Universal Display Corporation reported a record-breaking financial year for 2024, with full-year revenue reaching approximately $647.7 million, up from $576.4 million in 2023. The strong performance was driven by increased material sales, which climbed from $322.0 million to $365.4 million, and higher royalty and license fees that rose from $238.4 million to $266.8 million. The company attributed the rise in material sales primarily to strengthened demand for its emitter materials, even as changes in customer mix moderated some of that growth.

| Revenue comparison ($thousands) | 2024 | 2023 |

| Material sales | 365,419 | 322,029 |

| Royalty and license fees | 266,820 | 238,389 |

| Contract research services | 15,445 | 16,011 |

| Total revenue | 647,684 | 576,429 |

In the fourth quarter, the company’s total revenue reached $162.3 million, compared to $158.3 million in the same period last year. Material sales in Q4 increased significantly to $93.3 million from $82.2 million, reflecting robust demand for its high-performance emitter products. However, revenue from royalty and license fees declined to $64.4 million from $72.9 million, largely due to reduced cumulative catch-up adjustments and shifts in customer mix. Despite these fluctuations, the overall gross margin remained steady at 77% for both the quarter and the full year.

| Cost of materials comparision ($thousands) | 2024 | 2023 |

| Material sales | 365,419 | 322,029 |

| Cost of material sales | 137,006 | 123,076 |

| Gross margin on material sales | 228,413 | 198,953 |

| Gross margin as a % of material sales | 63% | 62% |

The cost structure also reflected the increased volume, with cost of material sales in the full year rising to $137.0 million from $123.1 million, and in the fourth quarter, to $34.2 million from $33.4 million. These changes yielded a gross margin on material sales of 63% in 2024, up from 62% in 2023 for the full year, and 63% in the fourth quarter compared to 59% the previous year.

On the expense side, Universal Display recorded $8.9 million in restructuring costs in Q4 related to the planned closure of its OVJP California operations, and $6.7 million in foreign currency exchange losses tied to a tax receivable denominated in Korean Won. For the full year, these adjustments totaled $8.9 million in restructuring costs and $7.2 million in foreign exchange losses, which together contributed to a modest reduction in diluted earnings per share. Despite these headwinds, operating income for the full year increased to $238.8 million from $217.2 million, although Q4 operating income was lower at $52.5 million compared to $64.7 million in Q4 2023. The effective income tax rate edged up slightly to 18.4% for 2024 from 17.2% in 2023, while in Q4 it was 16.8% compared to 18.0% the previous year.

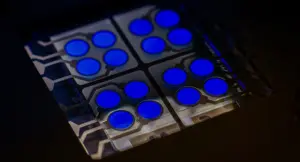

Looking ahead, Universal Display expects its 2025 revenue to fall within the range of $640 million to $700 million. The company noted that the OLED industry remains subject to various external factors that could materially affect results. Amid continued investment in next-generation phosphorescent materials, including its ongoing development of blue emitters, which could potentially boost display efficiency by up to 25%. The company has secured long-term, multiyear agreements with key industry players and is well positioned to benefit from increased OLED manufacturing capacity as major players like Samsung, Visionox, and BOE ramp up new production facilities.