Despite concerns about TV demand and falling profit margins, major South Korean and Chinese TV makers are expected to stock up on display panels in the third quarter to prepare for the seasonal year-end shopping spree by consumers.

Already carrying inventories from prior stocking, these TV makers will have factored in the risk of a correction in panel demand in the fourth quarter, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

According to the latest TV Display & OEM Intelligence Service by IHS Markit, South Korean TV brands’ panel purchasing volume is forecast to increase to 20.4 million units in the third quarter of 2018, up 18 percent from the previous quarter or up 3 percent from a year ago. This is indicative of a recovery in panel purchasing from a decline of 3 percent in the second quarter on a quarter-to-quarter basis and down 1 percent year-over-year.

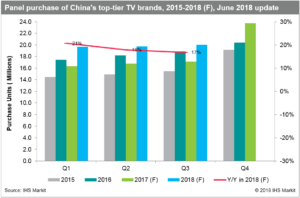

China’s top five TV brands, which bought more panels than expected in the first quarter, again increased their panel purchasing in the second quarter to meet their sales target by 0.4 percent quarter-on-quarter or 18 percent year-on-year to 19.8 million units. In the third quarter, these Chinese brands are likely to keep their purchasing volumes at a similar growth level of 1 percent quarter-on-quarter or 17 percent year-on-year.

“Although the panel demand outlook from South Korean and Chinese TV makers for the third quarter looks positive, the TV brands are still anxious about uncertainty in market demand in the second half of the year while carrying high inventories,” said Deborah Yang, director of display supply chain at IHS Markit. “The TV demand in Europe has particularly been weaker than expected, and the depreciation of local currencies in the emerging markets against the US Dollar has led to a higher price tag in local currencies.”

Another concern is the eroding profit margins caused by fast-falling average selling prices of TV sets. “As TV makers, particularly the Chinese brands, keep high inventories on hand, they end up cutting TV prices to manage their inventories, leading to lower margins – even for larger and premium TVs,” Yang said. “If their inventory clearance strategies and upcoming seasonal demand fall short of the expectations, these TV brands will eventually have to cut panel purchasing later in the year to lower the inventory burden.”

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. www.ihsmarkit.com