Samsung’s booth at ISE 2026 this week didn’t deliver a single jaw-dropping hardware surprise. What it delivered instead may matter more: a coherent argument that commercial displays have entered a phase where the panel is no longer the product: the platform is.

The centerpiece of that argument is Spatial Signage, Samsung’s first commercial glasses-free 3D digital signage display, an 85-inch autostereoscopic LCD now globally available to enterprise buyers. But the more consequential moves at the show were quieter: expanded Cisco and Logitech certifications, a cloud content platform with AI-powered 3D conversion tools, and a Micro LED lineup that’s inching closer to mainstream commercial deployment.

Together, these announcements position Samsung not as a panel vendor chasing spec sheets, but as an infrastructure provider trying to own the full stack from pixel to playlist.

The 85-inch Spatial Signage unit is a 4K UHD LCD in portrait orientation, 52 millimeters deep, weighing roughly 49 kilograms: dimensions that allow it to hang on a standard wall mount where any conventional signage display would go. Objects appear to float up to about one meter in front of or behind the screen plane, creating a depth effect visible to multiple viewers simultaneously without glasses.

The core technology is what Samsung calls the 3D Plate, a refractive or diffractive optical layer integrated within the LCD stack itself rather than affixed to the front as an external sheet. External analyses describe the architecture as embedded lenticular lenses combined with layered visual elements, essentially a lens-type autostereoscopic plate built into the panel, not bolted onto it. A tuned backlight and Samsung’s Quantum Processor handle 4K upscaling, 16-bit color mapping, and dynamic HDR processing to support the stereoscopic effect.

This is not a light-field display. It does not reconstruct a full 4D light field or solve the vergence-accommodation conflict that plagues near-eye stereoscopic systems. What it does is deliver a controlled number of viewing directions with conventional stereo cues (parallax motion in animated content, shading, occlusion) optimized for the medium-distance, multi-viewer scenarios typical of retail floors, museum lobbies, and brand experience centers. Samsung claims image clarity “without the blur typical of older stereoscopic systems,” which implies tighter optical alignment and aggressive content pre-processing to reduce crosstalk between views.

The trade-offs are real. True resolution per view is lower than native 2D 4K because pixels are shared across multiple viewing directions: an inherent constraint of any autostereoscopic approach. Accommodation-vergence mismatch can still cause visual fatigue if content pushes depth effects too aggressively. And the system is tuned for attention capture in public spaces, not for precision visualization work where head-tracked or light-field solutions would be more appropriate.

But those limitations may not matter much for the intended use case. Spatial Signage is chasing the “stop and stare” effect that large lenticular billboards have delivered for decades, except in a fully digital, remotely updateable format that fits into an existing signage infrastructure.

The unit already carries a CES 2026 Innovation Award and an IFA 2025 Innovation Award. Samsung has announced 32-inch and 55-inch models on the roadmap.

The historical bottleneck for autostereoscopic signage has never been optics alone: it’s been content. Traditional lenticular and multi-view displays require bespoke multi-view rendering pipelines: separate camera angles, interlaced frames, careful calibration to the specific lens sheet. For most advertising agencies and retail creative teams, this has been a non-starter.

Samsung’s answer is AI Studio, an AI content application integrated into the company’s VXT cloud signage platform. The workflow is designed to be straightforward: upload standard 2D assets, let AI Studio auto-generate motion and parallax depth, optimize the output for the 3D Plate’s specific optical characteristics, and deploy to Spatial Signage units (or conventional smart signage) through the same VXT management layer.

If this works as described, it eliminates the most significant adoption barrier for 3D signage: the creative cost. Content teams would not need to build multi-view render pipelines or hire stereoscopic specialists. The system hides the view-splitting and pre-distortion complexity behind what is essentially an automated filter.

That said, the quality of AI-generated depth will inevitably vary by source material. Strong depth cues (foreground objects against clean backgrounds, clear occlusion) should produce convincing effects. Busy, flat imagery will likely look more like enhanced 2D with subtle parallax. The gap between Samsung’s demo reel and real-world agency output will be worth watching closely.

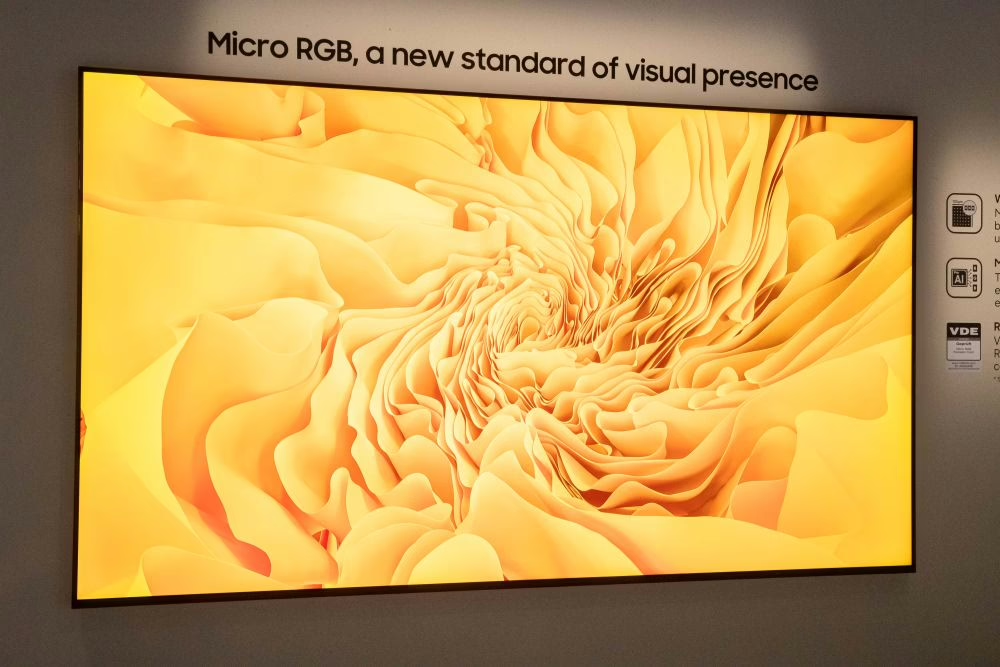

Micro LED Moves Toward Practical Scale

The other major hardware story at ISE was the 130-inch Micro RGB signage display, designated QPHX: previously shown in consumer form at CES 2026, now formally introduced to commercial customers. The unit uses micro-scale RGB LEDs at sub-millimeter pitch, driven by what Samsung calls the Micro RGB AI Engine Pro for color volume and detail enhancement.

Samsung is positioning QPHX for flagship retail, premium corporate lobbies, and brand experience centers: the same high-end venues where The Wall has been selling, but in a more accessible single-panel form factor rather than a tiled array.

The Wall itself continues to expand. Samsung showed a new 108-inch All-in-One 2K model, bringing the pre-configured Wall portfolio to five sizes spanning 108 to 146 inches in 2K and 4K configurations. The All-in-One approach (integrated control electronics and mounting hardware in a single shipment) targets faster deployment by reducing on-site integration complexity.

Neither product represents a technology breakthrough. The significance is incremental: Micro LED is moving from bespoke installations toward something resembling a catalog product with predictable delivery timelines.

Perhaps the least flashy but most strategically significant announcements involved partnerships. Samsung’s 115-inch 4K Smart Signage and 146-inch The Wall All-in-One are now Cisco-certified for use with Cisco collaboration endpoints. A new Logitech partnership adds Samsung’s QBC 4K Smart Signage series into Microsoft’s Express Install program for Teams Rooms, bundling displays with Logitech room systems for installations that Samsung and Logitech claim can be completed in under an hour.

These certifications matter because they shift Samsung’s positioning in enterprise accounts. A Cisco-certified Wall display is not just a screen: it’s a validated component in a collaboration stack. A Teams Rooms Express Install bundle competes directly with purpose-built videoconferencing hardware. Samsung is inserting itself into procurement workflows where the display decision is made alongside the UC platform decision, not separately.

Combined with VXT as a centralized management layer, the ISE lineup presents a picture of Samsung trying to own the relationship between the display and the network: whether that network is a retail CMS, a corporate UC platform, or a cloud signage service.

Samsung also expanded its Color E-Paper lineup with a 13-inch model using ultra-low-power digital ink, positioned as a drop-in replacement for printed shelf labels, counter signs, and door tags. It’s a niche play, but it fills out the bottom of the portfolio: Samsung can now offer display solutions from a 13-inch e-ink tag to a 146-inch Micro LED wall, all managed through connected platforms.

The competitive context is worth noting. LG’s current public signage lineup emphasizes 2D LCD, OLED (including transparent), outdoor, stretch, and video wall products. Its digital signage portfolio and recent announcements do not include a comparable commercial glasses-free 3D signage line. LG has historical experience with parallax and lenticular autostereoscopic technology in monitors and mobile devices, but it has not productized that technology into a shipping multi-viewer 3D signage system for the current cycle.

On 3D signage specifically, Samsung has a visible, productized lead. In the broader professional display market, LG continues to compete strongly on OLED contrast, transparent OLED form factors, and diverse LCD signage, but that is a 2D competition on image quality and industrial design, not on glasses-free depth.

No Revolution, Just Consolidation

ISE 2026 was not a revolution for Samsung. It was a consolidation: of display technologies spanning e-paper to Micro LED, of content tools that lower the barrier to 3D adoption, of enterprise partnerships that embed Samsung hardware into collaboration ecosystems. Spatial Signage is the attention-getter, but the strategic bet is broader: that the value in commercial display is migrating from the panel to the platform, and that the vendor who controls the content pipeline and the integration layer will capture more of the margin than the one selling glass.

Whether Spatial Signage becomes a durable product category or a novelty that fades after the initial retail curiosity cycle depends less on the optics and more on whether AI Studio can reliably produce compelling 3D content from ordinary creative assets at scale. That’s the question Samsung needs to answer next.