The Asia-Pacific excluding Japan region (APeJ) has been witnessing significant growth in the smart TV stick market, according to research firm Fact.MR. APeJ is projected to grow its smart TV stick market share by nearly 8% between 2018 and 2028. With this, it will become the second-largest smart TV market, surpassing Europe. The espousal of western entertainment habits by the people in the APeJ region has led to a surge in demand for smart TV sticks. The modernisation of network infrastructure and broadband has elevated the demand for live streaming, thereby boosting the growth of the smart TV stick market globally.

North America has been the dominant smart TV stick market, commanding over 40% of global demand. The US accounts for over a 40% share of the global smart TV stick market. It is the largest consumer of OTT content, where its reach extends to nearly 54% of the households. An average US home has a viewership of nearly 49 hours across the month. This figure itself states the demand for smart TV sticks in the country, analysts say.

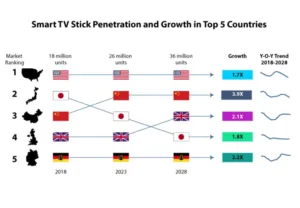

The top-five countries in the smart TV stick market are estimated to account for shipments of 18 million units in 2018. China is estimated to witness the strongest growth and become the second-largest smart TV stick market by 2028. Home entertainment has been undergoing a drastic change, while technology is empowering viewers. The popularity of OTT, including smart TV sticks, has brought with it opportunities for a variety of associated devices.

The modern living room experience in the US features digital, OTT and IoT-enabled devices, including smart TV sticks. Digital devices include computers, smartphones and tablets. OTT consists of smart TV sticks and devices, smart TVs, game consoles, DVRs and set-top boxes, and internet-enabled Blu-ray players. Among streaming devices, smart TV sticks and boxes represent over a 70% share of the US OTT device market.

Smart TV sticks and streaming devices have a reach of around 38 million, compared to 28 million homes with smart TVs. Roku, Amazon, Chromecast and Apple are the key contenders in the streaming device market in the US. However, Apple is sidelined when considering only players which offer smart TV sticks.

Source: Fact.MR

Over 40% of the US OTT audience enjoy cordless service such as smart TV sticks, with satellite-based streaming next in line. Non-Ultra HD smart TV sticks make up over 60% of North American demand. However, large numbers of non-UHD smart TV sticks are being replaced by UHD-and-above versions. Also, most of the audiences that are newer to smart TV concept prefer to buy UHD-and-above versions of smart TV sticks, analysts say.

While OTT viewership has become mainstream in the US, other countries are gradually looking at it, thereby boosting demand for smart TV sticks. Amazon has the privilege of its own e-commerce channel, which has led to continuous, strong growth of its smart TV sticks globally. Other providers’ direct-to-customer online offerings are limited to fewer countries, leading to slightly slower growth. Google is also expanding penetration of its Chromecast-branded sticks.

Broadband penetration has been the most important factor for the growth of smart TV stick demand. In most countries with low adoption of smart TV sticks, poor broadband infrastructure is a key factor. According to internet stats in 2017, household broadband penetration in the US was more than 90%, which has enabled high adoption of smart TV sticks. European countries, including Germany, France and the UK, are also expecting strong broadband growth, while most emerging economies are anticipated to reflect even stronger broadband penetration, making fertile ground for smart TV sticks in these countries.

The prices of smart TV sticks have been eroding continuously, therefore encouraging volume growth. With technological advancements, smart TV sticks that are to become obsolete are offered at prices lower than consumers’ expectations. Amazon’s Prime Day offerings further encourage short-term, high-volume purchases of smart TV sticks. The emergence of smart TVs embedded with streaming technology has been, to some extent, obstructing the demand for smart TV sticks. However, in the short term, the implications are low for the market.