DSCC is reporting that it anticipates a 0.3% YoY decline in OLED smartphones, to 585 million units, and an 11% YoY decrease in panel revenues, to $29 billion. These declines are attributed to the slower-than-expected recovery in China post-pandemic, elevated inventories in the first half of 2023, and prevailing macroeconomic conditions.

For flexible OLEDs, 2023 is projected to deliver 14% YoY growth, but with a 9% YoY reduction in panel revenue due to a 20% decline in blended panel average selling prices (ASPs). Chinese OLED panel suppliers initiated an aggressive price-cutting strategy in 2022 to gain market share from Samsung Display’s rigid OLED business, resulting in a shift of significant volume from rigid to flexible OLEDs. Panel suppliers are eyeing a 5% – 10% increase in Q4’23, though challenges remain in negotiations.

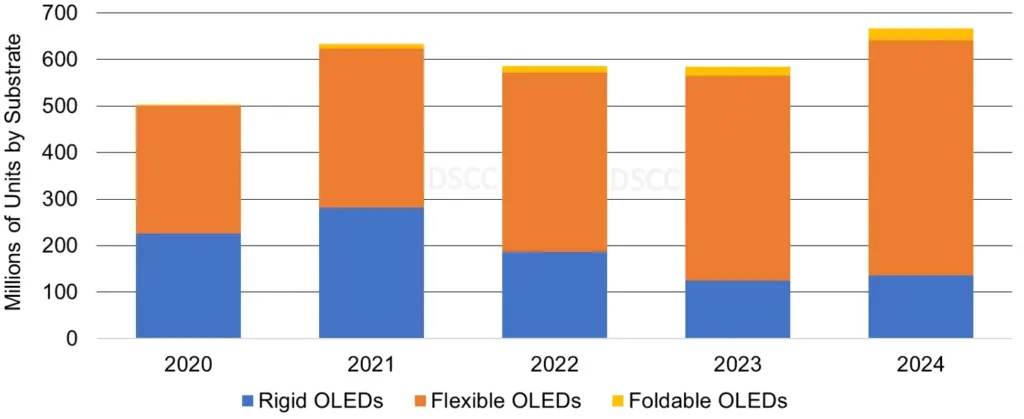

Flexible OLED smartphones are expected to expand their market share, surging from 66% in 2022 to 75% in 2023, while their revenue share is forecasted to rise from 80% to 83%. Foldable OLEDs are projected to increase from a 2.6% unit share in 2022 to 3.4% in 2023, representing 20 million panels, with the foldable panel revenue share rising from 7% to 10%. By contrast, rigid OLEDs are poised for a 33% YoY unit decline and a 49% YoY panel revenue drop in 2023, causing their share to decrease from 32% in 2022 to 21% in 2023, with revenue share dwindling from 13% to 7% due to a 24% decrease in ASPs.

Moving to 2024, DSCC predicts that flexible OLED smartphone panels will achieve a 76% unit share and an 81% revenue share, driven by substantial ASP declines. Foldable OLED smartphone panels are expected to capture a 4% unit share and an 11% revenue share. Despite a 33% YoY decline in 2023, rigid OLEDs are anticipated to experience a 9% increase in 2024, benefiting from a 6% rise in ASPs, as brands seek to recover lost volume in 2023 for entry-level price points.

In the second quarter of 2023, OLED smartphones saw a 6% QoQ and 4% YoY increase, reaching 138 million OLED smartphone panels. The growth stemmed from a 7% QoQ surge in flexible OLED panel shipments, primarily driven by higher volumes from Honor, Oppo, Vivo, and Xiaomi. Rigid OLED panels experienced a 1% QoQ increase due to higher volumes from Honor and Vivo, while foldable OLED smartphones soared with a 60% QoQ increase, fueled by Huawei, Samsung, Techno, and Xiaomi.

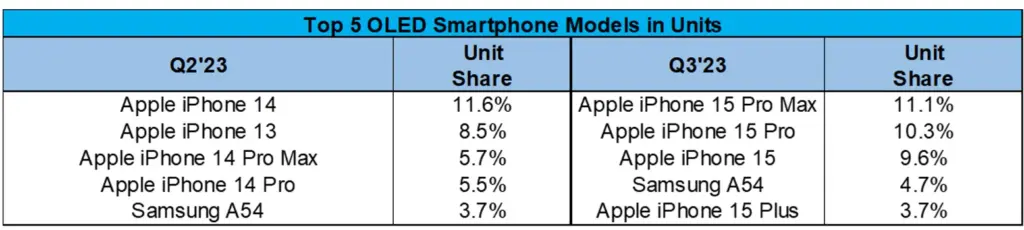

In Q2’23, Apple dominated the top five models, securing four out of five spots, with the iPhone 14, iPhone 13, iPhone 14 Pro Max, and iPhone 14 Pro. The Samsung S23 Ultra claimed the fifth position.

For Q3’23, DSCC anticipates a 1% QoQ and 13% YoY increase, totaling 139 million panels. This growth is attributed to significant panel shipments for the iPhone 15 series, triple-digit growth in foldable OLEDs, improved inventories, and seasonal patterns. In Q3’23, the top three models are expected to be the iPhone 15 Pro Max, iPhone 15 Pro, and iPhone 15, accounting for 31% unit share and 47% smartphone revenue share.