“The add-in graphics board market behaved seasonally in Q4’17, decreasing 4.6% sequentially, explained Jon Peddie, president of the industry’s research consulting firm Jon Peddie Research.

The seasonal ten-year average for Q4 is -4.4%%, and this year it was just below that, which we think is due to the sharp rise in prices driven by cryptocurrency miner’s demand.”

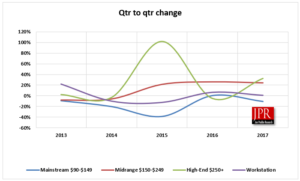

The market shares for the desktop discrete GPU suppliers shifted in the quarter too.

Table 1: Market share changes quarter-to-quarter, and year-to-year

Over three million add-in boards (AIBs) were sold to cryptocurrency miners worth $776 million in 2017. AMD was the primary benefactor of those sales.

Quarter-to-quarter graphics board shipments decreased 4.6% and increased 9.7% year-to-year.

The add-in graphics board market dropped in Q4’17, decreasing -4.6% sequentially.

The market for AIBs decreased this quarter due partially to seasonal demand, as well as price-elasticity caused by the increased price in AIBs as a result of the cryptocurrency miners demand.

AIBs using discrete GPUs are found in desktop PCs, workstations, servers, rendering and mining farms, and other devices such as scientific instruments. They are sold directly to customers as aftermarket products, or are factory installed by OEMs. In all cases, AIBs represent the higher end of the graphics industry with their discrete chips and private, often large, high-speed memory, as compared to the integrated GPUs in CPUs that share slower system memory.

Table 2: Segment share this quarter, and last-year

The overall GPU shipments (integrated and discrete) are greater than desktop PC shipments due double-attach—the adding of an AIB to a system with integrated processor graphics, or a second AIB using either AMD’s Crossfire or Nvidia’s SLI technology.

Improved attach rate. The attach rate of AIBs in desktop PCs has declined from a peak of 84% in 2002 to a low of 36% in 2015, and steadily increased since then to 54% this quarter, a decrease of 23.0% from last quarter which was negative. Compared to this quarter last year it increased 15.8% which was pretty good.

Figure 1: Add-in board shipments over time

This detailed 83-page report will provide you with all the data, analysis and insight you need to clearly understand where this technology is today and where it’s headed.

The report contains the following content:

- Worldwide AIB Shipment forecast by segment, 2015 to 2021.

- Attach rate of AIBs from 2001.

- Detailed worldwide AIB Shipment Volume, by segment, and forecast to 2021.

- Major suppliers: Detailed market share data-on the shipments of AMD, Nvidia, and others.

- Market share history from Q1 2004.

- Percentage of shipments by region, from 2015 to 2021.

- Market value of AIBs, and pricing trends

- A Vision of the future: Building upon a solid foundation of facts, data and sober analysis, this section pulls together all of the report’s findings and paints a vivid picture of where the PC graphics market is headed.

- Memory load and forecast.

AIB report subscribers will also receive an updated Cryptocurrency report.

Table of Contents

| All about cryptocurrency mining’s use of, and effect on the AIB market |

.5 |

| Cryptocurrency mining use of AIBs |

.5 |

| Raw power |

.5 |

| How many AIBs used in mining? |

.10 |

| Methodology |

.10 |

| Consequences of crypto mining |

.11 |

| Is it all worth it? |

.11 |

| And now this |

.12 |

| Epilog |

.13 |

| The future of GPUs in crypto mining |

.13 |

| Looking forward |

.16 |

| What do we think? |

.17 |

| How many AIBs have been bought for mining? |

.19 |

| Get ready for a shock—AIB shipments down |

.23 |

| Macro dynamics |

.25 |

| Selling shovels |

.30 |

Pricing and Availability

Jon Peddie Research’s AIB Report is available now in both electronic and hard copy editions and sells for $1,500. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s AIB Report is $4,000 and includes four quarterly issues. Full subscribers to JPR services receive TechWatch (the company’s bi-weekly report) and are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at

www.jonpeddie.com.

The overall graphics market includes discrete GPUs (dGPU) and GPUs integrated in chipset or embedded in CPUs. The overall PC graphics market is larger than the PC market, as shown in Figure 2. Discrete GPUs are on AIBs. Integrated and embedded GPUs are on the main, or system or motherboard, and are not covered in this report. For market and shipment information on all GPUs, refer to Jon Peddie Research’s quarterly report Market Watch. More information can be found at –

https://www.jonpeddie.com/store/market-watch.

About Jon Peddie Research

Dr. Jon Peddie has been active in the graphics and multimedia fields for more than 30 years. Jon Peddie Research is a technically oriented multimedia and graphics research and consulting firm. Based in Tiburon, California, JPR provides consulting, research, and other specialized services to technology companies in a variety of fields including graphics development, multimedia for professional applications and consumer electronics, high-end computing, and Internet-access product development. Jon Peddie Research’s AIB Report is a quarterly report focused on the market activity of PC graphics controllers for notebook and desktop computing.