDC continues to expand its OLED technology portfolio, experiencing growing adoption across IT and consumer electronics sectors. The OLED IT market saw notable growth with the introduction of OLED tablets by leading OEMs like Apple and Microsoft, while companies like Samsung and Dell also launched new OLED products.

The company also made progress in developing a commercial phosphorescent blue emissive system, though the timeline for meeting commercial entry specifications has been extended by a few months. Despite the delay, customer interest and engagement remain strong according to CEO Steven Abramson.

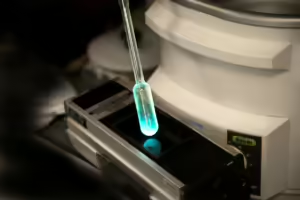

UDC has also seen notable investments in new OLED fab facilities, with Samsung, BOE, and Visionox announcing significant investments in OLED IT and automotive production. The company is committed to advancing its research and development efforts, focusing on next-generation red, green, and blue phosphorescent materials. One of its notable R&D advancements is OVJP technology, which demonstrated a printed red, green, and blue OLED device with 8K resolution.

UDC revised its revenue guidance for 2024, projecting it to be between $645 million and $675 million. The company also announced a quarterly dividend of $0.40 per share, reflecting its positive cash flow generation and commitment to returning capital to shareholders.

During the Q&A session on its investor call announcing the results, UDC addressed the delay in the commercialization of phosphorescent blue, attributing it to the complex final stages of development. However, they noted that strong customer interest and engagement continue. UDC also discussed its confidence in maintaining a competitive edge in OLED materials, asserting that no current materials on the market match their quality.