According to the latest figures published by International Data Corporation (IDC), the overall tablet market for Western Europe declined 2.9% YoY, shipping 7.5 million units in the second quarter of 2018 (2Q18).

Slates continued to show resilience in the commercial space, with strong back to school sales and a solid growth in enterprise driven primarily by an exceptional iPad performance. Other vendors experienced healthy growth in the SMB space, as smaller companies proved to be more susceptible to consumer promotions. On the consumer side, slates entered positive territory for the first time since 2013, supported by strong iPad sales, as well as Amazon Prime day and early preparation for seasonal promotions such as Black Friday and Cyber Monday that enabled vendors to move large volumes of units.

Detachables had another challenging quarter, declining 14.5% YoY as device refreshes were postponed prior to the wave of new launches in 4Q18. Despite this, there was a softer decline in the commercial space as more companies invested in the mobile solutions that detachables can provide for the mobile worker, while on the consumer side there was a higher level of stabilization in demand.

“The Surface Go was positioned to offer a midrange alternative, aimed predominately at the consumer and education space, and its greater affordability triggered an uptake for Microsoft in the third quarter, after quarters of challenging performances,” said Dennis Pedersen, research analyst, IDC Western European Personal Computing Devices. “Microsoft reached number-one position in the detachable category this quarter, which was further aided by the inventory management by Apple, ahead of the iPad Pro refresh.

“Android players such as Huawei and Samsung are pushing their higher end devices with keyboard capabilities, suitable both for productivity and media consumption purposes, to address the opportunity of detachable as a notebook replacement. This strategy is underlined by Samsung’s embedding of Samsung Dex in its latest Tab S4 flagship.”

Company Analysis

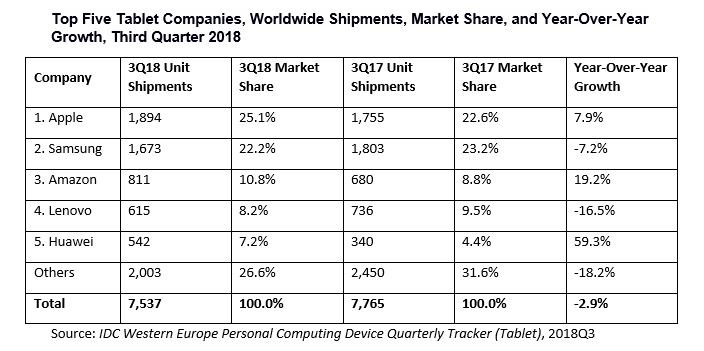

Apple ranked first with 25.1% market share and increasing 7.9% YoY. Once again, slates were behind the strong performance for Apple, with strong double-digit growth across both segment groups as the refreshed iPad at the more attractive price point continues to drive demand.

Samsung ranked second, recording a market share of 22.2%, but decreasing by 7.2% YoY. This softer decline for Samsung was supported by strong results in the higher-end space, particularly in consumer as the holiday season approaches.

Amazon rose to third with a market share of 10.8% and increasing by 19.2% YoY. Strong sales during Prime day drove this growth, as Amazon continues to push low-priced devices as a gateway into its ecosystem.

Lenovo ranked fourth with 8.2% market share, but with a decline of 16.5% YoY. A strong relationship with channel partners enabled Lenovo to maintain its position in the top 5, but a strategic prioritization of other lines of business has meant it has been less aggressive in the lower-end tablet market, leading to an overall decline.

Huawei ranked fifth with a 7.2% market share and growth of 59.3% YoY. The growth trajectory for Huawei persists, following a particularly strong consumer performance as Huawei continues to expand its footprint in Western Europe across its entire technology portfolio.

Note: Tablets are portable, battery-powered computing devices inclusive of both slate and detachable form factors. Tablets may use LCD or OLED displays (epaper-based ereaders are not included here). Tablets are both slate and detachable keyboard form factor devices with color displays equal to or larger than 7.0in. and smaller than 16.0in.

IDC’s Quarterly PCD Tracker provides unmatched market coverage and forecasts for the entire device space, covering PCs and tablets, in more than 80 countries — providing fast, essential, and comprehensive market information across the entire personal computing device market.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.