According to DSCC’s latest report, the display industry is performing exceptionally well. Display companies saw a strong rebound in Q2 2024, with total revenues rising 12% QoQ and 10% YoY to $26.2 billion, signaling a recovery after the seasonal slowdown in Q1.

EBITDA for the industry surged by 30% QoQ and 131% YoY, reaching $3.6 billion, indicating enhanced operational efficiency across many companies. Operating cash flow also improved, with LG Display (LGD) turning around its negative cash flow from Q1.

Companies focused on large-area LCD displays benefited from rising panel prices and strong demand, while those concentrating on smaller displays, such as for smartphones, reduced losses or reported weaker results. For instance, HannStar experienced its worst results in over a decade.

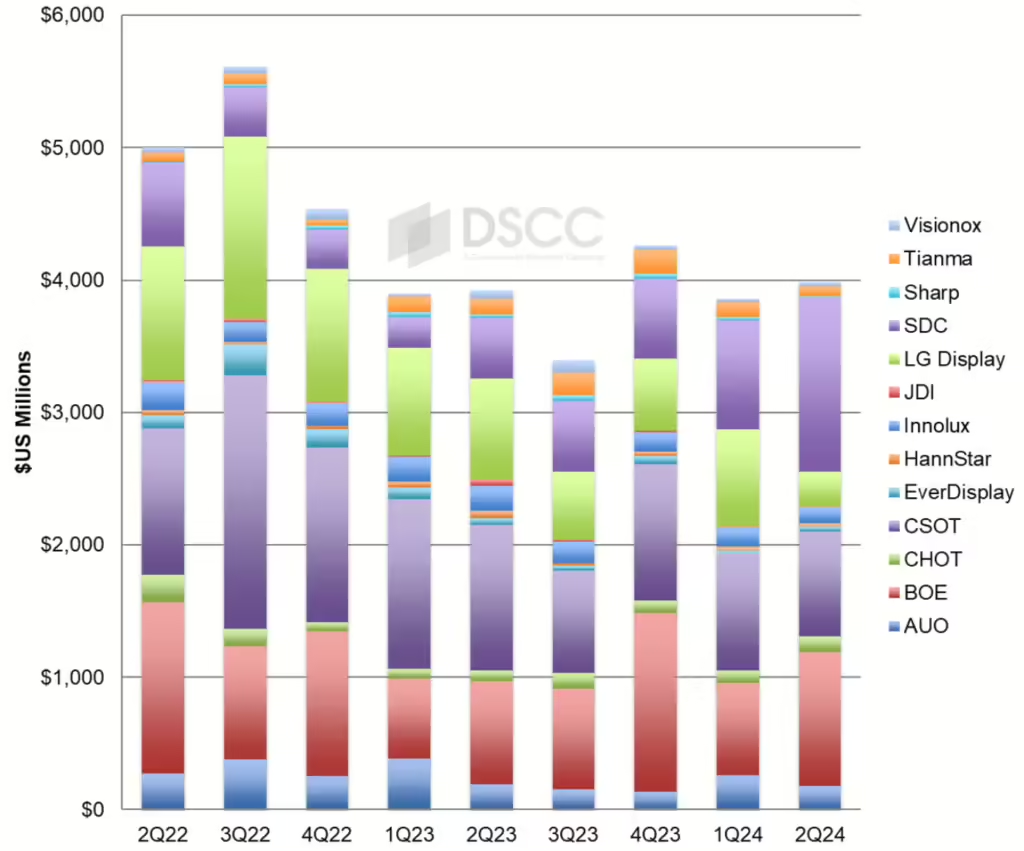

Samsung Display (SDC) reclaimed the top spot in display industry revenues, with a 38% QoQ increase and an operating profit of $736 million. BOE also showed improvement, though only by 2% QoQ, maintaining its position as a key player behind SDC. Other companies like CSOT, CHOT, and Innolux posted net profits, while smaller-screen-focused companies such as HannStar and Japan Display continued to struggle.

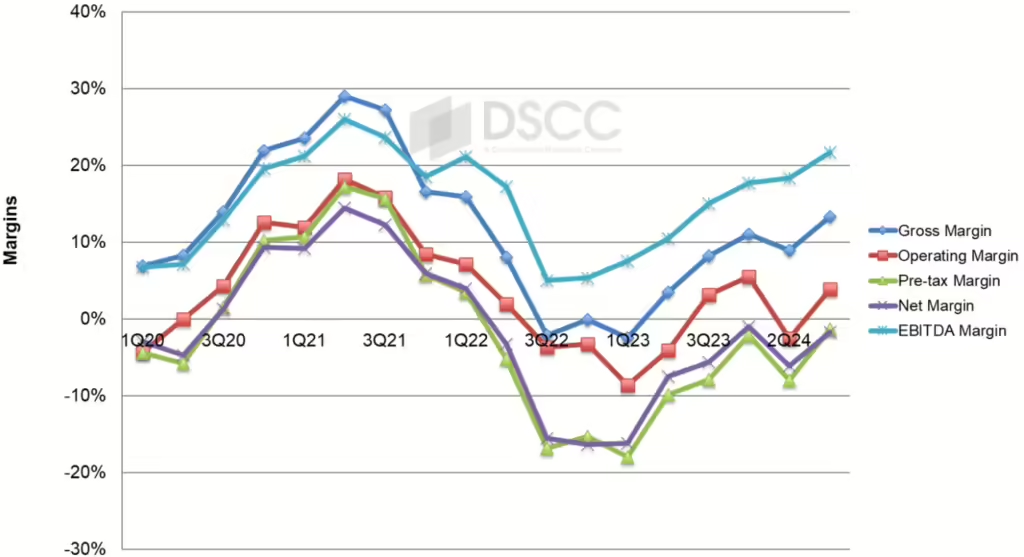

The industry recorded an operating profit of $900 million in Q2, with six of the 13 panel makers reporting profits. However, Samsung’s success accounted for much of this growth. Despite the positive performance in operating profit, the display industry still reported a net loss of $275 million, marking the ninth consecutive quarter of losses. Nevertheless, the net loss improved both QoQ and YoY, indicating signs of recovery.

Capital expenditures (capex) in the display industry increased slightly to $4.0 billion in Q2, with Samsung Display and BOE leading in investments, showcasing their focus on maintaining or expanding their market leadership.

The Q2 2024 performance points to a modest recovery, particularly in large-area displays, but there are still some structural challenges hanging around. Ongoing net losses and struggles in the small-display market continue to be issues. While the industry has bounced back from its roughest patch, it’s still dealing with hurdles like managing inventory, falling LCD prices, and uneven performance across sectors. Compared to the big boom during the pandemic in 2020-2021, this recovery is slower and less consistent. Things are getting better the industry is not out of its down cycle quite yet.