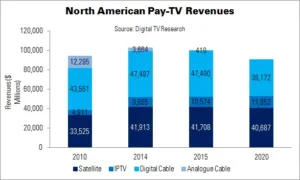

North American pay-TV revenues peaked in 2013, at $102.9 billion. Digital TV Research now forecasts that they will fall 11.7% ($12 billion) between 2014 and 2020, to end at $90.7 billion.

Cable revenues in Canada and the USA will fall $13 billion ($3.7 billion from analogue and $9.7 billion from digital), while satellite will decline $1.2 billion and IPTV will rise $2.2 billion.

By 2020, there will be 56.6 million cable TV subscribers in North America. Satellite will overtake the platform, to become the largest pay-TV platform earner, in 2019 – despite revenues falling to $40.7 billion. Homes paying for IPTV will climb 23% between 2014 and 2020, to reach almost 18.1 million (13.5% market share).

Traditional pay-TV households will remain flat, at 110 million. However, penetration will fall from 86.7% in 2010 to 82.6% by the end of the forecast period. Homes that do not pay for a TV service will rise from 18.9 million to 26.3 million.

OTT will rise significantly. Digital TV Research estimates that revenues will climb to $10.4 billion in 2020, from $6.9 billion in 2014.

SVoD subscribers will reach 66.9 million in 2020, up from 50.6 million in 2014. Revenues will top $6.9 billion, from $4.9 billion in 2014.