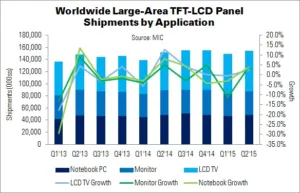

Taiwan’s MIC says that shipments of large-area TFT-LCD panels, for notebooks, monitors and TVs, reached 148.8 million units in Q1’15. This is a 4.1% QoQ fall. Monitor panels slipped the most, by 11.2%, while notebook panels fell 3.1%.

MIC writes that notebook vendors had been prompted to build panel inventories since Q2’14, due to concerns over rising panel prices and short supply. In Q1’15, they mainly focused on inventory adjustments. With panel prices falling again, these vendors are being more conservative about building inventories.

The double-digit fall in monitor panel shipments was due to “lukewarm” end-user demand, said MIC’s Brian Chen. LCD TV panel shipments managed to continue growing, despite a Korean vendor cutting its shipment goal for 2015. In preparation for the 1st May holidays in China, LCD TV vendors increased pull-in demand for flat panels, keeping panel shipments up in Q1.

The trend is expected to reverse in Q2; MIC predicts 3.4% QoQ growth, to 154 million units. Notebook vendors are more optimistic about the end-user market, and forecast almost 10% growth. The benefits to panel shipments have been low, however, as inventory levels are still high. Notebook PC panel shipments are expected to have grown about 4.1% QoQ in Q2’15. LCD TV panel shipments continued to grow in Q2, as vendors sought to expand their worlwide market share.