The Europe, Middle East, and Africa (EMEA) traditional PC market (desktops, notebooks, and workstations) came in stable in the third quarter of 2018, with the market turning positive (+0.5% YoY) and totaling 18.1 million units, according to International Data Corporation (IDC).

The commercial space grew 4.9% YoY as ongoing device renewals continued and the adoption of Windows 10 picked up, while the consumer space remained negative (-4.1% YoY), recording a decrease in both desktops and notebooks. Desktops declined for the first time this year (-2.4% YoY), but continued to grow in the commercial space. A stable notebook performance (+1.4% YoY) kept the market in positive territory, as mobility adoption and renewals continue to drive demand in the commercial space.

The Western European traditional PC market registered overall growth of 2.0% YoY, with the commercial segment continuing to show strong growth (+8.3% YoY), offsetting the impact of the consumer decline (-5.5% YoY). The overall consumer decline can be attributed primarily to desktop, where erosion persisted, while notebook also continued to decline, albeit at a softer rate. On the commercial side, ongoing device renewals in the midmarket space, as well as growing Windows 10 adoption, continued to drive growth in this segment. Being a back-to-school quarter, education undoubtedly contributed to this growth. From a sub-regional perspective, the Nordics, DACH, and UKI were strong performers this quarter, but Benelux recorded the strongest results, boosted by strong double-digit growth in the commercial space.

“In WE, renewals continued to affect the commercial space positively, despite the impact of the component shortage, especially on the CPU side,” said Laura Llames, research analyst, IDC Western Europe Personal Computing. “All the subregions performed well in this space, with Benelux and DACH leading the rally.”

Despite the negative performance in the consumer PC market in Western Europe, ultramobile, thin and light, and 2-in-1 devices continue to elicit consumer interest, softening the overall notebook decline as the holiday season approaches. Gaming, while not substantial in volume, persists in providing a strong pocket of growth in this segment.

“The third quarter of the year reported surprising results given the different dynamics in the CEE and MEA regions,” said Stefania Lorenz Associate VP CEMA. “The traditional PC market in the CEMA region reported a contraction of 2.4% YoY. The MEA dragged the overall region to negative results due to the worst decline recorded in Turkey as the market dropped by nearly 60% YoY. The country is facing major challenges with currency fluctuation as well as economic uncertainty affecting all commercial sectors.”

“Contrary to the strong decline in MEA, the CEE region reported better than expected results, increasing 7.1% YoY,” said Nikolina Jurisic, product manager, IDC CEMA. “Behind the overall success is Russia reporting double-digit growth. Despite all the uncertainty about sanctions and fluctuation of the ruble, the country’s economy remained stable with low inflation during the quarter. Demand continued to be strong thanks to few large deals in the corporate and public sector and with retailers already purchasing for the Christmas season.”

Vendor Highlights

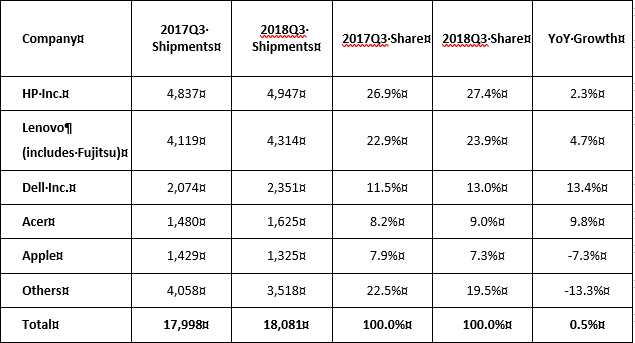

Traditional PC market consolidation persisted, and the top 3 vendors’ share continued to grow in 2018Q3. The top 3 players accounted for 64.2% of total market volume, compared with 61.3% in 2017Q3.

-

HP Inc held on to no. 1 position in EMEA, gaining 0.5% YoY to reach 28.4% market share. Solid results across both segments helped maintain the company’s leadership position.

-

Lenovo (including Fujitsu) once again secured the second spot, reporting 23.9% market share (an increase of 1.0% YoY). Particularly strong notebook performance in the commercial space supported its overall results.

-

Dell Inc. retained third place with a market share of 13.0% (up 1.5% YoY). Dell had an exceptional quarter, with double-digit growth across both segments attributing to their strong growth in market share.

-

Acer came fourth in the overall ranking with 9.0% market share (up 0.8% YoY). A solid performance in the shrinking consumer market, and an exceptional commercial performance, aided by back to school, drove this growth.

-

Apple crept into fifth with 7.3% market share (down 0.6% YoY). Despite a decline, Apple outperformed ASUS, which continued to erode in the EMEA market.

Top 5 Companies: Europe, the Middle East, and Africa (EMEA) Traditional PC Shipments*

2018Q3 (Preliminary) (000 Units)

Source: IDC Quarterly PCD Tracker (PC Pivot)

EMEA Preliminary, 2018Q3, October 2018

Table notes:

-

Some IDC estimates were made prior to financial earnings reports.

-

Shipments include shipments to distribution channels or end users. OEM sales are counted in the vendor/brand under which they are sold.

-

Traditional PCs include desktops, notebooks, and workstations, and do not include tablets or x86 servers. Detachable tablets and slate tablets are part of the Personal Computing Device Tracker, but are not addressed in this press release.

-

Data for all vendors is reported for calendar periods.

For more information on IDC’s EMEA Quarterly Personal Computing Device Tracker or other IDC research services, please contact Vice President Karine Paoli on +44 (0) 20 8987 7218 or at [email protected]. Alternatively, contact your local IDC office or visit www.idc.com.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries worldwide. For more than 50 years, IDC has provided strategic insights to help our clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.