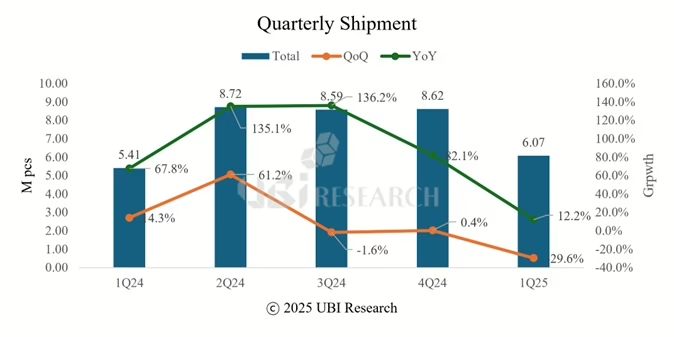

OLED panel shipments for medium-to-large displays jumped 12.2% in the first quarter as manufacturers capitalized on surging demand from automotive applications and premium consumer electronics, according to Korea’s UBI Research.

Revenue climbed even faster at 17.1% YoY, reflecting the premium pricing power of OLED technology as brands increasingly adopt the displays for high-end products. The growth comes as the global display industry navigates supply chain pressures and competitive dynamics between Asian manufacturers.

Samsung Display and LG Display, the sector’s dominant players, both posted YoY gains in their medium-to-large OLED shipments during the quarter. Chinese panel makers maintained steady performance compared to the same period last year, suggesting market share stabilization after years of aggressive expansion.

The automotive segment emerged as the standout performer, with OLED panel shipments tripling to 810,000 units from 270,000 units in the first quarter of 2024. Samsung Display led the charge with shipments surging to 540,000 units from just 100,000 units a year earlier, while competitors LG Display, BOE and Everdisplay held steady at previous levels.

The automotive momentum reflects broader industry trends toward premium in-vehicle displays as electric vehicle manufacturers and traditional automakers compete on interior technology. Chinese display maker Tianma has joined the push, actively promoting automotive OLED panels and expanding its customer relationships.

Automotive OLED shipments will reach 3 million units for the full year 2025, according to UBI Research, a 20% increase from 2024 levels. The company noted that growing demand for high-end automotive displays, combined with premium brand adoption of OLED technology, should drive continued expansion in the automotive segment.

Tablet PC shipments also contributed to growth, though quarterly momentum slowed. First-quarter OLED shipments for tablets reached 1.95 million units, down from 2.2 million in the previous quarter. LG Display bucked the trend by more than doubling its tablet shipments compared to the fourth quarter, benefiting from resumed panel production for Apple’s iPad Pro.

The monitor and TV segments also posted gains during the quarter, while notebook panel shipments declined slightly. The mixed performance across applications highlights how OLED adoption varies by product category and price sensitivity.