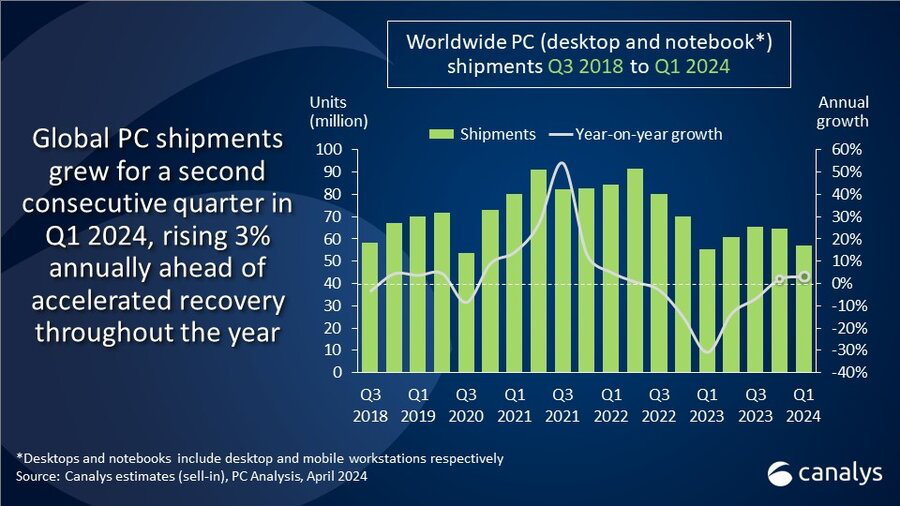

According to market research firm, the global PC market is showing signs of vitality and promise. There’s been a 3.2% year-over-year increase in desktop and notebook shipments, totaling 57.2 million units in the first quarter alone. The notebook segment, inclusive of mobile workstations, is riding a high with a 4.2% bump to 45.1 million units shipped. Desktops, on the other hand, are holding their ground with a slight 0.4% dip, rounding off at 12.1 million units.

This uptick isn’t just a flash in the pan. It reflects a broader resurgence in PC demand across various segments, with expectations of accelerated purchases as the year progresses. Two major tailwinds contributing to this optimistic forecast include the widespread adoption of Windows 11 and the impending introduction of AI-capable PCs.

While inventory adjustments and economic conditions in some areas might dampen demand temporarily, the silver lining lies in the refresh opportunity, especially from the business sector. The convergence of a larger and aging PC base with the innovative push towards AI-capable PCs could rejuvenate the market significantly. Canalys expects that nearly 50 million PCs equipped with dedicated AI accelerators, like NPUs, will ship in 2024.

As for the present, leading the pack of the world’s biggest PC vendors is Lenovo, grabbing a 24% market share with an impressive 8% growth and 13.7 million units shipped. HP follows, with 12.0 million units, while Dell, despite a slight 2% dip, holds onto the third spot. Apple, not far behind, had 2.5% growth, attributed largely to its late-quarter launch of new MacBook Air models. Acer completes the top five, with 3.7 million PCs shipped.

| Vendor | Q1 2024 Shipments | Q1 2024 Market Share | Q1 2023 Shipments | Q1 2023 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Lenovo | 13,735 | 24.0% | 12,746 | 23.0% | 7.8% |

| HP | 12,029 | 21.0% | 11,999 | 21.6% | 0.3% |

| Dell | 9,273 | 16.2% | 9,481 | 17.1% | -2.2% |

| Apple | 5,361 | 9.4% | 5,231 | 9.4% | 2.5% |

| Acer | 3,727 | 6.5% | 3,523 | 6.4% | 5.8% |

| Others | 13,117 | 22.9% | 12,475 | 22.5% | 5.1% |

| Total | 57,242 | 100.0% | 55,455 | 100.0% | 3.2% |