The global LCD TV market had a dismal 2015. Rising prices of imports caused by currency depreciation was a major force that dragged down consumer spending in Europe and the emerging markets. As a result, the European LCD TV market was too weak to help sustain the overall demand as anticipated, and sell-through in the emerging markets kept falling throughout the year.

China, another major market, was also seeing slowing demand and the overall sales results there were also far below expectations. According to the latest reporting by WitsView, a division of TrendForce, global shipments of LCD TV sets for 2015 totaled 215 million, down 0.6% from 2014 and representing a decline for the first time since 2013.

WitsView Research Manager Ricky Lin said 2016 will be a year of mixed blessing for the LCD TV market. “Presently, the biggest concern is the interest rate hike by the U.S. Federal Reserve,” Lin noted. “This would further erode consumers’ purchasing power in markets with weak currencies and in turn could cause a heavy impact on TV shipments.”

On the other hand, the recent decline in LCD panel prices may boost the profitability of TV sets. “Brands could lower their manufacturers’ suggested retail prices (MSRP) to reflect the falling panel costs, thus bringing about a surge of TV buying during the coming peak season,” Lin added. Large-size LCD TVs, for instance, have become economical for consumers, and the reduction in their prices will spur the demand to replace small-size sets with large ones. WitsView’s estimates that shipments of LCD TVs for the entire 2016 will reach 222 million sets, up 3.3% year on year.”

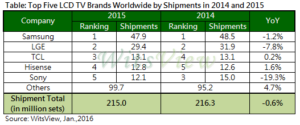

South Korean brands Samsung Electronics and LG Electronics held on to their respective first and second place positions in the global shipment ranking for 2015, though both also posted annual declines. The leader Samsung shipped 48 million sets, down 1.2% from a year ago; while LGE shipped 30 million, down 7.8%. With the currencies of the emerging market still being weak, Lin expects major TV brands to scale back their shipments and reduce their inventory levels as to minimize the losses caused by the foreign exchange differences.

China-based brands TCL and Hisense both jumped in the shipment ranking by one spot and overtook Japan’s Sony. TCL became the No. 3 LCD TV brand worldwide with of 13.1 million sets shipped, showing a slight year-on-year increase of 0.2%. Hisense climbed to the fourth place with 12.8 million sets shipped, up 1.6% from 2014. In addition to being supported by domestic demand, Chinese brands also acquired other well-known international brands as part of their overseas strategies. With these acquisitions, they have raised their brand awareness globally and will be able to access new export channels later on.

Sony was knocked down to fifth place in the ranking with 12.1 million sets shipped in 2015, amounting to an annual decline of 19.3%. Since Chinese and South Korean brands produce TV sets at much lower costs, Sony is now focusing on raising the product margins rather than shipment growth as its main goal.

For top 5 LCD TV brands ranking table and more details, please visit http://press.trendforce.com/press/20160128-2295.html