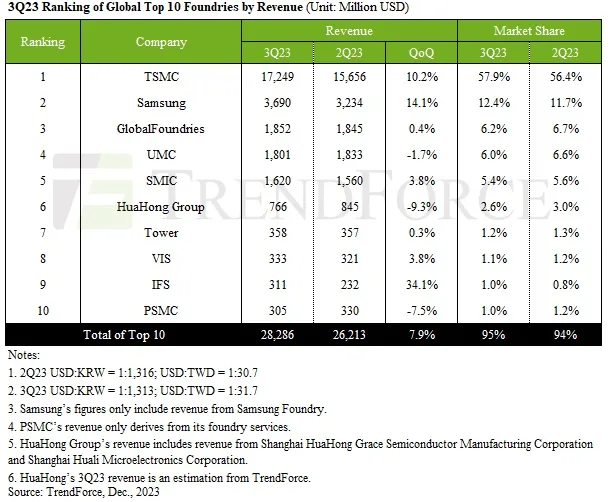

Samsung Foundry’s revenue grew 14.1% quarter-over-quarter in Q3’23 to $3.69 billion, driven by strong orders for mobile phone chips and display components, according to market research firm Trendforce. The demand was fueled by Qualcomm application processor orders for mid-to-low end 5G and 4G Android devices, 5G modems, and Samsung’s own 28nm OLED display driver integrated circuits.

Trendforce reported the total Q3 revenue for the top 10 foundries reached around $28.29 billion. TSMC maintained its commanding market share of over 58%, with sales growing 10.2% to $17.25 billion. TSMC’s advanced manufacturing processes under 7 nanometers accounted for close to 60% of its total Q3 revenues. The company’s cutting-edge 3nm node contributed around 6% of revenue as production ramped up and it widened the gap between itself and Samsung. Intel’s foundry business benefited from seasonal laptop chip demand and early production of leading-edge nodes.

Overall, the global semiconductor foundry market continues to show resilience, with the top 10 foundries by revenue experiencing 7.9% quarterly growth in Q3’23.