According to DSCC, the OLED market is experiencing a mix of trends across different segments. For mobile and IT applications, a current oversupply is anticipated to gradually decline by 2028. The fastest-growing segment in this market is OLEDs with a rigid glass substrate and thin-film encapsulation, primarily used for IT applications. And, despite oversupply, OLED TV panels will remain in surplus through 2028, with improvements in utilization not expected to limit supply.

Samsung’s dominance in the flexible OLED panel market, which includes foldable and rollable devices, is projected to decline from 40% in 2021 to 31% by 2028. This decrease is due to aggressive capacity expansions by Chinese manufacturers. BOE, currently the second-largest supplier, is expected to grow its market share to 25%, while LG Display will drop to fourth place by 2026, surpassed by Tianma, according to DSCC.

The overall demand for OLED panels saw a decline in 2022 and continued to decrease in 2023, primarily due to weak demand and inventory corrections in the TV market. Although a recovery in OLED TV demand is expected from 2024 onwards, the share of TV demand within the overall OLED market is not anticipated to return to previous levels.

By 2028, TV demand will likely represent only 39% of the total OLED area, while demand for IT-related applications such as monitors, notebooks, and tablets will rise to 21%. Smartphones are projected to account for 40% of the OLED area demand by 2028.

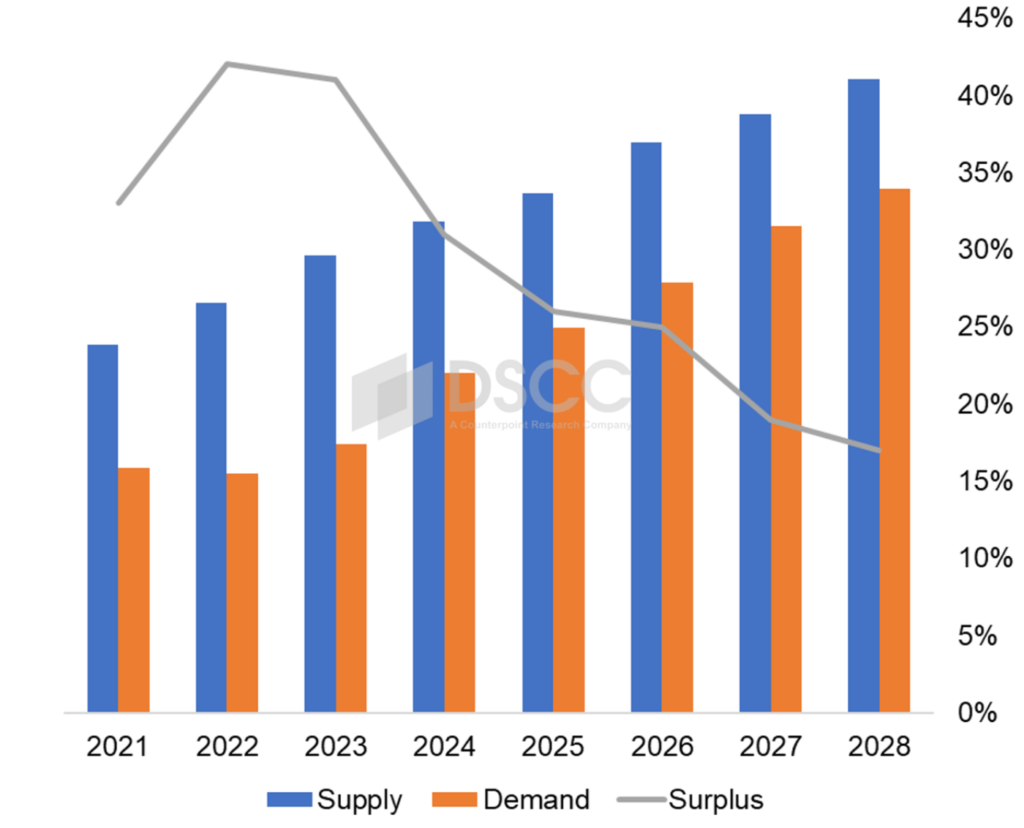

In the mobile OLED panel market, the oversupply that was reduced in 2021 due to growing demand saw an increase again in 2022 and 2023 because of a sharp decline in demand for rigid OLED panels for smartphones. However, steady demand growth coupled with controlled supply growth is expected to gradually reduce the oversupply through 2028.

For larger screen segments like TV and monitor panels, demand declined significantly in 2023, marking the second consecutive year of decline. With increased capacities from LG Display and Samsung Display, the capacity surplus surged from 9% in 2021 to 50% in 2023. Despite expectations of demand growth for OLED TV and monitor panels outpacing supply growth, a surplus of 22% is still projected for 2028.