Global tablet shipments in the first quarter of 2018 (1Q18) reached 31.7 million, declining 11.7% from the prior year, according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker.

However, the growing niche of detachable tablets like the Microsoft Surface and iPad Pro did experience more than 2.9% year-over-year growth and captured 15.3% share as newer models came into play.

Meanwhile, the decline for traditional slate tablets continued as vendors managed to ship 26.8 million units, down 13.9% from the prior year.

“Chrome OS’ entrance in the detachable market is a welcome change as Google is finally a serious contender from a platform perspective,” said Jitesh Ubrani, senior research analyst with IDC’s Worldwide Quarterly Mobile Device Trackers. “Google’s tighter control and integration of Chrome OS will allow brands to focus more on hardware design and additional services rather than spending resources reconfiguring Android to work in a detachable setting. Combined with Microsoft’s efforts to run Windows on ARM, the detachable market is poised for strong growth in the near term.”

“The timing of Chrome OS’ official entry into the tablet category is apt,” stated Linn Huang, research director, Devices and Displays. “Peak education buying season is approaching, and Chrome OS has resonated with administrators for its manageability where deployment is strong. Schools looking for that same environment but in tablet form – generally students aren’t provisioned a device with a keyboard until older – could find favor with these new devices.”

Tablet Company Highlights

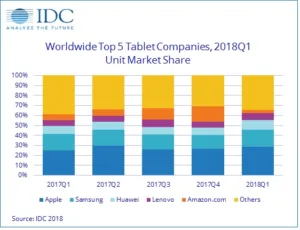

Apple’s leading position remained unchallenged during the quarter as the company managed to ship 9.1 million iPads. Of that, 1.8 million were iPad Pro tablets, making Apple the leader in the detachable market as well. Apple’s latest iPad launched towards the end of the quarter and along with the company’s renewed focus on the education market should prove to be quite lucrative in the coming quarters.

Samsung maintained the second position although the company’s shipments declined 11.4% compared to last year. Samsung is one of the few remaining brands to offer premium Android tablets with its Tab S lineup. However, barring any significant changes, maintaining its position in the premium space may prove challenging as detachables based on the Apple, Microsoft, and even Google Chrome platforms pick up steam. Towards the end of the quarter, Samsung announced a new enterprise focused tablet, the Tab Active 2, and while this is a niche market, it tends to be one with high margins.

Huawei grew 13% year over year, gained more than 2% of share sequentially, and climbed back into the ranks of the top 3. Huawei is still geographically anchored in Asia/Pacific (excluding Japan) – 49.5% of their shipments went to this region – but it saw tremendous growth particularly in Europe where its volumes grew 72.7% against the backdrop of a 8.7% total market decline.

Lenovo managed to grow 1.8% compared to the past year with most of the growth stemming from its detachable portfolio as the company shipped over two hundred thousand detachables. The company’s strong presence in Asia and Europe has helped cement its position amongst the top 5 and helped differentiate it from close competitors like Huawei.

Amazon.com slipped into fifth place though this does not come as a surprise as the company’s tablet shipments are highly seasonal. Moreover, during the first quarter, the company was far more focused on enhancing the Alexa platform and even announced availability of its voice assistant on the smaller 7- and 8-inch Fire tablets.

|

Top Five Tablet Companies (Detachable + Slate), Worldwide Shipments, Market Share, and Growth, First Quarter of 2018 (preliminary results, shipments in millions) |

|||||

|

Company |

1Q18 Unit Shipments |

1Q18 Market Share |

1Q17 Unit Shipments |

1Q17 Market Share |

Year-Over-Year Growth |

|

1. Apple |

9.1 |

28.8% |

8.9 |

24.9% |

2.1% |

|

2. Samsung |

5.3 |

16.7% |

6.0 |

16.7% |

-11.4% |

|

3. Huawei |

3.2 |

10.0% |

2.8 |

7.8% |

13.0% |

|

4. Lenovo |

2.1 |

6.6% |

2.1 |

5.8% |

1.8% |

|

5. Amazon.com |

1.1 |

3.5% |

2.2 |

6.0% |

-49.5% |

|

Others |

10.9 |

34.4% |

13.9 |

38.8% |

-21.7% |

|

Total |

31.7 |

100.0% |

35.8 |

100.0% |

-11.7% |

|

Source: IDC Worldwide Quarterly PCD Tracker, May 3, 2018 |

|||||

Notes:

-

Total tablet market includes slate tablets plus detachable tablets. References to “tablets” in this release include both slate tablets and detachable devices.

-

“Convertibles” refers to convertible notebooks, which are notebook PCs that have keyboards that can either flip, spin, or twist, but unlike detachable tablets, convertible notebook keyboards are hardwired to the display.

-

Data is preliminary and subject to change.

-

Company shipments are branded device shipments and exclude OEM sales for all companies.

-

The “Company” represents the current parent company (or holding company) for all brands owned and operated as subsidiary.

-

About IDC Trackers

About IDC Trackers

IDC Tracker products provide accurate and timely market size, company share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of International Data Group (IDG), the world’s leading media, data and marketing services company that activates and engages the most influential technology buyers. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC and LinkedIn.