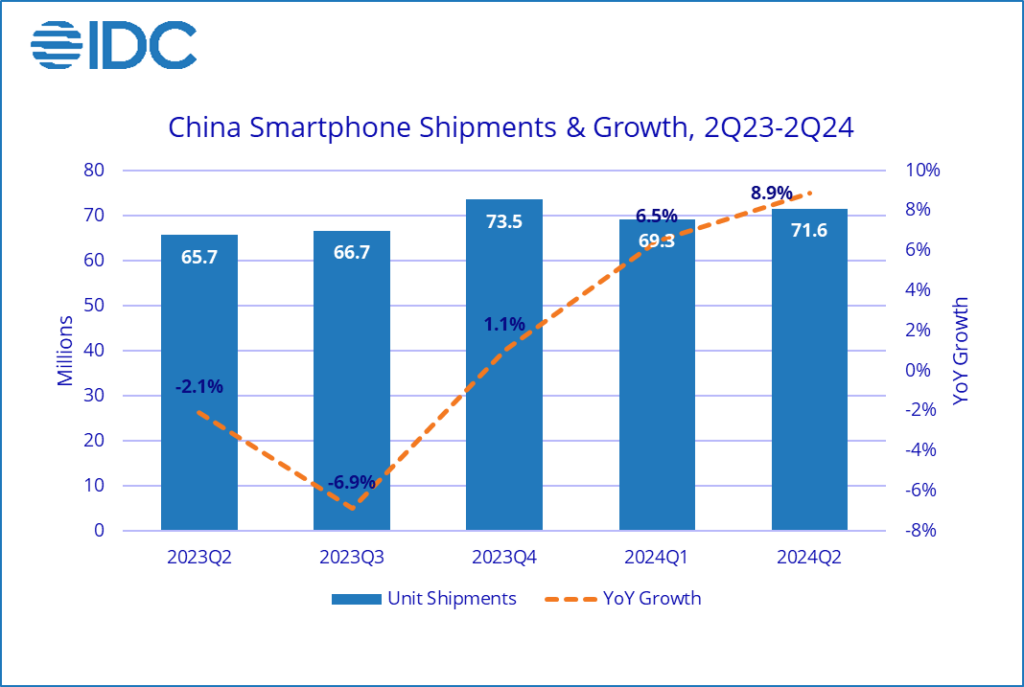

A burgeoning smartphone market is a driver of display sales and by the looks of things, Chinese display makers are in for a windfall. According to IDC, the country’s smartphone shipments saw an 8.9% year-over-year (YoY) increase in the second quarter of 2024, totaling 71.6 million units. This marks the third consecutive quarter of growth, and a total of 140.8 million units shipped in the first half of 2024, a 7.7% YoY growth. The market is being driven by pent-up demand for replacements and a low base comparison year.

Chinese original equipment manufacturers (OEMs) such as vivo, Huawei, and Xiaomi experienced substantial double-digit growth contributing to the market’s momentum in the second quarter. This surge caused Apple to drop to the 6th position, allowing local brands to dominate the Top 5 rankings for the first time in nearly four years. Despite price promotions that boosted iPhone demand in the quarter, Apple saw a 3.1% YoY decline, while the overall Android market grew by 11.1%.

According to IDC in China, vivo surged to the top position in the second quarter of 2024, moving up from fifth place in the previous quarter due to the strong performance of their new products in the low- to mid-range market. Meanwhile, despite US trade restrictions, Huawei led the market in the first half of the year and continued to close the gap with Apple in the premium segment of over $600.

Additionally, a noticeable trend of premiumization is occurring in China as consumers are keeping their devices for longer periods. This led to the share of shipments priced over $600 increasing to nearly 26% in the second quarter of 2024, compared to about 23% in the same period the previous year. However, some consumers, facing a slower-than-expected economic recovery, have shifted towards more affordable smartphones, creating significant opportunities in the used phone market.

Back in the first quarter of this year, the data was already coming out about how Chinese display makers are dominating AMOLED shipments. Well, now we know why.

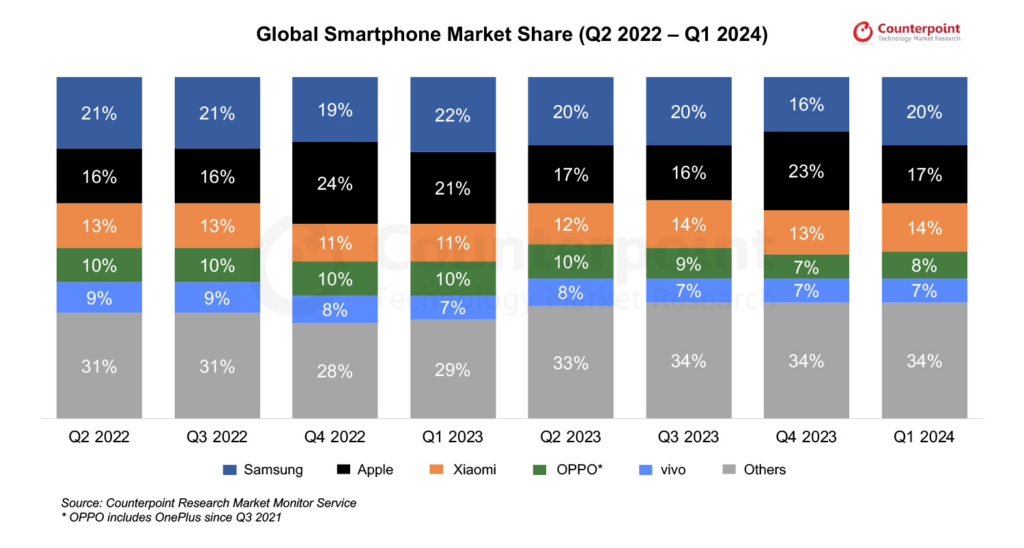

Omdia has noted that Chinese display makers, leveraging the local smartphone market, are driving AMOLED pricing, being competitive, and growing the market. The only companies out of reach to Chinese display makers are Apple and Samsung, who combine for over a third of the world’s smartphone shipments. But, how long can they maintain that position once Chinese companies expand internationally?

The highs for Apple and Samsung may continue to be less high, and the momentum behind China’s smartphone makers inevitably suggests competitive pricing of AMOLED displays for all smartphone vendors, creating even more pricing pressure on the incumbent brand leaders.

Chinese display panel makers like BOE, TCL CSOT, Tianma, and Visionox have significantly expanded their AMOLED production capacity leading to even reduced costs through economies of scale. Chinese manufacturers are also investing heavily in flexible AMOLED technology. BOE has been mass-producing flexible AMOLED screens with improving yield ratios. TCL CSOT is developing inkjet-printed OLED panels, which are expected to achieve mass production in the second half of 2024.

BOE is already only second to Samsung in shipments of AMOLED panels and that has other repercussions as Samsung is forced to readjust its own investments and planning to protect its market share. With companies like TCL CSOT and Tianma close behind, it’s not going to be a fair fight by any means.