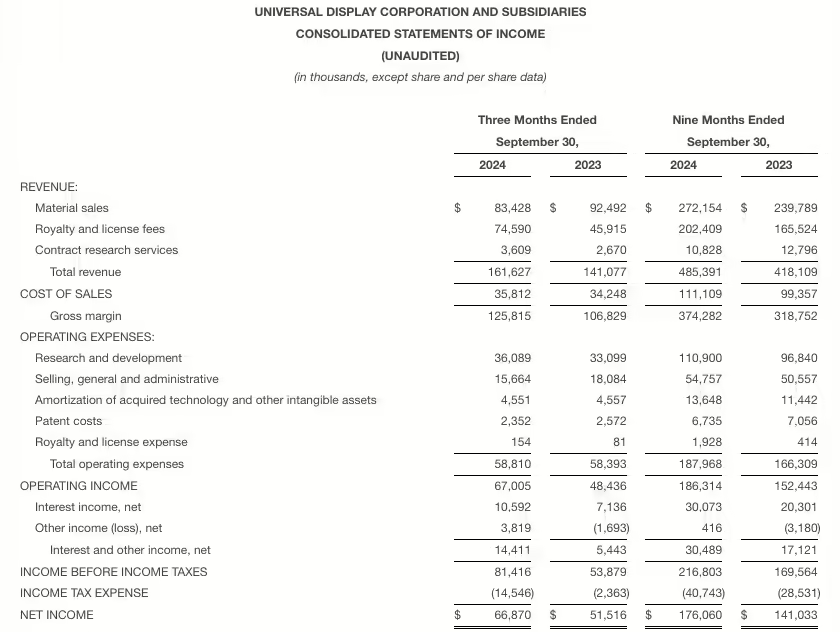

Universal Display Corporation (UDC) reported third-quarter financial results in its earnings call last week. CEO Steve Abramson and CFO Brian Millard discussed UDC’s Q3 revenue of $162 million and a net income of $67 million. This brings the company’s year-to-date revenue to $485 million, a 16% increase over the prior year. Although UDC started 2024 on a high note, the company has revised its full-year revenue forecast to a range of $625 million to $645 million due to adjusted customer expectations for Q4.

In the recent quarter, material sales contributed $83.4 million to revenues, down from $92.5 million in the prior year, impacted by fluctuating consumer purchasing patterns. Revenues from Green emitters decreased to $62.6 million from $68.9 million, while Red emitter sales dropped to $20.1 million from $22.1 million year-over-year. In contrast, royalty and license fees experienced significant growth, rising to $74.6 million from $45.9 million. Contract research services generated $3.6 million in revenue, up from $2.7 million in the previous year.

| (In thousands) | 2024 | 2023 |

| Material Sales | $272,154 | $239,789 |

| Royalty and License Fees | $202,409 | $165,524 |

| Contract Research Services | $10,828 | $12,796 |

| Total Revenue | $485,391 | $418,109 |

| (In thousands) | 2024 | 2023 |

| Material Sales | $272,154 | $239,789 |

| Cost of Material Sales | $102,759 | $89,697 |

| Gross Margin on Material Sales | $169,395 | $150,092 |

| Gross Margin Percentage of Material Sales | 62% | 63% |

Abramson emphasized UDC’s optimistic view of the OLED market’s potential, particularly in the IT, automotive, and consumer electronics sectors. Throughout the third quarter, UDC maintained a gross margin of 78% and expects full-year margins to fall between 76% and 77%. Operating expenses for Q3, excluding costs of sales, reached $59 million. The company’s operating income of $67 million reflected an operating margin of 41%. A quarterly dividend of $0.40 per share was announced, payable on December 31, 2024. UDC cited ongoing investments in OLED production facilities, highlighting nearly $20 billion allocated to Gen 8.6 OLED plants, aimed at supporting new technologies and increasing production capabilities. Recent developments included the completion of Visionox’s Gen 6 Flexible OLED module factory, which will support production for both IT and automotive OLED modules.

UDC also reported substantial interest in its research and development projects, particularly in its ongoing efforts to create a commercial phosphorescent blue emissive system. While the commercialization timeline remains uncertain, the development has generated positive reception among customers. Additionally, Abramson noted that OLED displays and taillights are increasingly being integrated into automotive designs by manufacturers such as Audi, Lotus, and Zeekr, who recently unveiled models with this technology.

In the Q&A session, UDC executives discussed factors impacting the downward revenue revision for Q4. They attributed the adjustment to various factors, including shifts in consumer sentiment, geographic economic conditions, and customer inventory reassessments. In response to questions about phosphorescent blue OLED development, Abramson confirmed ongoing collaborations with customers but refrained from providing a specific adoption timeline. CFO Brian Millard highlighted the positive trajectory for the OLED market and reiterated that customer forecast adjustments were temporary.