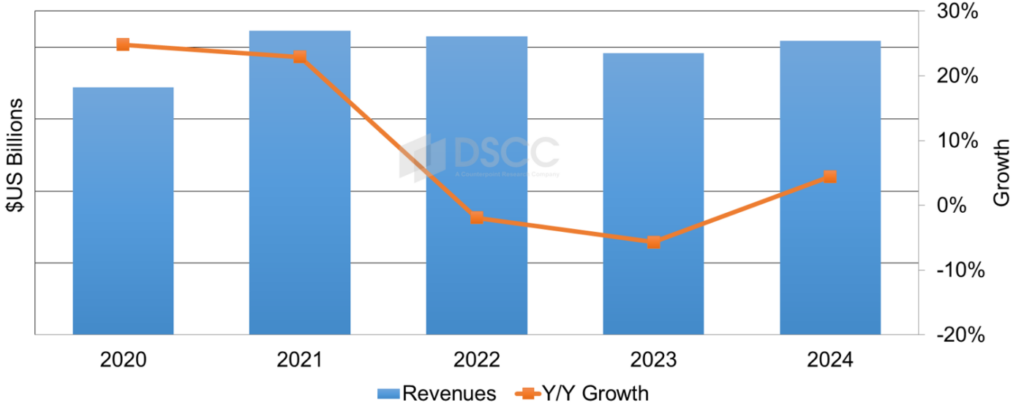

According to DSCC, the OLED panel market is set for a robust recovery in 2024, following a challenging 2023. Despite a 4% year-over-year (YoY) decline in OLED panel revenues in 2023, the market showed signs of improvement in the second half of the year, with revenues increasing by 50% compared to the first half. Looking ahead to 2024, DSCC forecasts an 11% YoY increase in OLED unit shipments and a 4% YoY growth in revenues.

The second half of 2023 saw a recovery in several segments, as excess inventories continued to improve and strong back-to-school and holiday selling periods boosted demand. China’s GDP grew 5.2% in 2023, surpassing the pessimistic estimate of 4.6%, while the US GDP grew 3.3%, indicating that the Federal Reserve had successfully managed to bring down inflation and secure a “soft landing” without major repercussions for workers or the economy.

The recovery in 2024 is anticipated to be driven by unit and revenue growth for flagship smartphones and OLED TVs, supported by lower panel average selling prices (ASPs). In the IT applications segment, OLED tablets are expected to experience triple-digit YoY growth, largely due to Apple’s entry into the OLED tablet category, while monitors and notebook PCs are also projected to see double-digit YoY growth.