It looks like the display market is rebounding in 2024, after weak demand (post-Covid) and oversupply conditions in 2023. The Display 360 Summit by DSCC (a Counterpoint Research company) held in October in Silicon Valley, California gave a detailed 360-degree view of display applications market and technology, showing current issues as well as industry expectations and development for future.

Improved economic conditions, large number of older phones in the market, new AI functionality, and other features are helping boost smartphone display demand in 2024 and 2025 after slower replacement cycles and negative growth in 2023. The total IT display market is increasing in 2024 as a result of AI PCs, Microsoft Windows upgrades and 3-5 year refresh cycles for the consumer and commercial market after the decline in 2023. Advanced TV display shipments have returned to growth in 2024 after declining year-over-year in 2023 and TV screen sizes are increasing.

Display Fab Investment

According to DSCC CEO Ross Young’s presentation at the Summit:

- Display equipment spending is expected to rise 44% in 2024 to $7.2B with LCDs up 89% and OLEDs up 14%. LCD spending will hold a 53% share versus OLEDs at 43%. 2024 is the last year LCDs are expected to lead.

- In 2025, display equipment spending is expected to fall 3% with OLEDs up 65% and LCDs down 58%. OLEDs are expected to account for a 74% share.

SDC, BOE, Visionox, JDI, LGD and others are planning higher generation (Gen 8.7) OLED fabs for IT which will drive OLED equipment spending. However, there are still fab technology concerns: uncertainties about FMM process, yield rates, high costs, new suppliers, different backplane approaches, etc. Slower than expected demand for Apple’s iPad Pro OLED panels has created concerns about OLED IT demand, delaying some fabs. As per Ross’s presentation, “due to slower than expected uptake of the Apple Vision Pro, there have been some delays in new micro-OLED fab schedules. Both Sidtek and BCDTek delayed POs to equipment suppliers.”

- DSCC expects display capacity to rise at a 1.4% CAGR from 2023 to 2028, with LCDs growing at just a 1% CAGR and OLEDs growing at a 4.8% CAGR. By application, LCD TV/IT is expected to continue to hold a 75% share through the forecast with LCD mobile/IT falling from 18% in 2023 to 15% in 2028 and OLED mobile/IT rising from 5% in 2023 to 7% in 2028.

OLED Display Technology Improving

There are numerous technology improvements coming to OLED displays such as deuterium (30% power savings), tandem RGB OLED stack (20%-40% power savings, increased brightness), phosphorescent blue OLED emitter (25% power saving as per UDC, improves lifetime), eLEAP/VIP (photo patterning, eliminates FMM, larger aperture ratio boosting brightness, efficiency and lifetime), CoE (reducing number of photomasks and increasing power savings) and other features that will increase OLED battery life, brightness and lifetime.

LGD is improving WOLED technology every year. It reached 3,000 nits peak brightness in 2024 using MLA+, optimizing lens shape, improved materials, improved polarizers, and optimization algorithm. According to Ross Young’s presentation, “LGD has been continuously developing a 4-stack WOLED solution, which could potentially allow them to remove MLA due to the high cost of the MLA materials and a narrower viewing angle. It is expected in 2025 with a peak brightness of 3,700 nits.” In 2024, QD-OLED by SDC also achieved peak brightness of 3,000 nits at the same power consumption level as 2023 models through new AI algorithms and luminance boosting technology. As per Ross, “In 2025/2026 – QD-OLED eliminating the separate CF/QD substrate. QD would be printed on the encapsulation layer with just 1 substrate used. It would boost brightness to 3,600 nits+ as targeting 4,000 nits in 2025.”

New OLED Manufacturing Process Coming to Market

OLED display is expected to take more market share from LCD for many applications, but high cost has been a major barrier for higher adoption rates. With fab technology and cost concerns, Gen 8.7 (FMM technology based) fabs are facing some delays. Photo patterning that eliminates FMMs and FMM VTE equipment at Gen 8.7 may become a preferred approach. JDI and Visionox are following this path with eLEAP and VIP technology. The latest announcement from Applied Materials with the news of Samsung Display partnership may lead to higher adoption of this technology.

Applied Materials introduced the MAX OLED solution, a patented OLED pixel architecture in November 21, 2024. According to the press release, Applied’s MAX OLED solution makes it easier to scale OLED manufacturing from Gen 6* glass substrates to Gen 8* substrates. Additionally, Applied will supply a MAX OLED solution to Samsung Display, a leading global manufacturer of OLED and QD-OLED panels. Samsung Display will be bringing in an alpha system to assess this new technology. Applied’s proprietary solution uses selective deposition to enable excellent pixel placement accuracy, more than doubling the amount of OLED material per area compared to previous technologies. The technology can increase OLED display brightness by as much as 3x and increase resolution by as much as 2.5x, to approximately 2,000 pixels per square inch. The solution can also reduce display power consumption by more than 30% and increase display lifetime by up to 5x.

Smartphone Display Demand Recovering

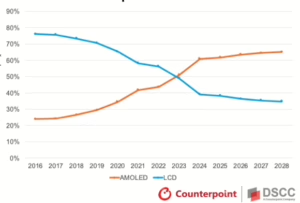

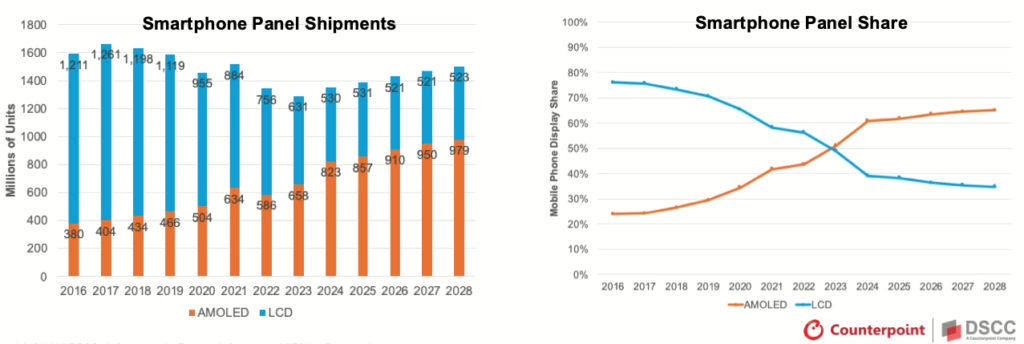

Smartphone display shipments have been declining as replacement periods have lengthened and prices have risen. As per Ross Young’s presentation, “improved economic conditions, large number of older phones in the market, new AI functionality and other features expected to boost demand by 5% in 2024 and 2-3% annual growth from 2025 to 2028. Weakness at the low-end smartphone helped OLEDs to overtake LCDs sooner than expected. OLEDs led LCDs in 2023 with a 51%/49% advantage which is expected to extend to 61%/39% in 2024 and extend to 65%/35% from 2027. Lack of OLED capacity growth and tighter supply/demand will prevent even higher OLED penetration.” DSCC data showed foldable panel shipments have grown at a 66% CAGR to an expected 24.5M panels in 2024. They have yet to break 2.0% market share of the smartphone display market and very much remain a small niche.

IT Display Market Improving

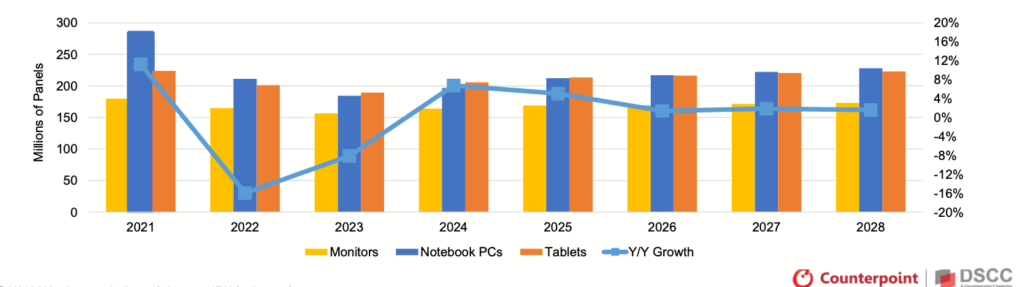

David Naranjo, Senior Director of DSCC, said in his presentation of IT market outlook at the summit, “The notebook PC display market declined 13% year-over-year in 2023. In 2024, DSCC expects the total IT display market to increase 7% year-over-year with notebook PCs increasing 7% year-over-year as a result of AI PCs, Microsoft Windows upgrade and the 3-5 year refresh cycle for the consumer and commercial markets.”

- In 2024, DSCC expects notebook PCs to increase 36% year-over-year for an 8% share, up from 6% in 2023. OLED notebook PCs are expected to increase 58% year-over-year and MiniLED notebook PCs to increase 22% year-over-year.

- In 2024, advanced tablets expected to increase 101% year-over-year, dominated by OLEDs with 221% year-over-year growth fueled by Apple.

- In 2024, advanced monitors expected to increase 37% year-over-year on 106% growth from OLEDs and 19% year-over-year growth from MiniLEDs.

Apple launched OLED iPad Pro’s in 2024 which included several firsts in the tablet market: tandem stacks (to boost brightness, efficiency, lifetime and prevent burn-in), thin film encapsulation (TFE) to reduce thickness and weight, chemical etching of the bottom glass down to 0.20mm to further reduce thickness and weight and LTPO to get to 1Hz-120Hz. Apple iPad Pro’s higher costs are a barrier for higher adoption rates. OLED IT products rely on Gen 5.5 and Gen 6 fabs whereas LCD IT panels are typically produced in Gen 8.5 fab. OLED material costs are also higher than edge-lit LCDs and panel costs can be higher than MiniLED LCDs as well.

Advanced TV Shipments Returned to Growth

According to Co-Founder of DSCC Bob O’Brien’s presentation at Display 360 Summit, “After declining year-over-year in 2023, Advanced TV shipments have returned to growth in 2024. In the premium TV market, we see a three-way battle between MiniLED LCD, white OLED and QD-OLED. OLED competes with MiniLED two full sizes larger. 55″ QD-OLED is sold at similar price points to 75″ MiniLED, with 55″ WOLED at a discount of ~20%. The portion of consumers choosing MiniLED has been increasing steadily while QD-OLED also cannibalizes WOLED sales. In the ‘super-premium’ category of TV consisting of OLED + MiniLED, MiniLED continues to gain share at the expense of OLED.” DSCC Data shows:

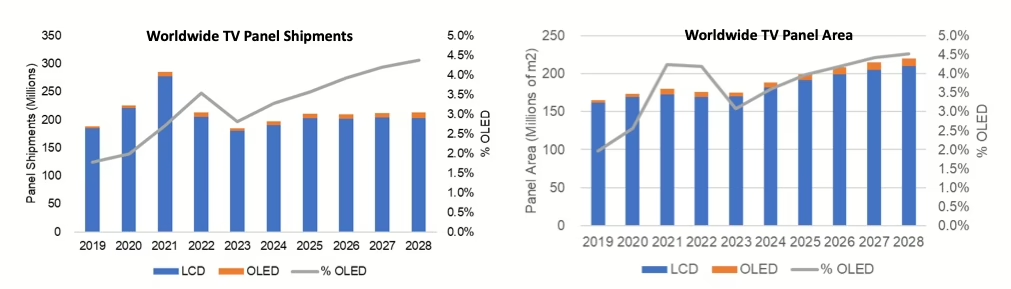

- The worldwide TV market will continue to be dominated by LCD technologies, including MiniLED.

- Unit demand will recover but not reach pre-pandemic levels, but screen sizes will continue to increase, driving area growth at a 5% CAGR (2023-2028) for total TV.

- OLED TV units/area/revenue will grow at a 12%/13%/7% CAGR (2023-2028)

- LCD TV units will increase at a 1% CAGR, area will grow at 4% and revenue will grow at 2%.

- Samsung’s QD-OLED TV shipments will be limited by capacity

- White OLED TV shipments will recover starting in 2024 but will surpass the 2021 peak only in 2027.

As per Yoshio Tamura, Co-Founder & President of DSCC’s presentation, “In 2023, OLED TV shipments fell sharply year-over-year, down 31% to 5.2M units. In 2024, they are expected to rebound and increase by 24%.” OLEDs are more expensive than LCDs. LCD products are made on Gen 10.5 lines while WOLED products are made with MMG on Gen 8.5 lines. Even the highest LCD costs with 8K and MiniLED have costs lower than WOLED in China. QD-OLED UHD cost is ~40% higher than WOLED MMG China in 2024, ~30% higher than WOLED MMG.

The display market needs new technology and differentiated products to boost replacement demand. LCD is improving with MiniLED and quantum dots. DSCC’s blog in November 18 showed that the new Apple M4 MacBook Pros are the company’s first products to use quantum dots in its new MiniLED-based laptop. OLED technology is enabling more advanced products but costs are higher. Increased investment in higher generation OLED fabs and newer manufacturing processes may lead to faster cost reductions in future years for higher adoption rates.

With more than 26 years of experience in the Display Industry and Display Market plus technology research, Sweta is a highly sought-after consultant and a frequent advisor to firms that invest in the Display value chain. Prior to starting Dash-Insights, Sweta was the Senior Director of Display Research, and Strategy at IHS Technology, and was the head of applied research, consulting, strategy, and Display Expert.