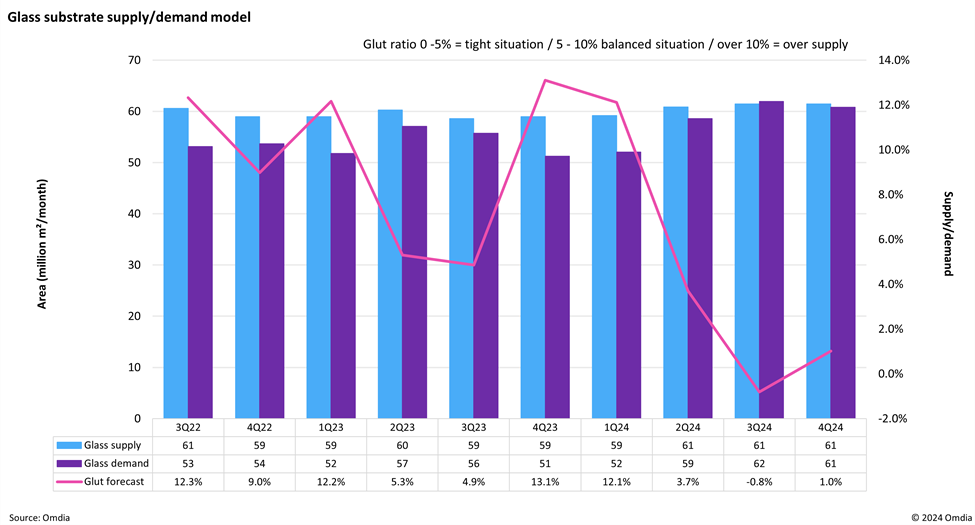

According to Omdia, the display glass market is expected to experience a tight supply-demand balance from the second quarter to the fourth quarter of 2024. The firm warns that minor accidents or sudden order spikes could lead to a significant glass shortage during this period, driving up prices.

Tadashi Uno, Research Manager for Display Components and Cost at Omdia, notes that display glass manufacturing is a typical heavy industry, and major display glass makers such as Corning, AGC, and NEG traditionally maintained a two-month inventory to account for the lengthy recovery process in case of glass tank accidents. However, with display glass prices falling for many years and recent energy cost inflation impacting the financial results of glass makers, companies like Corning have raised glass prices in 2023 and are seeking further increases in 2024, with other makers following suit.

In an effort to control capacity and optimize profitability, glass makers are aligning their production to shipment areas. AGC nearly finished display glass production in Japan in 2023, while NEG closed its Korean factory in the same year. Chinese domestic glass makers, on the other hand, are accelerating investments in new glass tanks, with plans to invest in over 30 tanks from 2022 to 2025.

Despite the potential for these investments to alleviate concerns about display glass supply/demand tightness in 2024, Uno cautions that it will take Chinese producers three to five years to increase their market share at Gen 8.6/8.6 lines, despite the rapid increase in Chinese FPD glass capacity.

The increasing demand for OLED displays has led to heightened levels of demand for LTPS and LTPO substrate and carrier since the third quarter of 2023. However, both AGC and NEG have faced challenges with LTPS glass production recently, prompting both manufacturers to change an-Si glass tanks to LTPS glass production. These glass tank allocation changes are now causing tightness in the total glass supply, a situation that would not have significantly impacted the market more than five years ago due to inventory and capacity room.