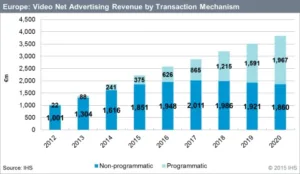

A new study released today by IHS Inc. (NYSE: IHS), the leading global source of critical information and insight, and SpotX, the video inventory management platform for publishers, found that revenue across Europe from online video jumped from €22 million in 2012 to €375 million in 2015. IHS forecasts that €2 billion, which is over half of all online video advertising revenue, will be generated programmatically by 2020.

Programmatic video is the automation of ads through the use of algorithms powered by the overlay of demographic (age, gender, income) and behavioural (gamer, traveler, football fan) data.

“Programmatic video advertising in Europe is on the path from experimentation to ubiquity,” said Daniel Knapp, senior director at IHS Technology. “In three of the markets surveyed – Netherlands, U.K., and France – programmatic video will even become the predominant source of video advertising revenue by 2020.”

Germany

Germany has the largest advertising market in Europe and the second largest digital advertising market after the U.K., or the largest if factoring out paid-for search. “The German online video advertising market will be worth €331 million in 2015 establishing it as the number three video advertising market in this study behind the U.K. and France,” Knapp said.

France

“France is a programmatic pioneer market,” said Eleni Marouli senior analyst at IHS Technology. While imbalances between a data-savvy demand side and a data-poor supply side have meant growing pains for many programmatic markets, France had an equilibrium of these issues which helped overcome hesitation and preconceptions of programmatic advertising.

“This environment helped the expansion of programmatic ads from banner display formats to higher-value video formats,” Marouli said.

IHS forecasts that by end of 2015, 18.6 percent of all video advertising revenue in France will be generated by programmatic means, placing it third behind the Netherlands and the U.K. in terms of market penetration. By 2020, 54 percent of all French video revenue will be generated via programmatic channels.

Italy

“Italy is a programmatic video market waiting to happen, and we expect the market to explode in late 2016 and 2017,” Knapp said. “We consider the revision of European data protection regulation and the establishment of the EU Digital Single Market as major drivers for improving volume, quality and utility of available data. The Italian market will rapidly scale to a strong middle position among European markets by 2020 when programmatic video will fetch 46.6 percent of all video advertising revenue.”

Data

Territories covered in the report include France, Germany, Italy, Spain, U.K., Denmark, Finland, Norway, Sweden, Belgium, Netherlands, Austria, Switzerland and Poland.