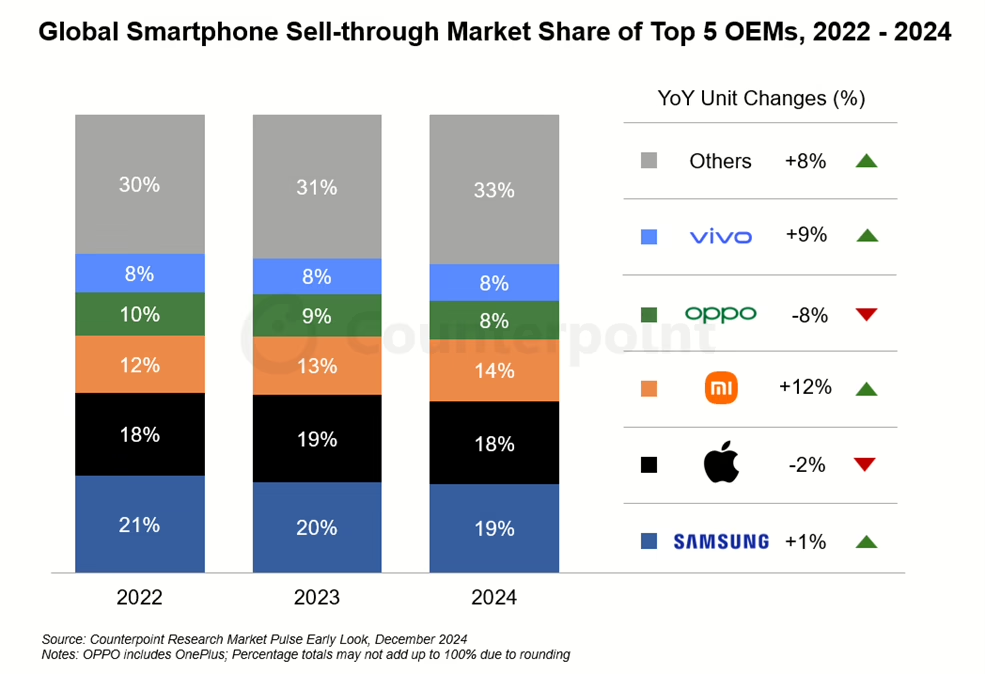

The global and Chinese smartphone markets both bounced back in 2024, each posting 4% YoY growth after previous periods of decline. The worldwide smartphone market rebounded from its weakest performance in a decade in 2023. Samsung maintained its global leadership position, driven by demand for its S24 series, which was particularly well-received in Western Europe and the USA. Apple secured the second position with an 18% market share, though its iPhone 16 series received mixed reactions. It was China that showed the most progress, Xiaomi emerged as the fastest-growing brand among the top five global vendors, followed by Oppo and vivo.

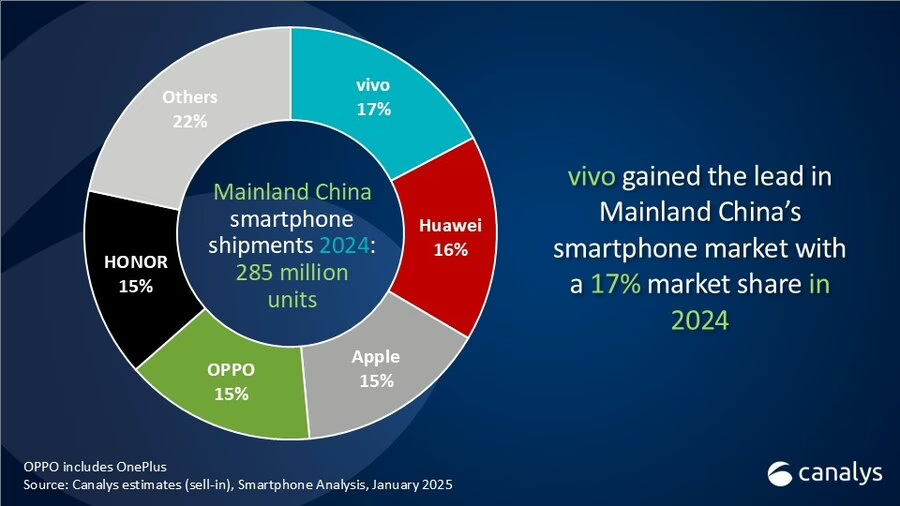

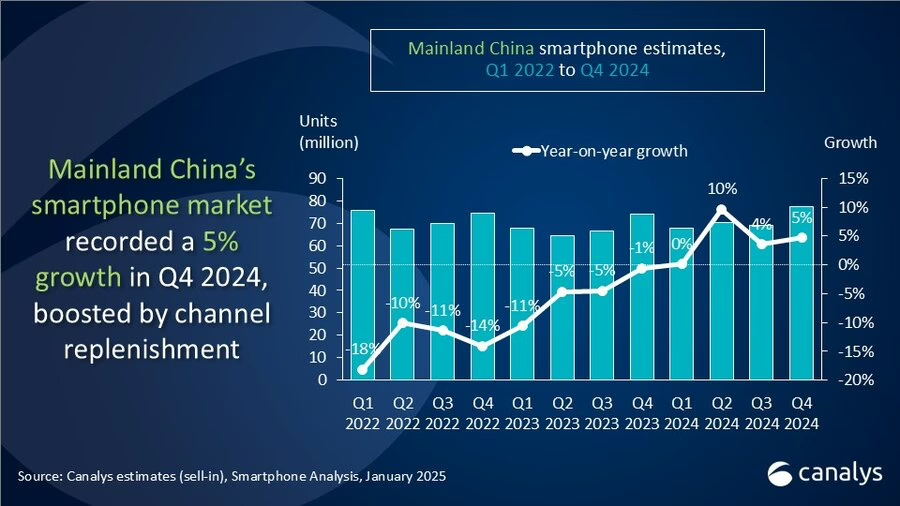

China’s own smartphone market shipped 285 million units in 2024, with vivo leading at 17% market share, equivalent to 49.3 million units. Huawei showed remarkable recovery, securing second place with 46.0 million units and 37% YoY growth. Apple, Oppo, and Honor each captured 15% market share, creating intense competition in the premium segment as Apple dropped 25% for the fourth quarter and 17% for the year. Apple can’t blame the economy on this one because the Chinese market’s recovery was particularly strong in the fourth quarter of 2024, growing 5% YoY with 77.4 million units shipped.

The year 2024 marked the introduction of generative artificial intelligence in smartphones, primarily in premium segments, with expectations of broader adoption in mid-range devices by 2028. Ultra-premium smartphones priced above $1000 showed the fastest growth globally, supported by device subsidies and financing options. Canalys predicts that China’s smartphone shipments will exceed 290 million units in 2025, while global revenues are expected to grow 8% YoY, outpacing volume growth of 4%. The global recovery was led by Europe, China, and Latin America, where improving macroeconomic conditions supported consumer confidence.