The global display industry enters Q1 2026 as a structurally China-plus-Korea duopoly under acute cost pressure, disciplined on LCD utilization, and increasingly defined by an OLED and premium-application arms race. The quarter is not about expansion in units but about re-pricing, re-routing, and re-tooling across the entire value chain.

Panel makers are deliberately trimming output into February rather than chasing volume. According to Omdia, global fab utilization plans for February 2026 have been cut to below 80% across applications, reversing late-2025 efforts to run harder for scale. In China, TrendForce estimates LCD TV panel utilization will fall by about 3.5 percentage points quarter-on-quarter to 87.7% in Q1 2026, driven by 5–10 day Lunar New Year shutdowns at module plants and reduced front-end fab output.

These cuts are expected to reduce global TV panel supply area by roughly 3.8% QoQ, tightening the supply-demand balance and stabilizing, even slightly lifting, LCD TV panel prices compared with the weakness that characterized 2023–2024.

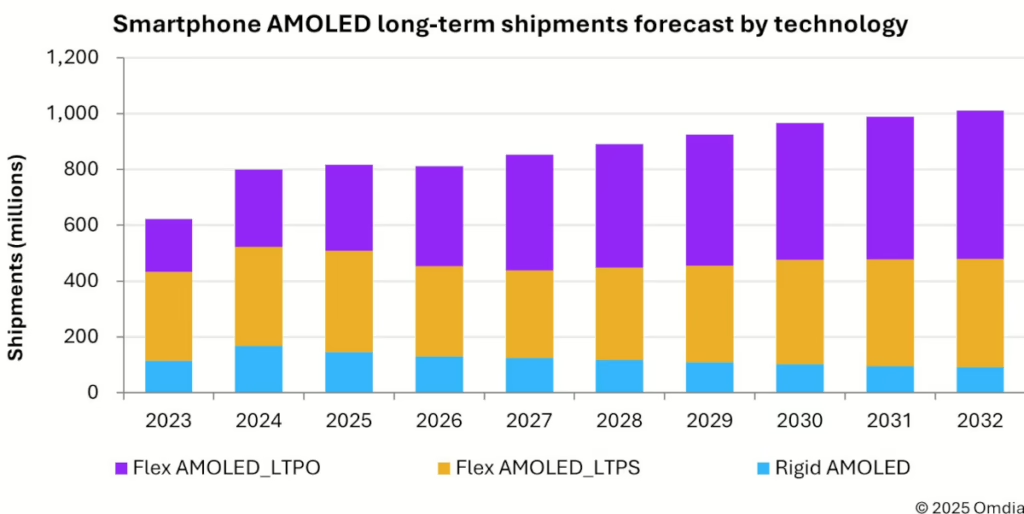

Demand is weak in units but firmer in area. Omdia’s 2026 outlook calls for total display shipments to decline around 2% by units while total area grows about 6%, reflecting continued consumer migration to larger TVs and monitors. Within that trend, OLED is the growth engine: Omdia figures show OLED unit shipments up 6.1% and OLED area up 10.6% in 2026, meaning OLED gains share even in a flat-to-down market. External market research puts the global OLED display market at about $34.7 billion in 2026, on track to roughly $55 billion by 2031 at about a 9.7% CAGR, driven by TVs, IT monitors and laptops, smartphones, and automotive displays.

China remains the center of gravity for LCD. Chinese panel makers, including BOE, TCL CSOT, and HKC, control the bulk of LCD TV capacity and are orchestrating the February production pause to keep prices from sliding as demand softens seasonally. TrendForce notes that these Lunar New Year cuts deliberately cap LCD output while China uses policy tools to support end-demand, most notably a trade-in program providing a 15% subsidy for Tier-1 energy-efficient TVs, along with stocking ahead of the 2026 FIFA World Cup. Those measures help hold Q1 2026 TV panel demand area to only about a 1.8% QoQ decline, cushioning the impact of utilization cuts and reducing the risk of another deep price war.

At the same time, Chinese players are pushing hard into OLED. BOE commissioned what it calls China’s first fully complete 8.6-generation OLED production line in December 2025, aimed at high-volume TV and IT panels. Chinese AMOLED shipments, especially for smartphones, have surged past the 50% unit share mark, and China is rapidly localizing OLED materials, narrowing the technological gap with Korean leaders. The OLED materials market grew 22% in 2024, and a significant share of that growth is now being driven by Chinese suppliers making substantial progress in sophisticated OLED chemistry.

If all the planned OLED-on-glass and OLED-on-silicon capacity is realized, the industry could face massive oversupply unless demand and mix keep up. That risk hangs over the entire OLED expansion story.

Korea: The OLED Pivot and Premium Positionin

Korea has almost fully exited large LCD TV production and is betting the company on OLED and higher-value applications. Samsung Display ended LCD production in the first half of 2022, and LG Display stopped large LCD TV panel production in April 2025, leaving only LGD’s IT-oriented LCD lines active.

Entering 2026, Korea’s display industry is projected to grow roughly 5% this year even as total global display shipments fall, thanks to its concentration in OLED TVs, IT, and automotive displays. Korea effectively owns the premium OLED segment, holding about 92.4% of large (≥9-inch) OLED area, with almost all TV-class OLED production located domestically. In TV OLED revenue terms, 2025 saw about 81% of revenue at LG Display and 19% at Samsung Display, underscoring LGD’s scale lead and Samsung’s push to catch up with QD-OLED.

The strategic bet is most visible in IT OLED. Samsung Display has begun mass production on an 8.6-generation IT OLED line using 2,290 mm × 2,620 mm glass, more than double the area of older G6 substrates, explicitly aimed at reducing per-panel cost and gaining price competitiveness in laptops and monitors. IT OLED is expected to reach roughly 10% of all IT panel shipments by 2030.

Tariffs Shaping, Not Overturning, the Structure

US tariffs have become a chronic cost and routing factor rather than a transient shock. Section 301 duties on China-origin TVs have been raised and complemented by new reciprocal tariffs in 2025, while China has retaliated with higher duties on some US exports, including OLED materials and optical films. Because most LCD and OLED panels are produced in Asia and shipped embedded in finished TVs, monitors, or notebooks, tariffs usually hit brand-level imports of finished sets rather than bare panels.

Uncertainty around tariff timing has led TV brands to pull shipments forward. In 2025, Samsung, LG, TCL, and Hisense accelerated shipments to the US during grace periods, which contributed to a mid-single-digit bump in first-half 2025 global TV shipments before a later slowdown. Omdia warns that new US automotive tariffs are also starting to pull automotive displays into origin-of-content scrutiny, encouraging OEMs to route display module assembly through Mexico or Southeast Asia while regulators crack down on minimal origin shifting.

Samsung and LG are relatively well-positioned for the US market because they already assemble most North-American-bound TVs in Mexico. Samsung has indicated its TV division will be less affected by tariffs than rivals because of its Mexican production footprint. Both companies have expansive manufacturing capacities in Mexico, which could allow them to gain US market share at the expense of China-centric players like Hisense and TCL, especially if tariffs focus on China-origin sets.

On the commercial side, Samsung and LG have used pull-forward shipping and inventory buffers to manage tariff risk. The playbook is now clear: adjust forecasts by region, diversify assembly to tariff-friendly geographies, build more safety stock into US channels, and lean harder on premium mix and platform revenues, particularly Tizen and webOS advertising and services, to support margins.

TVs: A Year of Survival

Omdia characterizes 2026 as a “year of survival” for TV brands: input costs for panels, memory, and precious metals are rising, while end-demand is sluggish, forcing brands to prioritize profitability over share. Panel suppliers are using LCD production discipline to support prices, but as tariffs and component inflation filter through, TV makers are expected to pass at least part of the cost through to consumers, especially in the mid- and low-end segments. Premium segments, including larger diagonals, OLED, MiniLED, and QD-OLED, remain the main battleground for differentiation and margin, with Samsung and LG leaning on panel advances such as Samsung’s 4,500-nit QD-OLED and software ecosystems to justify higher ASPs.

IT Displays and Automotive: Key OLED Growth Frontiers

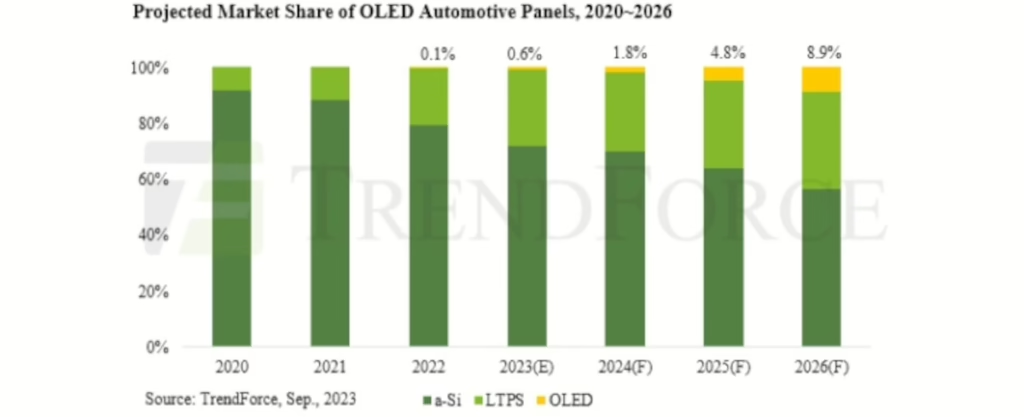

IT is emerging as a critical OLED growth vector. Samsung Display’s 8.6G IT OLED ramp is explicitly targeted at laptops and monitors, where OLED share is expected to rise from low single digits to around 10% by 2030. Omdia’s shipment and price trackers show 2025 growth in OLED monitors even as TV growth stalls, underscoring IT’s role in absorbing new OLED capacity. Automotive is another strategic front: both Chinese and Korean suppliers are courting OEMs with flexible OLED, MiniLED, and large integrated cockpit displays, but US tariffs and content-origin rules are complicating how those displays reach North American car plants.

B2B and Solution-Centric Plays

On the commercial side, players like LG are shifting from pure hardware to integrated solutions. At ISE 2026 in Barcelona, LG highlighted a massive three-sided LED tower, a 52.5-meter transparent mesh facade, and a unified cloud platform bundling displays with content management, AI tools, and data services. LG is also showcasing energy-efficient E-Paper displays and proximity-based interaction solutions such as ultrasonic audio via LG SoundCast, positioning itself as a provider of ecosystems for retail, corporate, and entertainment rather than just a panel vendor. This solution-centric model reflects a broader industry shift: as basic panels commoditize, value migrates to differentiated technologies, software, and services built around the display.

Several themes will shape the industry’s trajectory over the next six to twelve months.

LCD price and utilization discipline. Whether Chinese panel makers maintain February-style utilization discipline, around 87–88% for LCD TV, into Q2 will determine if the panel price recovery sticks or if another mini-downturn emerges.

8.6G OLED ramps. Samsung Display’s IT OLED output and yield ramp, plus any visible signs of BOE and others bringing 8.6G OLED to real volume, will signal how quickly the OLED cost curve can come down and how soon we reach serious China-Korea competition in large-area OLED.

Tariff regimes and routing. US policy on China-origin electronics, especially any move to broaden tariffs beyond finished TVs and autos, could accelerate the shift of assembly to Mexico and Southeast Asia and further entrench dual supply chains.

Mix shifts in TVs and IT. Watch for brands pushing even harder on 65–77-inch OLED and MiniLED, and for accelerated OLED adoption in high-end laptops, as they try to offset rising costs with richer mixes.

China’s local ecosystem maturity. Continued progress by Chinese OLED materials, equipment, and backplane suppliers will indicate whether Chinese fabs can erode Korea’s profitability advantage in OLED as they already did in LCD.

Taken together, Q1 2026 marks a phase where the industry is not expanding aggressively in units but is re-pricing, re-routing, and re-tooling. China manages LCD output and climbs the OLED stack. Korea retreats from LCD and leans into OLED and solutions. And all major players navigate a tariff-heavy, politically charged environment while trying to push displays into larger, brighter, and more intelligent form factors.