The global TV market is recovering, with TV set shipments increasing in 2024 after a decline in 2023. Strong demand growth was observed in Q4 2024, primarily driven by the premium TV segment. Competitive OLED TV pricing introduced by Samsung and LG Electronics, along with the availability of extra-large LCD TVs with MiniLED and Quantum Dot (QD) technology from TCL and Hisense at lower costs, contributed significantly to this growth. Despite this positive momentum, uncertainties remain due to potential tariff impacts, concerns about a glass shortage in 2025, and broader global economic factors.

TV Market: Demand Starting to Recover

According to Counterpoint Research’s (2025) press release, “Global TV shipments in Q4 2024 grew 2% year-over-year (YoY) to reach 61 million units, marking the third consecutive quarter of YoY increases. Annual TV shipments in 2024 reached 230 million units, also up 2% YoY.” A press release by Omdia (2025, February 27) similarly reported strong growth in the global TV set market in Q4 2024, driven by OLED and 80”+ LCD sales. Patrick Horner, Practice Leader for TV Set Research at Omdia, noted, “The TV sets market is increasingly a battle between ultimate picture quality and immersive screen size. In North America, consumers can choose between a 65” OLED TV set or a 98”/100” LCD TV at a similar average selling price. OLED technology is being aggressively marketed by industry leader Samsung, while Chinese brands are driving competitive pricing in the extra-large LCD segment.”

Large-Size TVs: Getting Extra Large

A recent Omdia study of 3,000 U.S. consumers found that 57% were interested or very interested in a 98” LCD TV, with price being the only real obstacle. By fall 2024, the average selling price of 98” and 100” LCD TVs in the U.S. had dropped to around $1,500. According to Omdia, shipments of 80”+ TV sets grew by 24.5% YoY in Q4 2024, making this the fastest-growing size segment in the region.

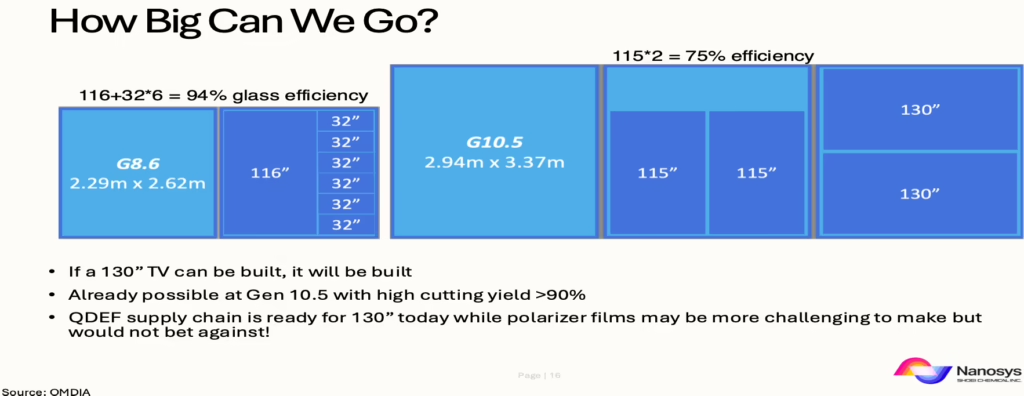

Bob O’Brien, co-founder of DSCC (Counterpoint Research), wrote in a March 10 blog post that the global 2% YoY growth in Q4 2024 was driven by larger screen sizes. TVs under 70” (which account for 86% of all shipments) saw a 1% YoY decrease in volume and a 4% decrease in revenue. In contrast, shipments of 70”–79” TVs grew by 8% YoY, 80”–89” grew by 56%, and 90”+ shipments surged by 118%. Production of extra-large LCD TVs is no longer a barrier. Jeff Yurek, Vice President of Marketing at Nanosys, presented a chart from Omdia at SID-LA showing that a 10.5 Gen LCD fab can produce two 130” TV panels with a high cutting yield of 90%. He added, “QDEF supply chain is ready for 130” today. Polarizer films may be more challenging to make, but I wouldn’t bet against it!”

MiniLED LCD TV: Growth Accelerating

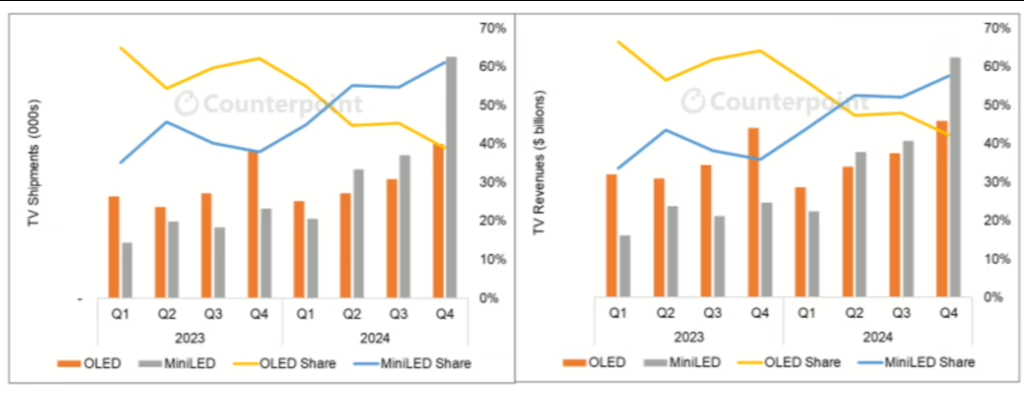

According to Counterpoint Research (2025), “Shipments of premium TV models—including QD-MiniLED, QD-LCD, NanoCell, LCD 8K, QD-OLED, WOLED, and MicroLED—grew 51% YoY to reach a record high. For the full year 2024, shipments increased by 38% YoY.” In particular, MiniLED LCD TV shipments grew by over 170% YoY, surpassing OLED TV shipments starting in Q2 2024. QD-LCD TVs also saw a 46% YoY increase, surpassing 5 million units in quarterly shipments. O’Brien (2025) reported, “TCL and Hisense surged in the TV market in Q4 2024 with a MiniLED storm. MiniLED’s share of the ‘super premium’ segment rose to an all-time high of 61% in shipments and 58% in revenue.”

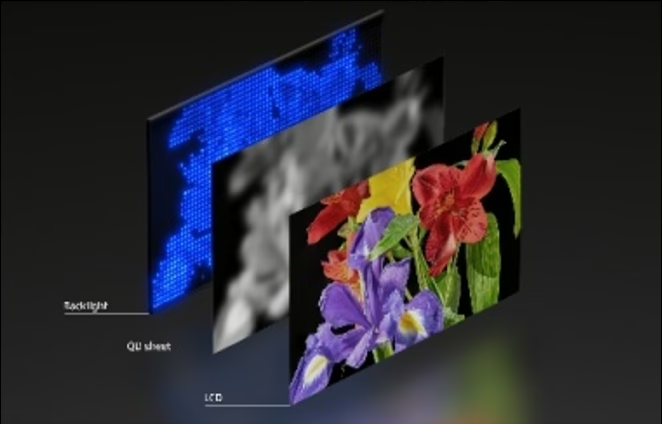

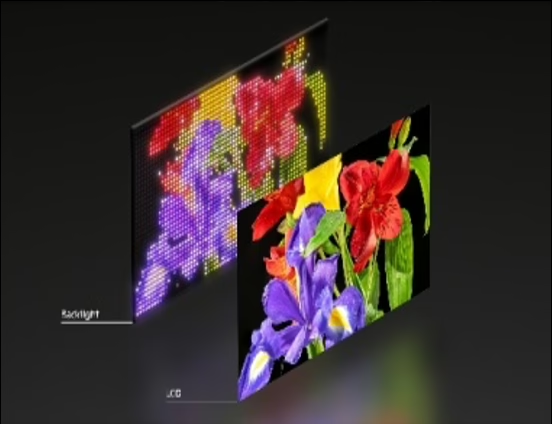

MiniLED QD LCD TVs benefit from significant cost advantages due to 10.5 Gen LCD production capacity in China for 65” and larger displays. These TVs combine MiniLED backlighting with QDEF (quantum dot enhancement film), achieving wide color gamut, high brightness, and immersive HDR while remaining power-efficient. As QDEF film costs have decreased, this combination now competes more effectively with OLED. According to Yurek of Nanosys, “Shoei’s acquisition of Nanosys has ushered in a new era for QD. Our combined manufacturing capacity is now fully operational, exceeding 40 million TVs per year. Improved environmental stability of QD solutions has also reduced packaging costs.”

OLED TV: Demand Improving

The premium TV market features a three-way competition between MiniLED QD, QD-OLED, and White OLED TVs. Samsung Display is the sole QD-OLED panel supplier; LG Display continues to supply White OLED panels, while multiple manufacturers now offer MiniLED-based LCDs. OLED TVs are thinner, lighter, and provide faster response times, wider viewing angles, higher contrast, and richer color saturation. They also tend to be more energy-efficient than LCDs.

After consecutive declines in 2022 and 2023, OLED TV demand rebounded in 2024. Omdia (2025, February 27) reported that Q4 2024 OLED shipments reached 2 million units, the highest since Q4 2022, representing 12.6% YoY growth. Samsung Electronics began procuring WOLED panels from LG Display in early 2024. Although OLED production costs remain high, they are expected to decrease as depreciation occurs at LG Display’s China fab (2025) and Samsung Display’s QD-OLED fab (2026).

OLED screen sizes are expanding with multi-model glass (MMG) production in 8.5 Gen fabs. LG Display introduced fourth-generation primary RGB tandem OLED technology, which enhances peak brightness by 33% (up to 4000 nits), improves color brightness by 40% (2100 nits), and reduces power consumption by 20% compared to previous models. Samsung’s 2025 QD-OLED panels also achieve >4000 nits using new panel driving technology and materials, 30% brighter than the previous year’s models.

RGB MiniLED LCD TV: Coming Soon

LCD TV makers are beginning to adopt RGB MiniLED backlighting to enhance image quality and energy efficiency. In March 2025, Sony announced a new display system that uses independent RGB LED drive technology for large screens. The system allows separate control of red, green, and blue LEDs, enabling a wide color gamut, color volume expansion, >4000 nits brightness, wide dynamic range, and accurate color reproduction. A prototype was showcased in Tokyo.

Hisense and TCL also introduced RGB LED-based LCD TVs at CES 2025. While most current MiniLED TVs use a blue backlight with QD film, the new RGB MiniLED TVs employ individually controlled RGB LEDs for better visual performance. Samsung showcased an 8K prototype using RGB MicroLED backlighting, delivering more vibrant color and 20% lower power consumption. Yurek noted, “RGB MiniLED LCD TV has the potential to improve both image quality and efficiency. However, brands say the cost may be double that of QDEF backlight. Additionally, color crosstalk can limit maximum gamut in real content, whereas QDEF provides more consistent performance.”

TV demand rose in 2024, driven by more competitive OLED pricing and the availability of extra-large MiniLED and QD LCD TVs. China’s device renewal program also supported demand. Both OLED and LCD TV technologies are advancing rapidly, becoming bigger, brighter, and better. However, on the supply side, Omdia predicts constrained display glass availability in 2025. Additionally, new tariffs in various countries could disrupt supply chains and increase global TV prices, creating uncertainties for future growth.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com.