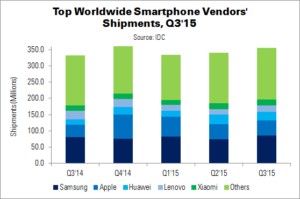

355.2 million smartphones were shipped worldwide in Q3 this year, according to IDC: 6.8% up from the 332.6 million shipped a year ago. Although the result represented the second-highest quarter of shipments on record, it was lower than IDC’s prediction of 363.8 million units. Limiting factors included slightly lower-than-expected iPhone shipments, and the introduction of Android flagship phones outside the consumer ‘sweet spots’.

More and more consumers are becoming aware of alternative options when buying new smartphones, says IDC’s Ryan Reith. There are now a large number of operators offering contracts and trade-in options in mature and subsidised markets. The number of unlocked smartphones available has also risen significantly, and these devices are “slowly starting to resonate with consumers”. Such products will put pressure on Android OEMs with products that are being sold for $500+.

Despite the changing market, there was an emphasis on flagship devices in Q3, as vendors tried to beat each other in terms of features and design. This led to fiercer competition at the high end of the market. However, the bulk of volume is still expected to come from low- and mid-range handsets – especially in emerging markets.

| Top Five Smartphone Vendors’ Shipments, Market Share and Growth, Q3’15 | |||||

|---|---|---|---|---|---|

| Vendor | Q3’15 Units | Q3’14 Units | Q3’15 Market Share | Q3’14 Market Share | YoY Change |

| Samsung | 84.5 | 79.6 | 23.8% | 23.9% | 6.1% |

| Apple | 48.0 | 39.3 | 13.5% | 11.8% | 22.2% |

| Huawei | 26.5 | 16.5 | 7.5% | 5.0% | 60.9% |

| Lenovo | 18.8 | 16.9 | 5.3% | 5.1% | 11.1% |

| Xiaomi | 18.3 | 17.3 | 5.2% | 5.2% | 5.6% |

| Others | 159.1 | 163.0 | 44.8% | 49.0% | -2.4% |

| Total | 355.2 | 332.6 | 100.0% | 100.0% | 6.8% |

| Source: IDC | |||||

Samsung remained the overall leader of the global smartphone market, shipping 84.5 million units: a 6.1% YoY rose. The company remained focused on the high-end with two new flagship phones (Galaxy S6 Edge+ and Note 5). Both of these models were launched earlier in the year than normal, in August. Beating Apple to the launch window helped Samsung to achieve higher-than-normal September shipments. Outside the key flagship models, sub-$200 phones, like the Galaxy Core, drove shipments in emerging markets.

Apple shipped 48 million phones, up 22.2% YoY. The iPhone 6S and 6S Plus broke company records for shipments in their launch weekend, and continued to capture upgraders and Android converts in key markets, such as the USA and China. Older models also sold well, thanks to price cuts. IDC expects Apple’s new upgrade plans to help drive shipments in developed markets.

Third-place Huawei shipped 26.5 million units, up an impressive 60.9% from Q3’14. The company’s efforts were focused on the mid-range and high-end segments, with almost a third of its shipments in this price range. New flagships like the Honor 6 Plus helped Huawei to grow its shipments in this segment 25% from last year. However, despite rapid growth in Europe and China, IDC says that the company must focus on the USA, where its presence remains relatively low. The launch of Google’s Nexus 6P, built by Huawei, could signal that the firm is ready to compete in the US market.

Lenovo, helped by its acquisition of Motorola, continued to fight its way to the top of the market. Combined Lenovo and Motorola-branded shipments reached 18.8 million units: an 11.1% rise. Lenovo-branded phones have primarily been sold in China, although have recently spread to the MEA and CEE regions. Motorola continues to be strong in North America and LATAM.

Xiaomi placed fifth, shipped 18.3 million smartphones (for an annual total of 52.1 million). The company continues to pursue South-East Asia, India and Brazil, although China is still the main focus. Three new phones (Redmi Note 2, Redmi 2A Prime and Mi 4C) were launched in China and drove volumes in Q3.