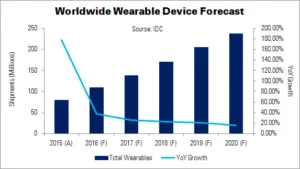

An expanding vendor base, as well as rising consumer awareness and demand, will push annual wearable growth to double digits between 2015 and 2020, says IDC. This year, worldwide shipments are expected to reach 110 million units, representing 38.2% growth. By 2020, shipments are forecast to be 237.1 million.

New wearable products will serve to drive the market. This year, wrist-based wearable shipments will reach 100 million units, from 72.2 million in 2015. Other form factors will be much less popular; eyewear, clothing and ‘hearables’ will reach a combined total of 9.8 million units. However, they will more than double their share by 2020, although the main focus of the wearable market will still be smartwatches.

Smartwatches will have around a 25% share of the wearable market this year, growing to more than 30% by 2020. Jittesh Ubrani of IDC said, “

It’s time to start thinking about smarter watches — traditional watches with some sort of fitness or sleep tracking but are unable to run apps—built by classic watch makers. These devices have the potential of making the technology invisible while still integrating themselves within day-to-day activities.

“By creating smarter watches, vendors also stand to side-step some of the typical challenges that smartwatch platforms face”, Ubrani added. “There’s no need to create a developer or app ecosystem for one thing, and there’s plenty of room for simpler devices that appeal to the average user while smartwatches continue catering to the technophiles.”

| Top Smartwatch Operating Systems’ Shipments, Share and 5-Year CAGR (Millions) | |||||

|---|---|---|---|---|---|

| Smartwatch OS | 2016 Unit Shipments | 2020 Unit Shipments | 2016 Share | 2020 Share | CAGR |

| WatchOS | 14.0 | 31.0 | 49.4% | 37.6% | 22.0% |

| Android Wear | 6.1 | 28.8 | 21.4% | 35.0% | 48.0% |

| RTOS | 1.4 | 8.3 | 5.0% | 10.1% | 56.0% |

| Tizen | 3.2 | 5.4 | 11.3% | 6.6% | 14.0% |

| Android | 1.0 | 4.3 | 3.6% | 5.2% | 44.0% |

| Linux | 0.6 | 2.3 | 2.3% | 2.8% | 37.0% |

| Pebble OS | 2.0 | 2.2 | 7.0% | 2.7% | 3.0% |

| Total | 28.3 | 82.5 | 100.0% | 100.0% | 31.0% |

| Android Wear + Android | 7.1 | 33.2 | 25.0% | 40.2% | 47.0% |

| Source: IDC | |||||

IDC expects Apple’s WatchOS to slow down somewhat in early 2016, as consumers delay spending for the anticipated second generation device. However, the firm will remain the smartwatch leader through the majority of the forecast.

Android Wear will be the second most popular smartwatch OS. Google’s decision to limit UI differentiation (i.e. all smartwatches based on Android Wear must have a similar UI) will stifle further growth, IDC believes. However, the positive side effect may be to force brands to compete on hardware design and price.

If Android-based smartwatches were added to the Android Wear total, then this segment would become the market leader by 2020. However, Android watches will remain a ‘small portion’ of the overall market, says IDC, and will likely be limited to emerging regions.

Third place will belong to Real Time Operating System (RTOS), largely due to gains in emerging markets and its use by Chinese ODMs. Adoption will be high but user experience will be ‘sub-par’.

Tizen, used by Samsung, has a limited app ecosystem. However, if the firm can devise synergy between its Gear S watches and other consumer electronics products, the OS could pose a real challenge to Android Wear.

Linux-based watches will have a similar appeal to those using RTOS. The focus will be high adoption and low cost, with a focus on APACxJ. Finally, Pebble’s large fan base and unique hardware/software platform will lead to modest short-term growth. However, the company will eventually lose share to larger systems like Android Wear and WatchOS.