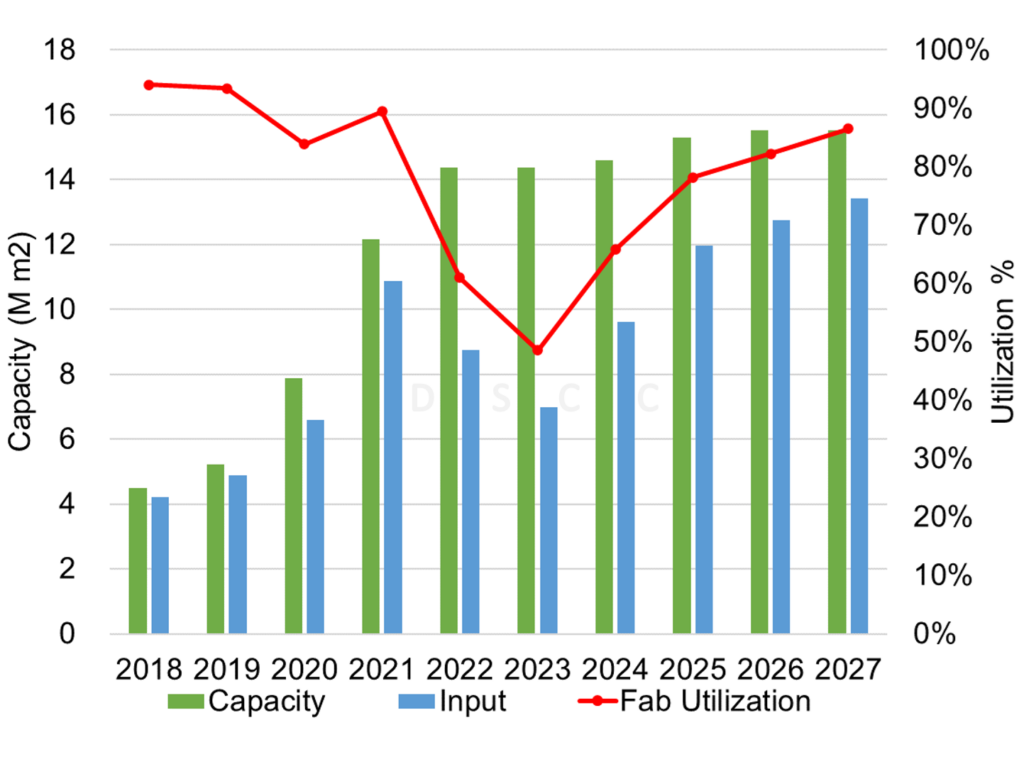

DSCC expects the oversupply environment for displays to continue into 2024, although there will be a modest recovery in demand which will reduce the gap between supply and demand.

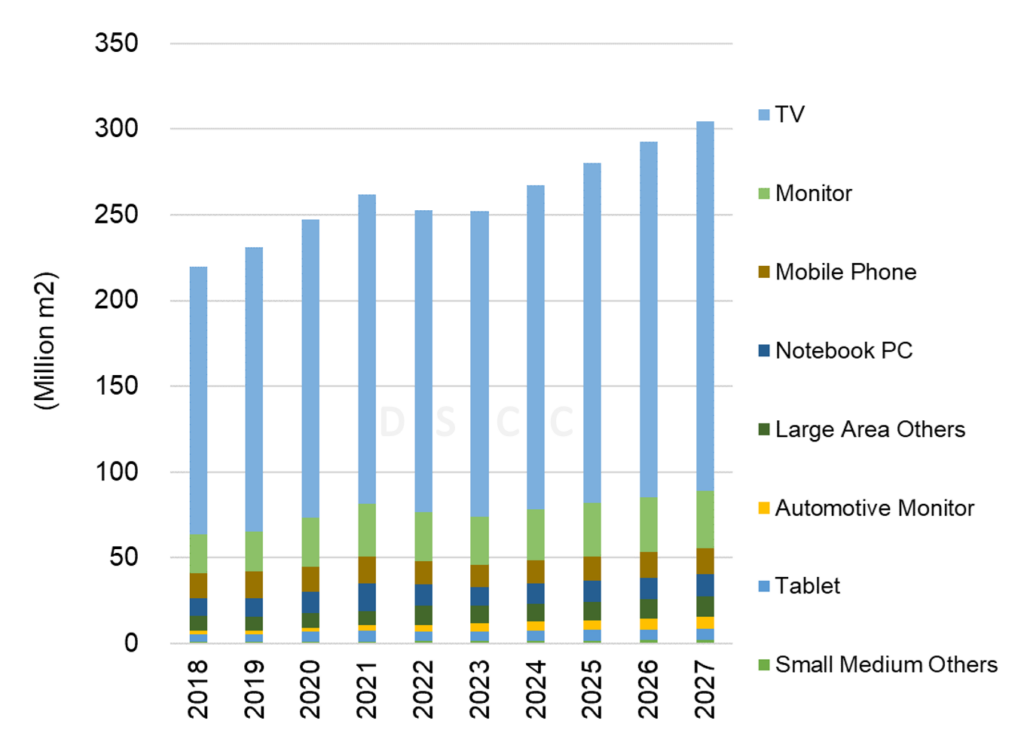

DSCC forecasts display demand area to grow at a 5% CAGR from 2024-2027 to reach 305M m2 in 2027, after decreases in 2022 and 2023. TVs will continue to represent a large share of display demand. TV panel area demand growth is expected to come from incremental unit growth of 1-2% per year and increasing average screen size from 48.2″ in 2023 to 51.6″ in 2027. LCD is expected to see area growth of 4% CAGR from 2023-2027 to 280M m2, while OLED demand area is expected to grow 18% CAGR over the period to 24M m2.

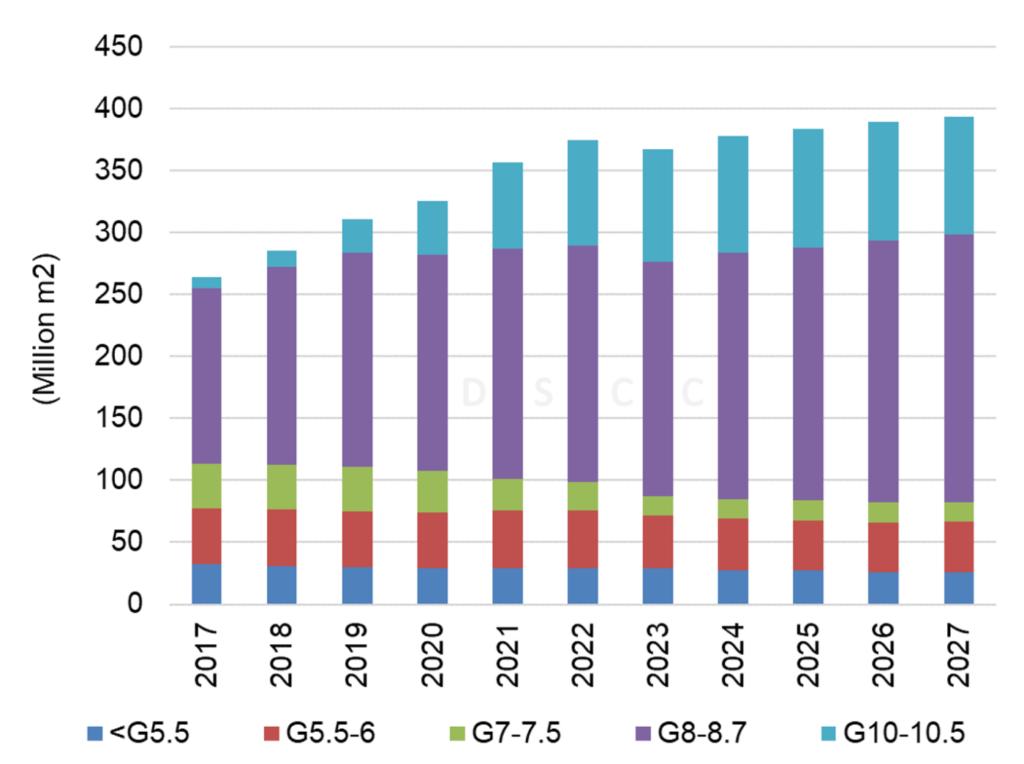

Minimal LCD capacity growth is expected, with Gen 5 and smaller decreasing 11% and Gen 5.5-6 decreasing 5% from 2023-2027. Gen 8-8.7 capacity should grow 14% and Gen 10-10.5 to grow 5% over the period. OLED capacity is expected to grow 5% CAGR from 36M m2 in 2023 to 44M m2 in 2027. Growth will mainly come from flexible OLED for mobile/IT and rigid OLED with thin-film encapsulation.