The smartwatch industry has experienced remarkable growth and innovation, especially in the wake of the COVID-19 pandemic. With functionalities ranging from phonetics and health monitoring to sports tracking, GPS, communication, and personal data management, smartwatches are becoming increasingly indispensable.

Global smartwatch display shipments surged from 259 million units in 2022 to 351 million units in 2023, according to Omdia. The firm forecasts that shipments will reach 359 million units in 2024. The display market is dominated by TFT LCD technology, which accounts for 63% of shipments, while OLED technology makes up the remaining 37%.

OLED displays, favored in the mid to high-end market segments, offer superior visibility, higher contrast ratios, a thin and light form factor, and lower power consumption compared to TFT LCDs. Chinese manufacturers have been focusing on the smartwatch OLED market, expanding their customer base and enhancing their production capabilities.

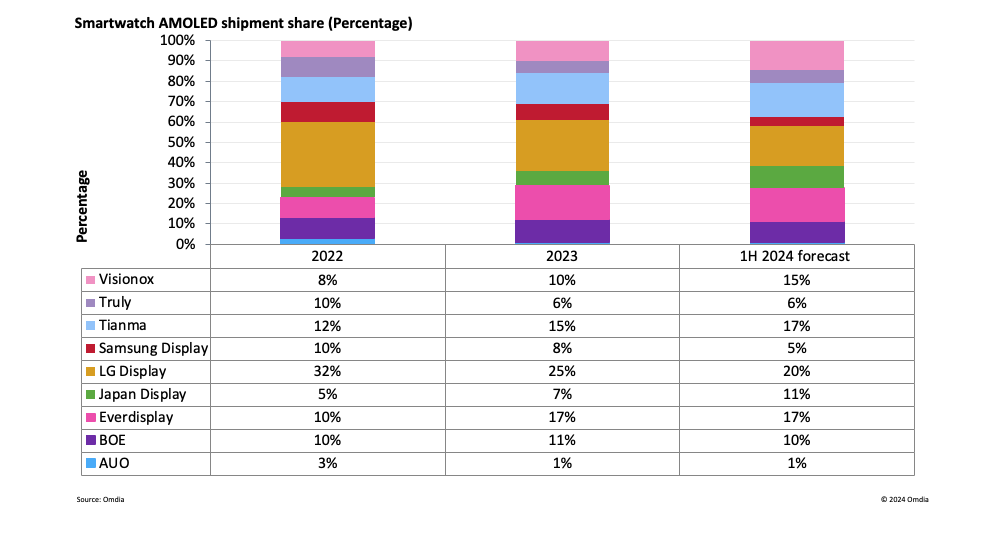

LG Display leads the smartwatch OLED market, primarily supplying to Apple Watch. However, Chinese OLED manufacturers have been increasing their market share since 2023. In the first half of 2024, LG Display, EverDisplay (EDO), and Tianma are projected to collectively account for 53% of the market share, with Chinese OLED makers expected to represent 64%.

In the AMOLED segment, LG Display and Japan Display provide high-end flexible OLED panels with LTPO backplane technology for the Apple Watch, while Samsung Display supplies OLED panels for the Samsung Galaxy Watch. Chinese manufacturers such as EverDisplay, Tianma, Visionox, BOE, and Truly are expanding their shipments by securing design wins with brands like Fitbit, Garmin, BBK, Honor, OPPO, Xiaomi, and Google. Additionally, OLED panels are seeing increased adoption in non-branded smartwatches.

Chinese TFT LCD makers like BOE have long dominated the smartwatch TFT LCD segment due to their extensive resources and successful design integrations.