OLED displays are ready to excel in next generations smartphones by bringing in thinner, lighter, lower power and higher performance products with differentiated designs and form factors. Technology is advancing. New materials, new process, new suppliers, new fabs and higher production are starting to come in.

Tremendous technology development will be coming in next few years to empower OLED display for next gen smartphones driving strong growth. But cost reductions, with yield , material and process improvements will take time before OLED display can achieve dominant unit market share.

Rigid OLED: Receiving renewed interest

Rigid OLED display first came to smartphones through Samsung, and chosen because they had a thinner, lighter form factor, better viewing angles, higher contrast and faster response time. OLED served mostly high-end and mid-range markets with limited market share. But the demand changed with introduction of flexible OLED displays. Samsung Display and LG Display both offered flexible OLED display for design differentiation in 2013.

Flexible OLED received low acceptance due to its high price and design issues. Flexible displays gained higher acceptance with Samsung’s Galaxy products with the new curved design (Edge design).

Samsung’s S6 Edge showed how flexible OLED could enable new form factors

Samsung’s S6 Edge showed how flexible OLED could enable new form factors

It reached the highest level of interest with Apple’s decision’s to use flexible OLED display for the iPhone X in 2017. All other smartphone brands also wanted to emulate Apple and focused their design on flexible displays. Market interest shifted from rigid to flexible and demand also shifted.

Most of the new suppliers from China decided to focus on flexible OLED production. But, after lower than expected sales of iPhone X especially in early 2018, the industry’s interest has now shifted to rigid OLED displays. Rigid OLED display cost has the potential to come closer to LTPS LCD’s cost level, especially for Samsung Display. But new suppliers will face cost challenges. The possibility of a lower price gap with LTPS LCD combined with the advantages of OLED is bringing renewed interest in rigid OLEDs.

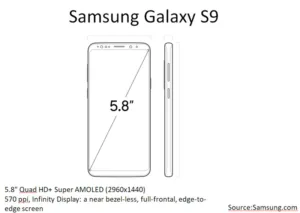

Samsung Display has increased its utilization rates in recent months bringing in higher production. Tianma, has also started rigid OLED production. Still there exist many challenges such as: not enough suppliers are focusing on rigid OLED and most of the new planned capacity from China is for flexible displays. There is very little design differentiation between LTPS LCD and rigid OLED smartphones due to new 18:9 full active bezel less screen designs.

Also miniLED backlight options are coming to LTPS offering higher contrast (by local area dimming), faster response time, and reducing the performance gap with OLED. That is why suppliers such as AUO, BOE, Tianma and many others showcased prototypes of miniLED based products at Display Week 2018. MiniLED backlight LTPS LCD costs are still high, but it may offer strong competition to rigid OLED in tne next few years.

Flexible OLED: Bringing in design differentiation

Flexible OLED display’s success came from design differentiation. The smartphone market has matured and growth has slowed down considerably in 2018. Brands are looking for design differentiation to drive replacement demand. OLED already shines inthe flexible display market with volume production popularized by Samsung’s Galaxy smartphones and Apple’s iPhone X. This technology is poised to dominate the next generation smartphone market with thinner, lighter, bezel less, immersive screens and differentiating form factors. But high costs will limit adoption rates in the near term, especially when most of the growth is coming from lowered priced products for the emerging markets.

Samsung is still the dominant supplier of flexible OLED in 2018, with long manufacturing experience and high capacity. BOE, Tianma, Visionox and LG Display, are all starting to bring in new supply. But manufacturing complexity of flexible OLED display will keep yield rates low and cost high for new suppliers. Due to the higher costs, most of the products will be for the high-end market, far from the affordable products needed for rapid unit growth. It may take another few years before costs can really come down and price can be competitive for mass-market adoption rates.

Foldable flexible OLED: Enabling form factor transformation

OLED display is ready to shift to the next level by bringing truly flexible, foldable, rollable and transparent displays for next generation smartphones. Samsung has been in the forefront of smartphone developments with its rigid and flexible OLED display-based products. Samsung is also expected to introduce its first foldable smartphones in the near future. Foldable products can be unidirectional, bi-directional, and can have single fold or multiple folds providing design flexibility. A big advantage of a foldable display is the ability to have “thin light unbreakable larger displays in a smaller form factor”. Foldable display curvature will need to be 1 – 3mm thickness and needs to provide the ability to bend multiple times without degradation. This has been a major challenge.

However, many display industry people believe foldable phones can only be ready for high volume production in 2019 or later, as the technology needs more time to mature. There are many challenges including

- process technology,

- materials,

- manufacturing issues,

- high capex,

- higher costs,

- high prices for consumer devices,

- durability of the products,

- design acceptance by consumers, and

- consumer willingness to pay higher prices for the new designs.

Besides Samsung, many other companies are working on foldable phone prototypes. BOE, Tianma and Visionox showed many flexible and foldable OLED displays at Display Week 2018. BOE showed prototypes of 5.99″ foldable smartphone and a 7.56-inch foldable tablet, with a radius of only 1mm. Tianma showcased 5.99″ foldable/flexible displays. Many suppliers are working on development of other components for foldable and rollable display. But product development and manufacturing process will be very complex with many technology and cost challenges. Foldable smartphone products will take a few years to have competitive price for mass production and mass-market acceptance.

OLED production: Improving on all fronts

Many suppliers including Universal Display, Cynora, Kulux and others are working towards improving the efficiency, resolutions, lifetime and costs to bring OLED to its full potential. Combined with printable OLED manufacturing capabilities, they have the potential to enable lower-cost flexible, foldable, rollable and transparent displays for the smartphone market.

Even though the potential future of next generation flexible and foldable displays is very promising, the technology needs more time to develop to meet expectations. Higher performance and differentiated form factors will not be enough. They have to be combined with higher production volumes and lower costs before OLED can achieve dominant unit market share in the smartphone market. – Sweta Dash

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insight.com