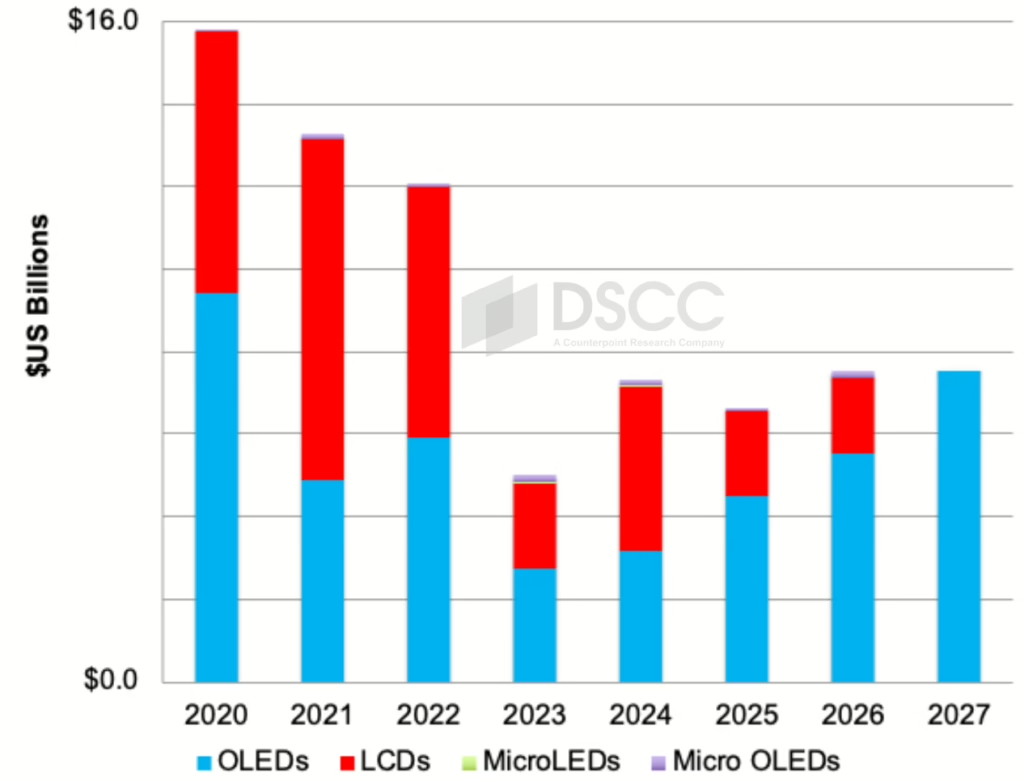

DSCC reports the display equipment industry is poised for significant growth in 2024, with spending expected to increase by 47% to reach $7.3 billion. This rebound comes after a sluggish 2023, where both LCD and OLED sectors faced downturns due to weak market conditions, oversupply, and reduced demand following the COVID-19 pandemic. Improved market conditions have led to a resurgence in LCD fab spending, projected to grow by 95% and capture a 54% share of the total display equipment expenditure.

OLED equipment spending is also anticipated to recover, with a 16% increase in 2024 after a 54% decline in 2023. The growth in OLED spending is largely driven by the IT market’s demand for larger panels, particularly in devices like laptops, tablets, and monitors. New Generation 8.7 (G8.7) OLED fabrication plants are planned, aiming to reduce production costs for 10-inch to 20-inch panels and boost OLED adoption in various applications. These G8.7 fabs are expected to account for 52% of all display equipment spending between 2024 and 2027.

The IT market’s demand for OLED panels is projected to rise at a compound annual growth rate (CAGR) of 46% from 2023 to 2028, surpassing 60 million units. This surge necessitates new manufacturing capacities optimized for IT products. Additionally, investments in mobile OLED technologies continue, with new Generation 6 (G6) fab lines and conversions to low-temperature polycrystalline oxide (LTPO) and color on encapsulation (CoE) processes enhancing spending further.

In the LCD sector, investments are being made in specialized equipment for ultra-large TVs (85 inches and above) and in technologies to increase transparency for augmented and virtual reality (AR/VR) applications through LTPO backplanes. There’s also significant investment from a new entrant targeting the e-reader market with innovative LCD-based reflective technology.