During a long session of trying to understand the financials for Innolux, which recently released its Q1’23 financials, two things changed the trajectory of the writing: TSMC provided its financials (not good), and DSCC provided a teaser of what to expect from display manufacturers as they are all set to release numbers in the next couple of weeks.

TSMC: Display Market Barometer

TSMC’s Q1 sales performance is considered a leading indicator for the performance of major tech companies like Nvidia, Intel, AMD, Apple, Qualcomm, Dell, HP, and Lenovo. A decline in TSMC sales may result in decreased revenues for these companies in subsequent quarters, along with a drop in hardware sales followed by software sales through the computing industry. Consoles from Microsoft, Sony, and Nintendo are also expected to be affected. Business buyers and consumers alike are bound to be impacted either through a lack of demand, a lack of supply as inventories tighten, and pricing, as an artificial squeeze on inventories is used to keep prices high and margins intact.

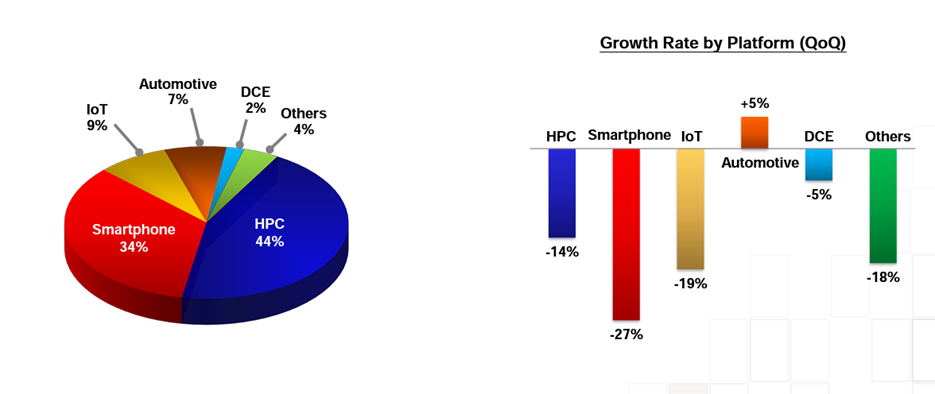

Forecasts for Q1’23 are down, and no significant improvements are expected until Q1’24. TSMC’s revenue distribution for Q1’23 shows a bleak outlook, with even worse results anticipated in the following quarter before a slow recovery begins. This situation affects not only the companies mentioned above, but also other firms that rely on TSMC chips. The only bright spot is automotive.

Additionally, ASML, the leading producer of chip-making machines and another trend indicator, despite seeing a significant increase in net profits and revenues, has warned that some customers are now reducing orders and capital expenditures, signaling potential challenges ahead, particularly concerning sales to China.

Innolux Battens Down the Hatches

Innolux’s financial performance in Q1’23 seems to be mirroring the sentiment, if not the trajectory, of TSMC’s results. The company said, the first quarter of this year was challenging, with a decrease in net sales and a net loss. However, it saw some positive signs such as an increase in small and medium-sized panel shipments and an improvement in gross margin and operating margin compared to the previous quarter, thanks to effective cost management, utilization adjustment, and pricing strategy.

Looking ahead to the second quarter of 2023, the company expects an increase in both large and small/medium panel shipments. It is positive to see the company’s efforts to optimize its product mix and non-display development to ensure a stable operation and financial performance. However, the industry remains highly competitive, and the company will need to continue to adapt to changing market conditions and consumer demand to maintain its position in the market.

| 1Q 2023 | 4Q 2022 | QoQ% | 1Q 2022 | YoY% | |

| Net Sales | 1,504.34 | 1,579.53 | -4.80% | 2,307.54 | -34.80% |

| Cost of Goods Sold | 1,610.32 | 1,819.08 | -11.40% | 2,022.10 | -20.40% |

| Gross Profit | -105.98 | -239.55 | -55.20% | 285.44 | -137.00% |

| Operating Expenses | 178.17 | 185.41 | -3.90% | 208.26 | -14.50% |

| Operating Profit(Loss) | -277.15 | -387.96 | -32.70% | 74.18 | -472.60% |

| Net Non-operating Income(Exp.) | 55.2 | 27.63 | 99.50% | 2.88 | 1810.40% |

| Profit(Loss) before Tax | -228.95 | -362.33 | -41.90% | 76.05 | -401.10% |

| Net Profit(Loss) | -255.87 | -408.18 | -37.40% | 62.71 | -507.40% |

What might be interesting is if Innolux Automotive is spun off as a separate entity with its own P&L and balance sheet, and there is some indication that this is being considered by Innolux. The automotive sector for display manufacturers is a systems integration opportunity that holds great promise. Apart from OLED displays in the cockpit, and projection systems for AR-type overlays on windshields, there is EV batteries and sensor components that would provide a huge opportunity for growth. You can expect display manufacturers to build cars, even though some will no doubt try, but they can certainly integrate a number of significant components to align with their display strategies.

Display Manufacturers Bracing and Hoping Throughout 2023

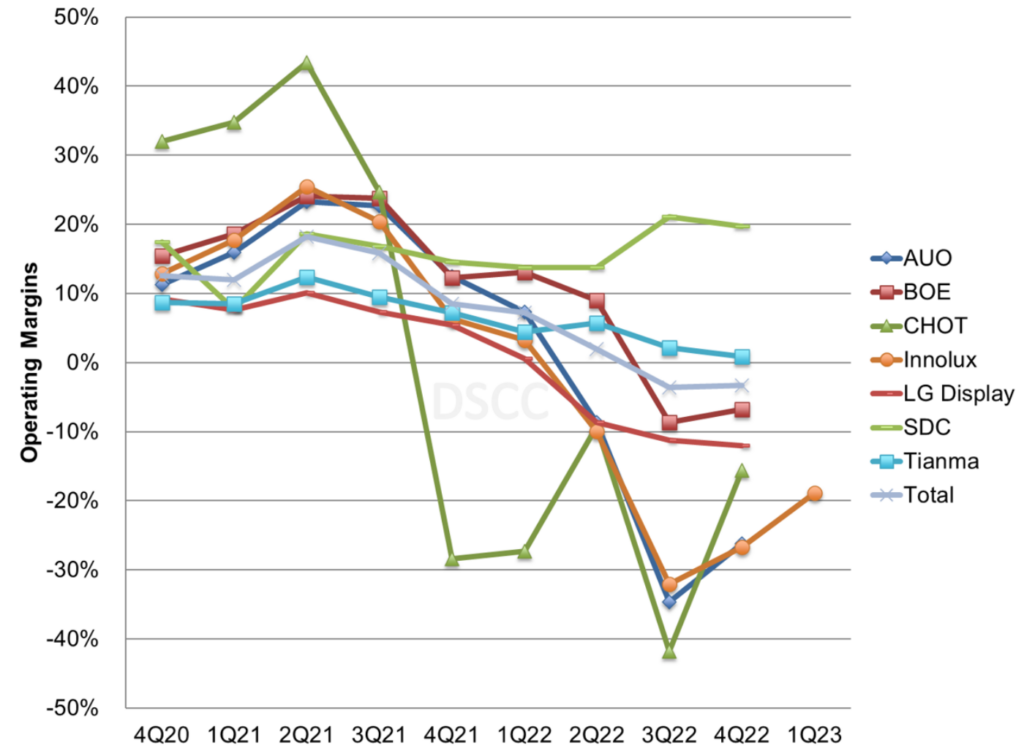

According to Bob O’Brien at DSCC, in Q1’23, display panel makers are anticipated to follow a pattern similar to Innolux, experiencing a decrease in revenues but slightly improved operating margins. Margins had peaked in Q2’21 and, after declining, stabilized at low levels in Q4’22. The industry is grappling with currency headwinds in Q1’23, as Asian currencies strengthened against the US dollar, potentially suppressing margins.

While SDC maintained positive operating margins and focused on OLED smartphone panels, LGD, AUO, and Innolux were more sensitive to the Crystal Cycle, causing their margins to fall sharply from Q2’21 through Q3’22. Tianma, with a focus on smaller panels and automotive displays, experienced eroding margins due to competition from other players.

LGD is set to release its Q1’23 financial results, with analysts predicting a revenue decline of 29% Q/Q. The industry’s focus will be on the guidance for Q2’23 and the full year.

From my perspective, Innolux and AUO, Taiwan’s big panel makers, had a very precipitous drop in margins, and they have no choice but to show a steep climb back towards profitability. That may not be a good indication of future performance just by virtue of the fact that extraordinary events require extraordinary reactions. Secondly, the TSMC results shouldn’t be discounted, and the projections going out are out of synch with consensus believe in the worst being over. The worse may be over, but the lag to getting back to more positive outcomes may be a lot longer than anyone has anticipated. Clearly, quarter by quarter scrambles to maintain the confidence of investors needs good results, but what is happening right now is not demand driven, but a result of operational adjustments after a period of exceptional growth when people had their foot on the gas pedal and burned up cheap money.

The other problem is that the US is waging a manufacturing war with China, and has an election coming up in 2024. There is still a war in Ukraine, and we have very little visibility on what will happen this coming winter with energy prices and supply chains, as a result. All the best intentions and operational efficiencies in the world will not help Asian manufacturers if exchange rates create havoc.

Automotive Demand is Display Demand

Clearly, consumer and business sentiment has to factor into projections for the future, and there is so much uncertainty about what is going to happen with demand in the second half of this year that I would just back off even being hopeful. Prepare for the worst and hope for the best. However, that is not the case with automotive. Automotive is going to keep moving up, and there is one thing that is guaranteed, consumers are going to demand new digital displays in their cars because they are cool. If you want to put it in management consultant terms, it is a time of digital transformation for the auto industry.

Who knows what is going to happen to TVs, computers, laptops, smartphones, and even mixed reality headsets. With the exception of that last one in the list, every other category just went through a boom period during the pandemic. The boom is over. Automotive had a pretty hard time during the pandemic, for obvious reasons, and it is set for a mini-boom of its own. And, 2024 and 2025 is going to see a slew of new EV vehicles coming to market, at price points that will appeal to all demographics. It’s the one category of display demand, the only category, that you can bet on.