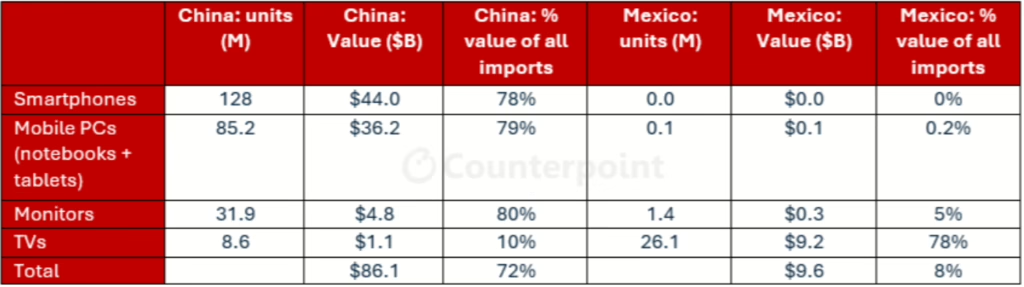

According to the analysis by Counterpoint using US International Trade Commission data, approximately 80% of US smartphones, mobile PCs, and monitors are imported from China, while around 80% of TVs come through Mexico. With the 10% tariff on Chinese goods already in place and a possible 25% tariff on Mexican imports looming, there is concern that the resulting tariff bomb will drive up prices on finished display products in the US market.

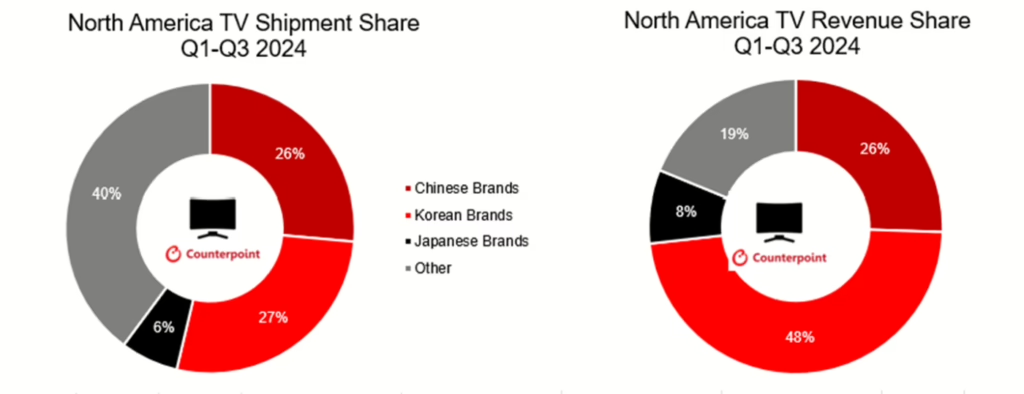

The impact of these tariffs varies across the whole display industry. In North America, Korean TV brands such as Samsung and LG, which enjoy a premium market position and account for nearly half of TV revenues, might be hit harder compared to Chinese brands, which hold a lower share of premium revenue despite similar shipment volumes. Chinese manufacturers like TCL and Hisense, while targeting the premium segment, may have less revenue resilience due to their focus on lower price points.

In response to the tariffs, manufacturers are considering supply chain diversifications. Chinese companies, for instance, might shift production from regions affected by the tariffs to alternative locations such as Europe and Southeast Asia. Korean firms, meanwhile, are evaluating options that include increasing production in these regions or even establishing facilities in the US to mitigate the tariff impact.

Adding a geopolitical twist, the Chinese government has announced plans to issue special long-term bonds, part of which could be used to subsidize key consumer goods. Such measures might help Chinese companies maintain stable prices despite tariff increases, potentially reducing the intended neutralizing effect of the tariffs and risking further escalation of the tariff war.