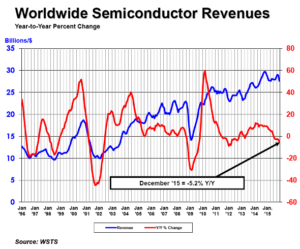

The global semiconductor industry posted sales of $335.2 billion in 2015, says the Semiconductor Industry Association: a slight (0.2%) decrease YoY. 2014 was the industry’s highest-ever result. Global sales for December reached $27.6 billion, down 4.4% MoM and 5.2% YoY. Q4’15 sales were $82.9 billion: 5.2% down from $87.4 billion in Q4’14.

Although the numbers were down, sales were “solid”, said SIA president and CEO John Neuffer. Factors limiting sales included softening demand, the strong US dollar and normal market trends and cyclicality. Modest growth is projected for 2016.

Several product segments stood out. Logic was the largest category by sales ($90.8 billion) in 2015, followed by memory ($77.2 billion) and micro-ICs ($61.3 billion). Optoelectronics was the fastest-growing, rising 11.3% YoY.

Regionally, annual sales were up 7.7% in China, which led all regional markets. All other markets fell YoY: the Americas were down 0.8%, Europe 8.5%, Japan 10.7% and APAC/All Other 0.2%.

| Semiconductor Sales by Region, December 2015 ($ Billions) | |||

|---|---|---|---|

| Market | Dec-15 | Dec-14 | YoY Change |

| Americas | 5.75 | 6.73 | -14.5% |

| Europe | 2.77 | 3.01 | -7.9% |

| Japan | 2.57 | 2.80 | -8.1% |

| China | 8.45 | 8.03 | 5.2% |

| APACxJ/Other | 8.08 | 8.57 | -5.7% |

| Total | 27.62 | 29.13 | -5.2% |

| Source: SIA | |||

Analyst Comment

Gartner released its figures on semiconductor customers this week, as well. The firm said that Samsung and Apple topped the rankings, taking a combined 17.7% of the market ($59 billion – an increase of $0.8 billion YoY). 2015 was the fifth consecutive year in which the two companies have led the semiconductor market.

The top 10 semiconductor customers bought $123 billion of semiconductors, representing 36.9% of the total market revenue – down from 37.9% in 2014. (TA)