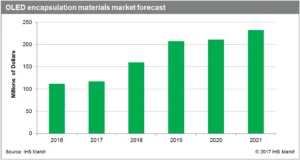

The popularity of organic light-emitting diode (OLED) TVs and smartphones has boosted not only the OLED display market but also the OLED encapsulation materials market. According to IHS Markit, a world leader in critical information, analytics and solutions, the OLED encapsulation materials market is expected to grow 4.7 percent in 2017 compared to a year ago, to $117 million.

“The market is forecast to grow even faster as Chinese and South Korean panel makers have aggressively invested in new OLED fabs, resulting in the increase in OLED shipments in terms of area,” said Richard Son, senior analyst at IHS Markit. In particular, South Korean Chinese panel makers recently announced new OLED fab investment plans for not only Gen 6 but also Gen 8.5 and even for Gen 10.5.

As a result of the investment, the OLED encapsulation materials market is forecast to reach $232.5 million by 2021, growing at a compound annual growth rate of 16 percent from 2017.

Unlike thin-film transistor liquid crystal display (TFT-LCD), OLED displays require encapsulation as the organic elements are vulnerable to moisture. The OLED encapsulation materials can be categorized into metal, frit glass, thin-film encapsulation (TFE) and hybrid.

The metal type is expected to lead the market in terms of revenue because it is mainly used for OLED TVs whose growth is fastest. However, with Chinese smartphone brands releasing a wide range of new products with OLED panels, demand for frit glass encapsulation materials, which are currently applied to smartphones with rigid-OLED displays, will remain steady, though losing its market share.

According to the AMOLED Encapsulation Materials Report 2017 by IHS Markit, in terms of revenue, metal type encapsulation is expected to account for 50 percent and the frit glass type to take 43 percent in 2017, and 67 percent and 23 percent in 2021, respectively.

“Hybrid encapsulation, which combines TFE with a barrier film, has high production cost and its flexibility is limited, and thus demand for the hybrid type will not increase significantly,” Son said. “However, the latecomers are focusing on the hybrid encapsulation as it has a lower technological entry barrier compared to TFE, allowing them to succeed in mass production faster than when using TFE.”

From a mid- and long-term perspective, the hybrid encapsulation materials market will continue to grow for a while. TFE and the hybrid type are expected to take 6 percent and 1 percent of the encapsulation materials revenue market in 2017, respectively, but they will grow to reach 7 percent and 3.5 percent respectively in 2021.

The AMOLED Encapsulation Materials Report 2017 by IHS Markit provides information about the entire range of OLED encapsulation materials shipments by technology and application, including five-year forecast. Latest industry trends, including new technology development trends, are also updated.