Both Latin America and Southeast Asia saw increased inventories from subdued consumer demand for smartphones, prompting companies to adopt a more targeted approach to specific market segments, according to new research from Canalys. Despite the present challenges, both regions hint at opportunities. Southeast Asia is expected to witness momentum in 2H23 and mid-single-digit growth in 2024. Meanwhile, Latin America, with improved economic forecasts and the upcoming peak sales season, may also see potential growth by the end of the year.

Southeast Asia Smartphone Market

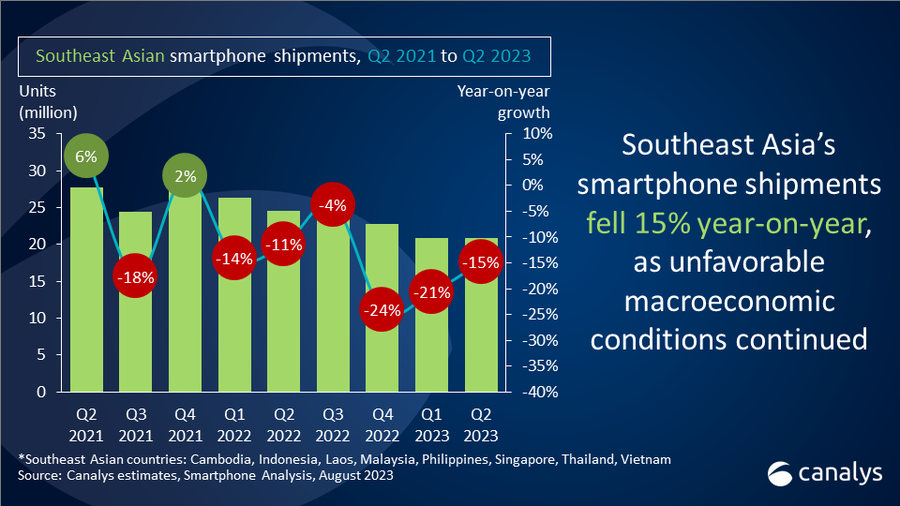

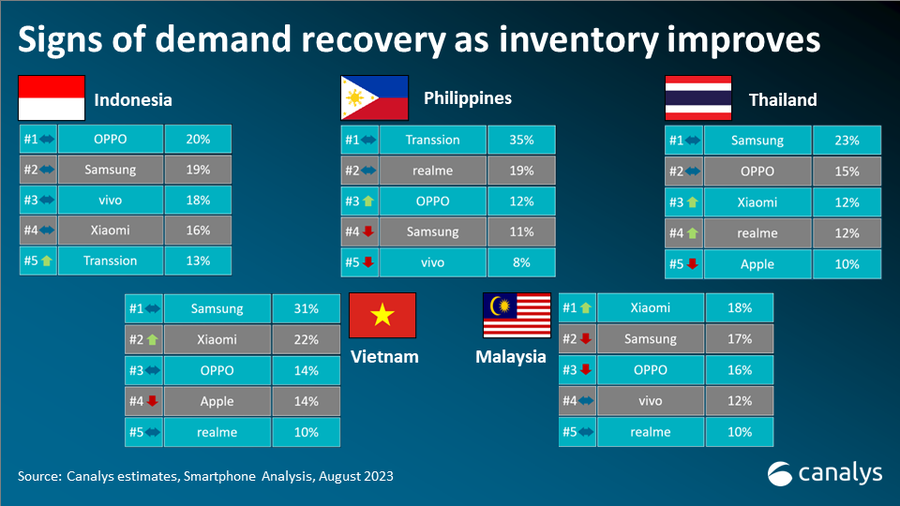

In 2023, the Southeast Asian smartphone market experienced a sharp downturn, with shipments plummeting 15% year-on-year to 20.9 million units in Q2, the lowest figure since 2014. This decrease marked the region’s sixth consecutive decline. Leading the market, Samsung faced a 26% drop but still shipped 4.2 million units, securing a 20% market share. While countries like Thailand and Malaysia found momentum in 5G adoption, Indonesia and the Philippines recorded significant shipment drops. However, a silver lining emerged as Transsion, focusing on Tier-2 cities, registered a robust 31% growth, marking its entry into the top five in the region.

| Vendor | Q2’23 Shipments (millions) | Q2’23 Market Share | Q2’22 Shipments (millions) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Samsung | 4.2 | 20% | 5.7 | 23% | -26% |

| Oppo | 3.4 | 16% | 4.4 | 18% | -23% |

| Xiaomi | 2.9 | 14% | 4.0 | 16% | -26% |

| Transsion | 2.9 | 14% | 2.2 | 9% | 31% |

| realme | 2.6 | 12% | 2.6 | 11% | 0% |

| Others | 4.9 | 23% | 5.6 | 23% | -13% |

| Total | 20.9 | 100% | 24.5 | 100% | -15% |

Latin America Smartphone Market

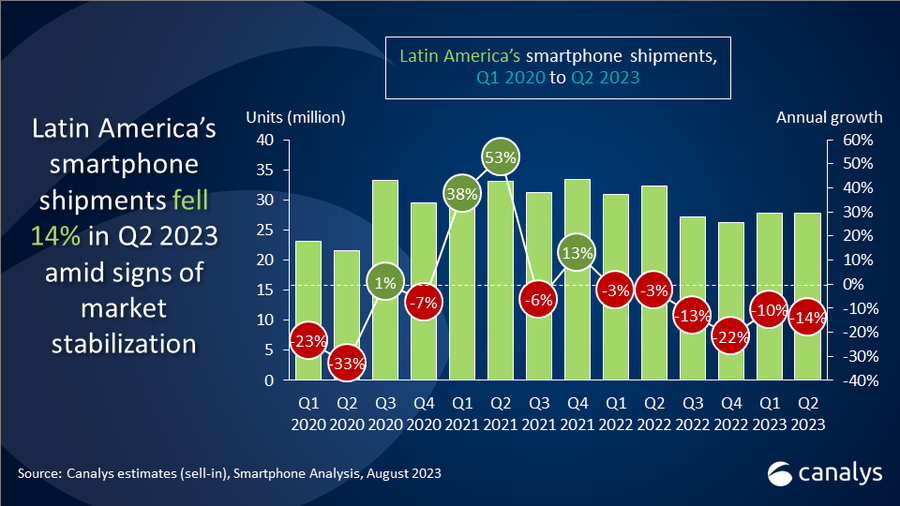

In Latin America, 2023 saw a 14% year-on-year decline in smartphone shipments, bringing the total to 28 million units. Major players, Samsung, Motorola, and Xiaomi, all faced double-digit percentage declines, prompting them to adopt strategic shifts. Samsung leaned towards higher-margin models, Motorola centered on the low-end and mid-price segments, and Xiaomi pinpointed models within the $100 to $500 price range. Amidst these declines, Honor and Transsion stood out, especially Honor, which achieved a staggering 168% year-on-year growth. On a broader scale, despite the contraction, Latin America’s economic stability and growth in powerhouses like Brazil, Mexico, and Colombia suggest an optimistic future for the smartphone market.

| Vendor | Q2’23 Shipments (millions) | Q2’23 Market Share | Q2’22 Shipments (millions) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Samsung | 9.4 | 34% | 11.6 | 36% | -19% |

| Motorola | 5.7 | 21% | 7.0 | 22% | -18% |

| Xiaomi | 4.6 | 17% | 5.3 | 17% | -14% |

| Transsion | 2.1 | 7% | 1.3 | 4% | 56% |

| Apple | 1.4 | 5% | 1.5 | 5% | -8% |

| Others | 4.7 | 17% | 5.5 | 17% | -14% |

| Total | 27.9 | 100% | 32.2 | 100% | -14% |