The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) grew YoY in 2019Q2 (+1.1% YoY) and totaled 16.4 million units, according to International Data Corporation (IDC). Once again, the commercial space drove the overall market (+11.4% YoY), with solid growth for notebooks (+7.3% YoY) and an exceptional performance for desktops (+17.2% YoY).

The consumer market remained weak (-11.3% YoY), as lack of innovation and longer product life cycles continue to impact demand.

The Western European traditional PC market expanded by 6.6% YoY, driven by the commercial sector (+16.1% YoY), although consumer struggled to follow suit, shrinking by 8.4% YoY.

The Windows 7 end-of-life cycle provides a significant boost for the commercial segment and had a particularly strong impact on the desktop figures. Desktops experienced their first year-on-year double-digit increase in five years, and the first solid increase since the end of support for Windows XP.

“This shows that OS upgrades are always the peak of demand for stationary device renewals, especially in the public sector where the transition tends to be slower and subject to greater constraints,” said Daniel Goncalves, senior research analyst, IDC Western Europe Personal Computing. “Desktop shipments this quarter were to some extent also supported by backlogs stemming from the CPU shortages in previous quarters that restricted the supply of Coffee Lake i5 configurations in particular.”

Weak sell-in shipments in the consumer space impacted by the high inventory among the largest countries in the CEMA region have negatively impacted the overall PC market, with results lower than forecast. The overall CEMA PC market declined by 7.9% YoY compared with a forecast decline of 4.3% YoY, and for the second consecutive quarter the CEE region reported a double-digit decrease (10.6% YoY) for the total PC market.

The consumer segment contracted by 16.4%, while the commercial segment declined by 1.3% YoY. The slight drop in the commercial space can be attributed to an unfavorable YoY comparison, as large education deals were not repeated, though the corporate segment saw good momentum thanks to the ongoing PC refresh ahead of Windows 7 EOS in January 2020.

“The Eastern subregion continues to be inhibited by weak demand in the consumer space, with Russia declining the most, at 27.5% YoY. The Central CEE subregion performed better than expected in both segments, particularly in commercial, posting 9.5% YoY growth,” said Nikolina Jurisic, product manager, IDC CEMA. “Despite posting an overall negative result of 4.2% YoY, MEA is slowly showing improvements after three consecutive quarters of strong, double-digit declines. The PC market was cushioned by demand in the commercial segment, at 2.5% YoY, with a few large deals deployed in a few countries across the region. On the other hand, the consumer segment remains inhibited by economic issues and weak currencies and posted a decline of 11.7% YoY.”

Vendor Highlights

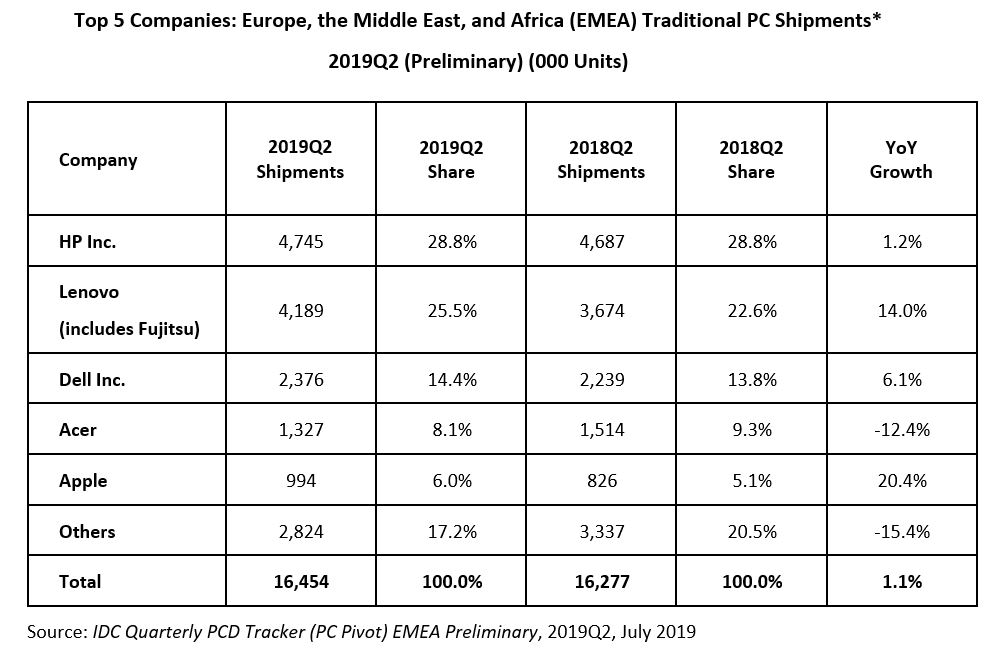

Traditional PC market consolidation persisted, and the top 3 vendors’ share continued to grow in 2019Q2. The top 3 players accounted for 68.8% of total market volume, compared with 65.1% in 2018Q2.

-

HP Inc. secured the number 1 position in EMEA, reaching 28.8% market share, flat YoY. Growing at 1.2% YoY, the overall result was boosted by a strong commercial segment, offsetting the double-digit decline in consumer.

-

Lenovo (including Fujitsu) took second spot, reporting 25.5% market share and increasing 2.9% YoY. A strong commercial performance combined with positive consumer shipments drove the overall solid results. ?

-

Dell Inc. maintained third place with 14.4% market share (up 0.7% YoY). The vendor registered 6.1% growth YoY, the second highest among the top 3, again primarily driven by the commercial space. ?

-

Acer ranked fourth with 8.1% market share (down 1.2% YoY). Its ongoing focus on the consumer market continued to impact Acer’s results (down 12.4% YoY) as the segment remained overwhelmed by high inventory.

-

Apple was in fifth place with a share of 6.0% (up 20% YoY). After declining for two consecutive quarters, the vendor returned to solid growth, thanks to the back-to-school season.

Table notes:

-

Some IDC estimates were made prior to financial earnings reports.

-

Shipments include shipments to distribution channels and end users. OEM sales are counted under the vendor/brand under which they are sold.

-

Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

-

Data for all vendors is reported for calendar periods.