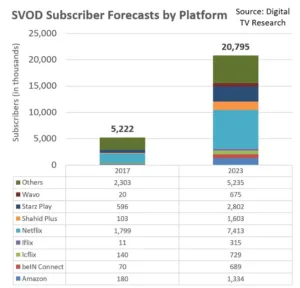

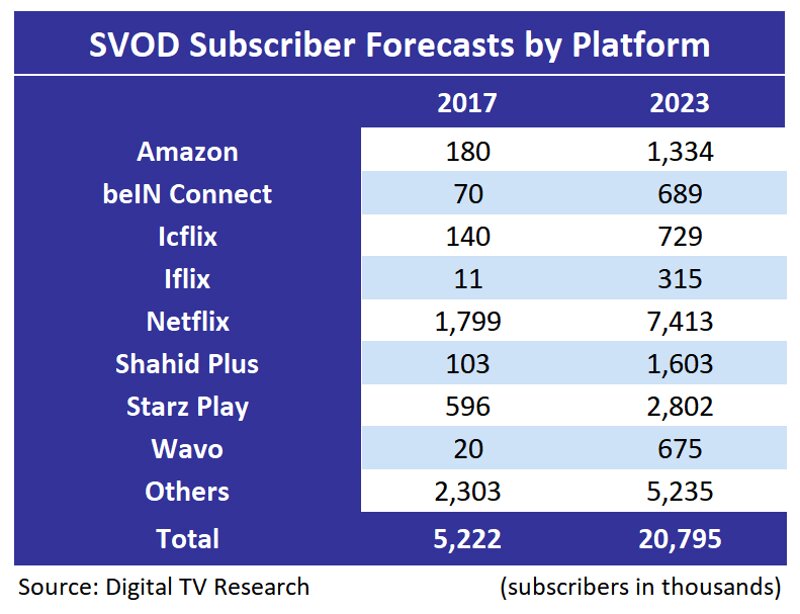

The MENA region will have 20.8 million movie and TV series SVOD subscribers by 2023, up from the 5.22 million recorded at the end of 2017. Turkey will remain the leader by some distance, with 6.72 million subscribers by 2023 — a third of the region’s total. Principal analyst Simon Murray commented:

“Netflix is domin

ant across the MENA region. This is partly because it operates in more territories than its Arabic competitors — it has significant subs bases in Israel and Turkey. However, its success is down to more than geographic reach. The global appeal of its original content has spread throughout the region”.

From its regional total of 7.41 million, Netflix will have 3.57 million subscribers in Arabic-speaking countries by 2023. This is higher than its nearest rival Starz Play with 2.80 million.

The top eight multinational platforms (Netflix, Amazon Prime Video, Icflix, Starz Play, Iflix, Wavo, beIN Connect and Shahid Plus) will account for three-quarters of the region’s SVOD subscribers by the end of 2023, up from 56% in 2017. Extracting Israel and Turkey, these eight platforms will retain 91% of SVOD subscribers. Murray continued:

“Although overall subscriber numbers will climb impressively, there are just too many Arabic platforms. They do not offer enough original or exclusive content to seriously challenge Netflix. We do not believe that the market can sustain this many Arabic platforms in the long run. Our report only covers paying SVOD subscribers, not those receiving free platforms as part of their pay TV subscription”.

SVOD revenues will grow sixfold between 2017 and 2023 to $2.03 billion. Market leader Turkey will add $451 million to more than double its total to $603 million by 2023. Saudi Arabia will increase its revenues by a factor of seven to reach $351 million in 2023, taking second place.