DSCC has released its Q4 2018 update of our Advanced TV Display Cost Report, with updates to all of the OLED and LCD cost outlines plus the first cost model for Samsung Display’s quantum dot OLED (QD OLED) product, as well as analysis detailing the cost advantages LG Display will realize in implementing Multi-Mode Mother Glass (MMG) technology.

The cost report provides detailed cost profiles of 36 distinct LCD products and 20 distinct OLED products, ranging in size from 55” to 77”, manufactured on Gen 8.5 and Gen 10.5 in China and Korea (plus Gen 7.5 for 75” in Korea). In LCD, the report covers standard LCD, plus products using Quantum Dot Enhancement Film (QDEF) and Quantum Dot on Glass (QDOG), while in OLED the report covers the current White OLED (WOLED) product and RGB OLED with inkjet printing, and new this quarter a view on QD OLED.

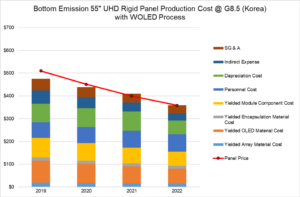

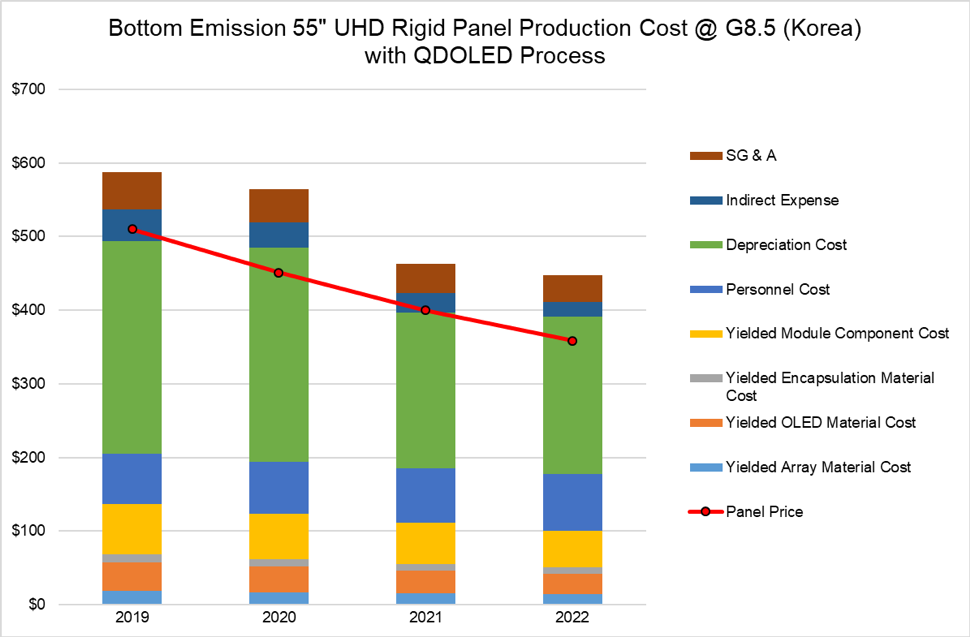

The next two charts show that QD OLED, at least in its initial configuration, is going to be expensive to make. The first chart shows the cost profile of 55” UHD WOLED on Gen 8.5 in Korea, and the next chart shows its QD OLED competitor. We base our initial expectations that panel prices for the two products will be the same; although it’s conceivable that QD OLED could command a slight price premium based on better color performance, the price in early stages is likely to be opaque, since it will be sold only via internal transfer from Samsung Display to Samsung VD.

Cost / Price for 55” UHD White OLED on Gen 8.5 in Korea

Source: DSCC Advanced TV Cost Report

While we expect that LGD will be able to make this 55” UHD product profitably in Korea in 2019-2020, the QD OLED product will be unprofitable on a full-cost basis due to heavy depreciation expenses. We expect that WOLED will be made at an operating margin of 7% in 2019 with a cash margin of 23%, and although the operating margin turns negative by 2021 with price declines, the product still brings cash margins of 19%.

Cost / Price for 55” UHD White OLED on Gen 8.5 in Korea

Source: DSCC Advanced TV Cost Report

The huge depreciation costs for QD OLED are a result mostly of the TFT backplane, as the initial product will require 12 TFT masks, according to our sources. This creates a massive discrepancy between the full cost and the cash cost, so that while we project an operating margin loss in 2020 of -25%, cash margins on the product will be +40%. Our sources indicate that SDC is considering improvements that would reduce the number of TFT masks from 12 to 8, which would considerably reduce the depreciation expense.

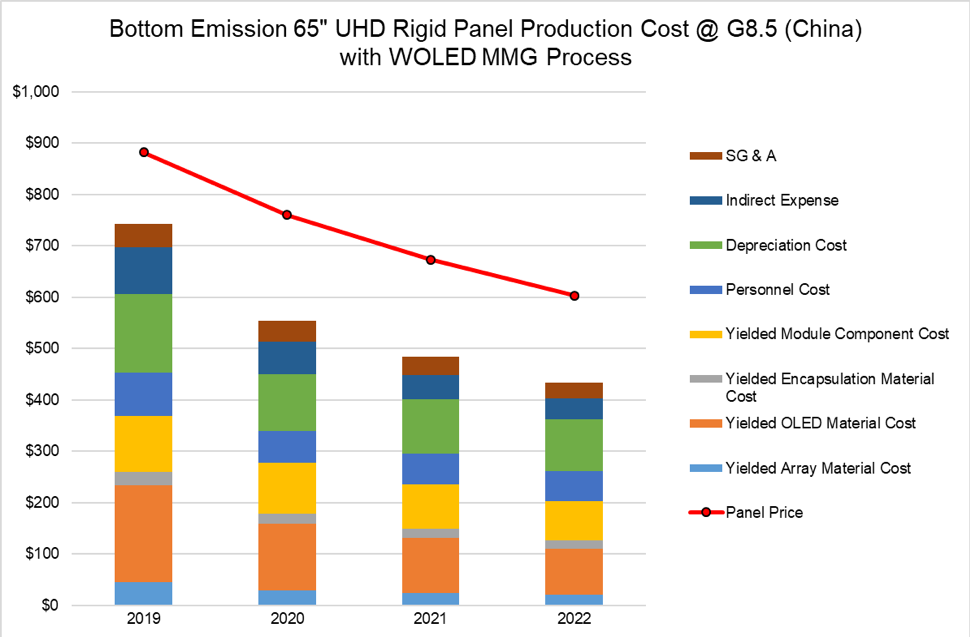

Also in the Q4 update we provide a look at the great advantages LGD will incur when they introduce MMG for 65” product. MMG will allow LGD to make 3x 65” panels plus 2x 55” panels on a single Gen 8.5 substrate, as opposed to the current case where they can make only 3x 65” panels. In other words, it’s like getting two 55” panels for free (though of course this only applies for the backplane and frontplane materials; module materials like ICs and polarizers still incur costs).

The result is shown in the next chart showing 65” MMG production in China. MMG may be introduced on the Gen 8.5 lines in both Korea and China, but we believe that it will be introduced first in China. There, LGD will benefit not only from the cost reductions of MMG, but also from the subsidies in China that reduce depreciation, personnel and indirect costs substantially. As a result, we see this as a very profitable product for LG Display, with operating margins of 27-28% in 2020-2022 and cash margins exceeding 40%, even with double-digit panel price drops every year.

Cost / Price for 65” UHD White OLED on Gen 8.5 in China Using MMG

Source: DSCC Advanced TV Cost Report

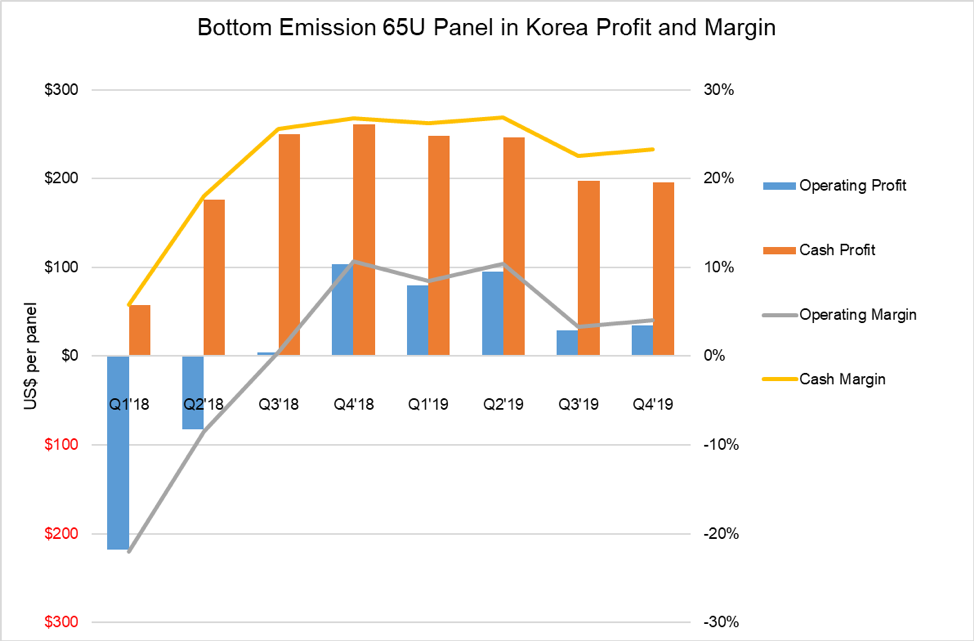

In addition to these new cost models, in the Q4 update of the cost report we provide a refresh on the operating profit of WOLED products 55” and 65”. As described in my article a few months ago about the report, LG Display made dramatic improvements in profitability for WOLED during Q2 – Q3 2018, with substantial cost reductions, the end of market development funds, and even an increase in prices, to improve from large operating losses in Q1 2018 to substantial operating profits in Q4 2018.

We expect that Q4 2018 represents the peak for WOLED profitability, as shown on the next chart, although it would be fair to call it a plateau rather than a peak, because WOLEDs will continue to be profitable throughout 2019 and 2020. The smaller 55” panels show a similar picture for profitability. These profits will help LG Display weather the continuing downturn in LCD panel prices, and help LGD continue investment to grow OLED capacity.

Operating & Cash Margins for 65” UHD Panels, 2018-2019

Source: DSCC Advanced TV Cost Report

As noted above, subscribers to the Advanced TV Cost Report receive cost profiles of all major product configurations competing in the premium TV space in both LCD and OLED. The report includes Excel files with the detailed cost models in tables and in graphical form, and a Powerpoint which outlines the main findings of this quarter’s update. The Powerpoint includes comparisons of competing technologies (such as WOLED vs. Inkjet Printing, or LCD vs QDEF) and differing manufacturing platforms (Korea vs. China, Gen 8.5 vs. Gen 10.5). DSCC Weekly Review readers interested in subscribing to the Advanced TV Cost Report should contact [email protected].