What will Sharp’s executives and stakeholders decide to do on May 14th?

If I knew, I could not tell you but I can offer a trip down memory lane to see how Sharp cut itself on leading-edge display technology. I can also offer some recent data showing how commercial success can add to financial distress.

The Ever-Sharp pencil was a milestone in post-war Japanese development. Unlike most other LCD pioneers in Japan, Sharp was not part of a zaibatsu (think Mitsubishi or Panasonic). As with Honda, it arose when General McArthur was running Japan, before the anti-Communist scare changed US policy. Sharp was not part of the old-boys network and its success depended on innovation. And innovate it did. The company produced the first LCD-based calculator in 1973 and the first full-color AMLCD notebook panel in 1988. Other Japanese producers innovated: Seiko’s LTPS, Hitachi’s IPS and Fujitsu’s MVA, for example. Other producers expanded: DTI, the IBM-Toshiba JV, was the world’s largest for example. But Sharp remained a technology powerhouse. Much like Samsung Electronics today, Sharp blended IC, LCD and design capabilities into some great products.

Then Japan caught up to IBM. The joke back in the 1990’s was that after years of effort, Fujitsu, Hitachi and NEC matched IBM in mainframe technology just in time for the PC revolution. Japan’s electronics companies began shedding assets. Panel makers put their engineers on planes to Taiwan and traded know how for panel supply from start-ups such as Acer Display, Chi Mei and Hannstar.

In hindsight, it looks like Japanese ministers reacted to the technology transfer suddenly (but too late). That is the only plausible explanation I have for the abrupt reversal of Sharp’s plan to outsource TV production to Quanta Display and its parent Quanta Computer, then the leading notebook maker. The initial partnerships date from 1999 and all was going well until Sharp withdrew technical support and instituted a virtual lock-down on its facilities and technologies. Conditions for Quanta Display deteriorated until AU Optronics acquired the company in 2006. Meanwhile in Japan, Sharp instituted the Only One policy of prioritizing vertical market sales within the group. From what I could tell back then, display export markets were supported only to the degree that demand did not interfere with Sharp branded product plans.

As you might expect, that created problems for Sharp’s customers. I heard complaints from TV set distributors and retailers back then; my impression was that Sharp wanted to serve Japanese consumers first. Domestic focus made sense until about 10 years ago when the Japanese market matured. Since then, overseas markets have presented the better opportunity but one dependent on good relationships with distributors and retailers outside Japan. On and off again export marketing may have cost Sharp a lot of global share of consumer product sales… and internal demand for panels, as we will see.

Slow expansion of the first fab in Kameyama constrained Sharp’s share, also. Sharp ramped its Gen-6 fab over three years, about three times slower than a Korean competitor. Executives admitted Sharp TV shipments had been constrained by the cautious ramp-up. Perhaps that explains the rapid expansion of Kameyama-2 in 2006 and the Sony JV that formed Sharp Display Products (the Gen-10 in Sakai) in 2009.

Unfortunately, neither the Sharp nor Sony brand was big enough to use all of those assets. The decision to double Sakai capacity in 2010 was the beginning of the end. From what I can tell, Sony never bought more than 7% of Sakai and Sharp was forced to put SDP into an off-balance-sheet entity after Sony declined its purchase option in 2011.

By that time, Sharp was scrambling for a new technology edge in Japan and some way to monetize its older technology in China. A technology and sourcing agreement with Hon Hai Precision Industries (Foxconn) and a technology transfer agreement with CEC Panda were announced in 2011. Capacity in Kameyama was taken off-line to solve loading problems. Later, some was converted to metal oxide (IGZO) technology in a bid for Apple-class business. As we know, that did not go well: one producer developing a new technology in a black box in which employees and suppliers are kept in the dark does not make for brilliant breakthroughs.

Whether Sharp opted out of the national consolidation that formed Japan Display in 2011 or was excluded from the deal is unclear to me. The need to restructure was clear to Sharp, however. Negotiations with Foxconn and bankers and ministers that began in 2011 are still on going. I assume the issues are complex politically and operationally but that all agree Sharp cannot go forward as-is. Problems in the PV and TV market in recent years have added to the challenge of remaining a merchant supplier of AMLCD as China becomes the center of panel production.

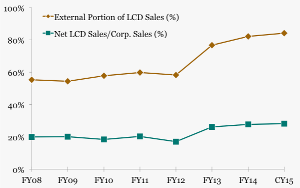

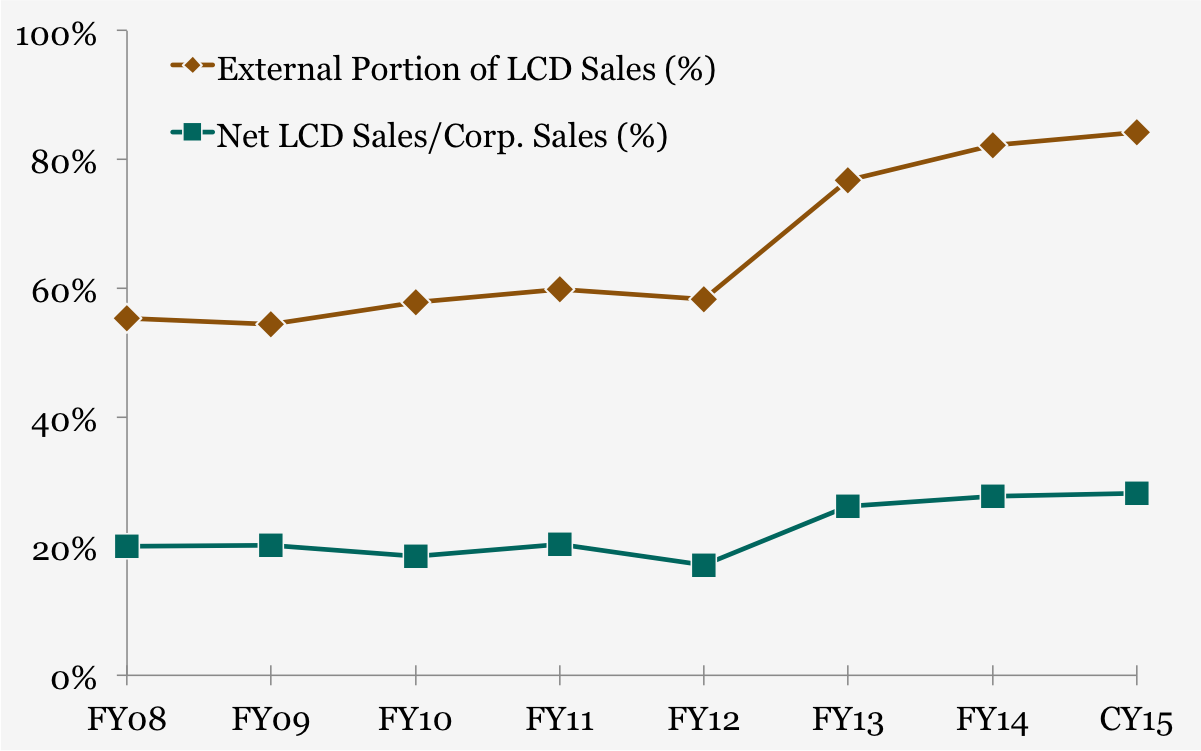

Looking at two numbers available from Sharp’s financial reports provides some insight into the problem that must be solved. (Note that the date dots are fiscal years ending in March except for the last one, which represents nine months ending December 2014.)

The top (brownish) line is the portion of Sharp’s LCD sales to external customers. This comes from comparing unconsolidated sales with consolidated sales. Consolidated accounting eliminates the value of panels sold to Sharp affiliates, so we can see how that has declined. Sharp transferred nearly 45% of its displays internally in 2008. Brand power must have diminished because that portion slipped to 16% in 2014. Sharp’s LCD sector now relies on merchant orders (the global commercial market) for about 84% of its sales. As a result, Sharp’s LCD sector is no longer sheltered and it must compete with much larger producers for smartphone or TV panel orders. Sharp now has only 6% of global TFT capacity and that share will decline.

The lower (greenish) line is the LCD portion of consolidated sales for all Sharp’s businesses. While LCD sales have been up and down year by year, the trend has been fairly flat. Yet, the LCD contribution to sales has increased from 20% in 2008 to 28% in 2014. That implies that Sharp has become more reliant on a commodity LCD business facing growing competition and continued price pressure.

In summary then, the numbers show why Sharp may want to put its display assets off balance sheet, inside another company (e.g. sale) or inside an unconsolidated joint venture. Either move might bring Sharp’s technology out of the dark and into a bigger, sunnier garden. – David Barnes