Changing panel prices are becoming the largest swing factor to TV makers’ profitability, says David Hsieh of DisplaySearch (http://tinyurl.com/ofwz9e6). The LCD module represents between 70% and 80% of the cost of a set, and the panel contains the majority of value-added features.

It is always a challenge for TV makers to balance market share against higher prices that erode margins. Neither LG nor Samsung showed good performance in their recent financial results, which Hsieh blames on ‘soaring’ TV panel prices. TV revenues are the most significant part of both companies’ multimedia and home entertainment departments; Samsung’s business unit had an operating profit margin (OPM) of 1.3% in Q4’14, while LG’s was 0%.

The same high panel prices that kept set maker profits low – even those with affiliate panel brands, like Samsung and LG – were responsible for high panel maker profit margins, especially in Q3 and Q4 last year. Many LCD modules and open cells are at historically-high levels of profitability, according to DisplaySearch.

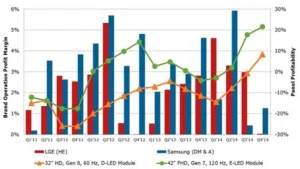

When the panel market is in oversupply, set makers’ profitability rises. In 2011 – a time of serious oversupply – the profit on a 32″ HD 60Hz LCD module, with a direct-LED backlight and made on a G8 fab, was between -20% and -25%. At the same time, LG’s Home Entertainment (HE) division raised its profit margin from 1% to 3%, and then a high of 5.5% in Q2’12.

As panel profitability rose in Q2’12 – Q3’12, LG HE’s profit margins began to shrink. OPM was 0% in Q4’12, but panel makers were only slightly profitable. In 2013, the opposite was true. Panel profitability fell as LG HE’s profits rose slowly; in Q1’14, LG HE’s profit was 4.5%, but profit on the same 32″ module was -15%. Since then, prices have climbed rapidly, to 10% profit in Q4’14, leading to 0% profit for LG HE again.

In 2011, the profitability of a 42″ FullHD 120Hz LCD module with an edge-LED backlight, produced at a G7 fab, was -10%. Samsung’s Digital Multimedia and Appliance (DM&A) division had >3% profit. Panel profitability rose in 2012 and 2013; Samsung DM&A’s OPM rose to its highest level, above 5.5%, in Q2’12, then fell.

In 2013, the division’s profit fell, while panel makers’ profit on the same 42″ module hovered around 0%. Panel profitability reached a low (-5%) in Q4’13, but TV makers’ OPM was at a high (5%). As with LG HE’s profitability, the rise of panel prices in 2014 has led to a poor business situation for Samsung DM&A.

New features being added by panel and set makers, such as new sizes and models, rely on the LCD module. ‘The only solution is for panel makers to step into the TV manufacturing industry directly or for TV makers to build their own fabs to offset the profitability challenges’, writes Hsieh.

Exchange rates are also important in TV brand profitability. While TVs are sold worldwide using local currencies, panels are traded with US dollars. The strong dollar could erode TV makers’ margins this year, while panel makers are comparatively secure.