Retail shipments of OTT set-top boxes (STBs) will overtake IPTV STB shipments from pay-TV operators this year, says IHS. 31 million retail OTT units will be shipped in 2015, compared to 30 million IPTV STBs from telcos.

OTT STBs were originally seen as a temporary measure to bring OTT video to TVs. It was assumed that they would be replaced by smart TVs, Blu-ray players, games consoles and similar products. However, they have still managed to grow, despite consumer adoption of other smart devices.

Content strategies of OTT STB vendors play a large part in these products’ popularity. Apple, Google and Roku have aggressively added new content and apps to their devices. Users can buy a dedicated box to choose the OTT services that they want, rather than simply accepting pre-installed options.

Pay-TV operators have embraced OTT with their own IPTV STBs and OTT services, launched in competition. These companies are increasingly relying on their STBs’ OTT features to enable catch-up services and features such as search and recommendation. Some vendors, such as Dish and Virgin Media, have begun to provide access to other video providers’ services, such as Netflix.

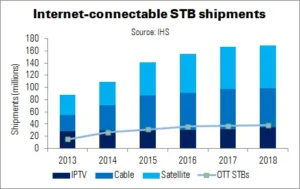

Total ‘connectable’ pay-TV STB shipments (including IPTV, cable and DTT satellite STBs) have outgrown OTT STBs. In 2018, IHS expects 169 million pay-TV STBs to be shipped, compared to just 38 million retail OTT STBs.

Although total shipments of pay-TV STBs are expected to fall 5% between 2014 and 2018 (to 197 million), they will still provide “an important opportunity” for STB vendors to grow their businesses, says IHS’ Daniel Simmons.

“Given the rate at which pay TV operators are integrating OTT services alongside traditional pay-TV features on their STBS, it’s likely that pay TV STBs will prove to be a bigger threat than smart TVs to the retail OTT STB market”, Simmons concluded.