QD-OLED display technology is capturing an increasing share of the high-end monitor market, with projections showing its dominance growing from 68% of OLED monitor shipments in 2024 to 73% in 2025, according to TrendForce. The technology’s expansion is being fueled by the introduction of new 27-inch UHD products and high-refresh-rate QHD 500 Hz monitors that appeal strongly to gaming and professional users. Analysts expect the penetration rate of QD-OLED in 27-inch models specifically to increase from 32% in 2024 to 47% in 2025, driven by product line expansions and technical improvements.

QD-OLED’s primary technical advantage stems from its use of blue OLED light to excite quantum dots that emit pure red and green light. This configuration enhances brightness, color saturation, and gamut coverage, delivering more vibrant and detailed visuals than conventional displays. Despite these advantages, the technology faces challenges. Its reliance on blue light potentially impacts panel longevity, and ambient light can trigger unwanted quantum dot emissions in dark scenes, potentially compromising visual clarity. Recent innovations, however, include adding a green emission layer that boosts luminous efficiency by 30%, improving both energy consumption and image quality.

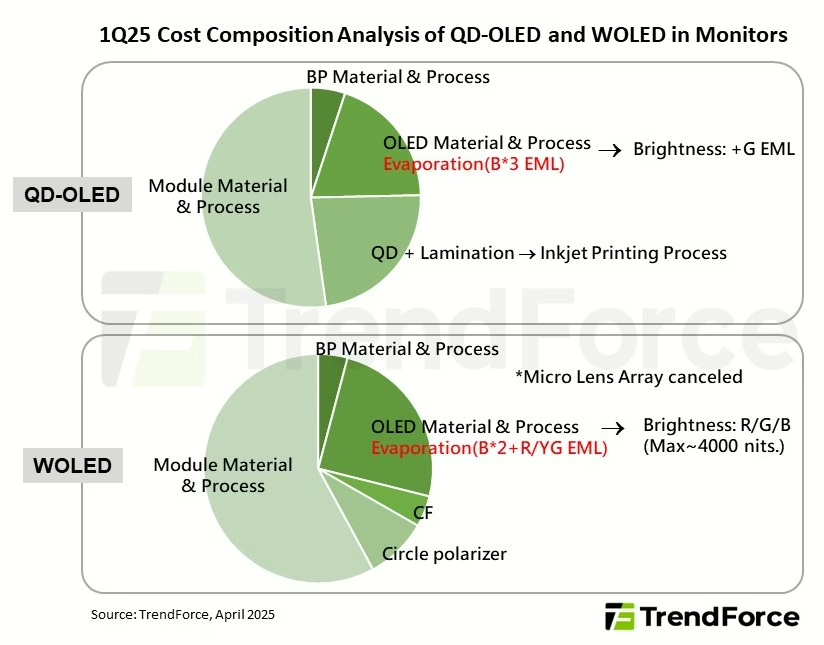

Manufacturing advances are addressing other limitations. PICO inkjet technology now allows for more precise quantum dot ink deposition, achieving pixel densities of 140 PPI and enabling 4K resolution on 32-inch panels, further strengthening QD-OLED’s position in premium applications. However, cost remains a significant factor in wider adoption. TrendForce reports that emissive materials and QD film constitute the largest portion of production expenses, with current inkjet processes resulting in approximately 20% ink waste per nozzle. New recycling techniques capable of recovering up to 80% of residual ink are helping reduce costs and improve material efficiency.

The analysts expect a significant cost reduction when SDC’s depreciation of QD-OLED production lines concludes in 2027. The company also plans to implement new emissive material solutions by that time to address burn-in issues and extend panel lifespan.

While OLED adoption in the television sector faces constraints from competing technologies like ultra-large LCDs and MiniLED backlighting, the IT sector represents a growth opportunity. As QD-OLED and WOLED technologies continue their technical race, analysts expect them to drive OLED adoption beyond traditional applications into industrial control systems, public information displays, and transparent displays.