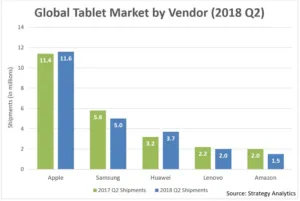

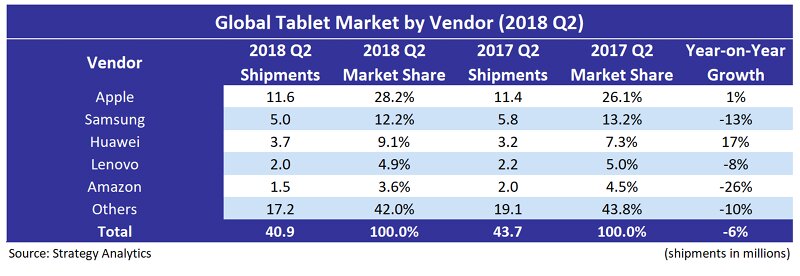

The latest research from Strategy Analytics shows an extremely competitive tablet market, where many Android vendors are losing share and revenue due to falling prices and little innovation compelling new consumer sales.

Apple, Huawei and Microsoft each showed shipment growth in the quarter and combined to take a 40% market share. Despite these successes, the tablet market declined 6% year-on-year to 40.9 million units in the second quarter of 2018, as demand for Android slates took a beating. Strategy Analytics’ Eric Smith remarked:

“Aft

er several quarters of softness in the Windows Detachable 2-in-1 segment, we are seeing a bounce-back due to enterprise demand and a good product refresh cycle. Microsoft’s shipments of Surface Pro and Surface Book 2 reached over 1 million and could reap even better results next quarter, with the release of the Surface Go in a much lower price tier.

Price has been a limiting factor in how vendors reach consumers with Detachable 2-in-1s, so 2018 is very interesting, as lower-cost options come into play with Surface Go, Qualcomm-powered 2-in-1s and Chrome-based 2-in-1s”.

Senior research analyst Chirag Upadhyay added:

“A

pple is using its market size and brand power to put pressure on its Windows and Android competitors.

By lowering prices and adding more functionality during every product cycle for the last year, Apple has regained several points of market share and is still maintaining a strong ASP due to its Pro and standard iPad mix. Android vendors, in particular, should be very concerned with how much revenue they are losing to Apple in 2018”.

Apple’s shipments grew 1% year-on-year as forecast, to 11.6 million units in the second quarter of 2018, pushing its worldwide market share to 28% of the tablet market. This represented a 27% sequential increase after the seasonally low first quarter. Apple benefited from strong sales of its newly launched standard iPad with Apple Pencil support just before the back-to-school buying season, which pushed ASPs lower year-on-year to $410.

Android shipments fell to 23.6 million units worldwide in the second quarter, down 10% from 26.4 million a year earlier and 1% sequentially. Market share fell 2% year-on-year to 58% as white box vendors slowly consolidate and exit the market, while many branded Android vendors have found it very difficult to compete on price, especially as Apple is willing to lower its iPad prices. Huawei was the only branded Android vendor showing growth this quarter, while Samsung stayed focused on revenue and Amazon’s growth spurt sputtered, analysts said.

Windows shipments fell 2% year-on-year to 5.8 million units in the second quarter of 2018, from 5.9 million in the same period in 2017. Shipments increased 1% from the previous quarter as back-to-school and enterprise demand helped the segment. Microsoft’s new Surface Pro and Surface Book 2 devices did better than expected this quarter and the company posted its second straight quarter of double-digit year-on-year growth since the third quarter of 2016.

The Windows tablet segment will not show sustained growth again until there are more serious Detachable 2-in-1 options in the mid to low tiers. Most PC OEMs are addressing this segment with lower-cost convertible PCs and traditional notebooks.