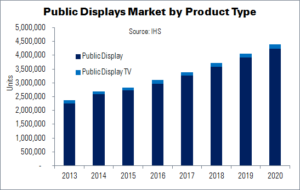

IHS expects public display shipments to rebound this year, with recovering regional economies and a rising number of large projects. Unit shipments will grow 9.3% YoY to around 3 million units, and revenues will climb even faster: 15.3% YoY. Rising ASPs will help that figure; IHS forecasts an increase from $1,826 last year to $1,926 this year. Total public display revenue will be up $1 billion per year to 2020, ending the forecast period at $9.7 billion.

Manufacturers need to focus their resources on products with high profit margins, said director of digital signage professional display research Sanju Khatri. Therefore, panel makers will continue to shift capacity to premium panels with larger sizes, higher resolutions and brightness and thinner bezels.

55″ LCD displays had a market share of 18.4% in 2015, but will reach their highest point in 2017, at 28%. However, share will fall to 21% by 2020. Even larger screens will take over. Shipments of 70″ displays are predicted to more than double, from 3.9% in 2015 to 8.9% in 2020. The 70″-79″ category will rise from 2.6% in 2013 to 11.8% in 2020. UltraHD LCD displays will also become more popular: these products had a share of 1.4% in Q4’15m, but will rise to 12.1% in 2020.

IHS also forecasts a sharp rise in public display TV (all-in-one signage solutions, including displays with media players and signage software) shipments. 100,000 of these products were shipped in 2015, and a CAGR of 11% is expected through 2020, reaching 167,000 units.

Shipments of public display displays vary from 3% to 5% of the market, but revenue was just 1.2% of the overall market in 2015, due to their lower ASPs. Revenue will rise only slightly to 2017, to 1.3%, and will stay there through 2020.