The OLED Association (OLED-A) has released its data for 2015, and some interesting projections for the year ahead.

2015 was a ‘great year’ for OLED displays, with shipments rising 53% YoY, to almost 275 million. This compares very favourably to 2014, when shipments were down 17%. Revenues for AMOLED displays also rose, climbing 40% to almost $13 billion. Again, these were down in 2014 (-18%).

Samsung Display and LG Display were responsible for the growth of OLED technology. Samsung aggressively rolled out its smartphone displays to vendors other than Samsung Electronics, and promoted flexible display technology in a high volume product (G6 Edge and Edge+).

LG, meanwhile, sold more than 400,000 OLED TVs and around 14 million (the OLED-A said 14,000, but we believe this is millions – Man. Ed.) flexible OLED displays (thanks to the Apple Watch). The TV shipments were only 65% of LG’s target. However, the company had managed to reduce the OLED-LCD cost premium of 55″ and 65″ TVs to around 10%-20% by the end of the year.

Other OLED makers, such as JOLED, AUO and BOE, were relatively quiet. They announced plans and prototypes, but only shipped very low numbers of commercial products.

There were a number of technology announcements last year:

- Samsung said that it is using Kateeva IJP equipment for organic material deposition;

- LG demonstrated large rollable panels, which could be commercialised by 2017;

- DuPont opened a new facility, where it will produce pure soluble organic material for use with IJP. The company also signed a joint development agreement to work with Kateeva;

- Merck announced a new facility to produce soluble phosphorescent material, and provided specifications for red and green materials. These appear to have performance levels around 33% of a vacuum-deposited material and close to the same efficacy;

- Idemitsu Kosan and Doosan Corp. agreed to develop, manufacture and sell OLED materials using each other’s patents;

- Dow Chemicals and DuPont announced their intent to merge, and to eventually form three separate companies.

Finally, there were multiple claims at the end of the year that Apple would soon begin to use OLED displays in its iPhones.

Future Predictions – Smartphones

- The OLED-A expects Apple to announce contracts with Samsung and LG to supply OLED displays for the iPhone 8, starting in Q4’18. The company will also continue to negotiate OLED supply with JDI, beginning in 2019 or 2020. However, JDI will face some difficulty meeting the Apple specification in its first production fab (a G6 conversion from a-Si LCD). OLED shipments to Apple are expected to be around 30 million units in 2018 and 70 million in 2019.

- LG will announce that it is switching from fluorescent to phosphorescent red and green materials in 2017, in preparation for supplying OLED smartphone panels that are comparable to Samsung’s.

- Samsung will begin the expansion of its A3 G6 flexible OLED fab, to meet Apple’s needs, and LG will begin to order equipment for its own G6 flexible facility. This prediction leads the OLED-A to conclude that the iPhone 8 will feature a flexible display.

- None of the Chinese OLED makers will be ready to ship volume displays to compete with LG or Samsung.

- AUO will abandon the OLED smartphone market, leaving it to Korean and Japanese companies.

- Foxconn will be in a ‘learning mode’ as it builds its own G6 OLED fab in Taiwan.

- LTPS prices will begin to fall, as smartphone makers gear up to use OLEDs.

- Finally, foldable displays will make their appearance in a Samsung smartphone, although this is likely to be a prototype or pre-production model.

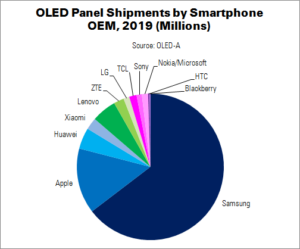

| OLED Panel Shipments by Smartphone OEM (Millions) | |||||||

|---|---|---|---|---|---|---|---|

| Vendor | 2013 | 2014 | 2015 (E) | 2016 (E) | 2017 (E) | 2018 (E) | 2019 (E) |

| Samsung | 209.1 | 166.8 | 237.1 | 249.2 | 260.9 | 279.3 | 298.0 |

| Apple | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 38.0 | 66.3 |

| Huawei | 0.0 | 0.0 | 2.1 | 4.7 | 6.3 | 13.4 | 21.5 |

| Xiaomi | 0.0 | 0.0 | 0.0 | 0.9 | 1.9 | 5.4 | 12.1 |

| Lenovo | 1.2 | 2.7 | 5.2 | 8.5 | 13.5 | 19.0 | 25.2 |

| ZTE | 0.0 | 0.0 | 0.6 | 1.3 | 3.1 | 7.2 | 10.4 |

| LG | 0.0 | 0.0 | 0.6 | 1.2 | 2.4 | 4.8 | 6.0 |

| TCL | 0.0 | 0.0 | 0.4 | 0.0 | 2.4 | 5.3 | 7.5 |

| Sony | 0.8 | 0.8 | 0.9 | 1.4 | 2.6 | 3.6 | 5.4 |

| Nokia/Microsoft | 0.6 | 1.0 | 3.4 | 7.5 | 7.0 | 6.3 | 6.3 |

| HTC | 0.0 | 0.0 | 0.2 | 0.3 | 0.5 | 0.9 | 1.6 |

| Blackberry | 0.0 | 0.0 | 0.0 | 0.1 | 0.2 | 0.5 | 0.7 |

| Other | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Total | 211.7 | 171.3 | 250.6 | 276.2 | 300.7 | 383.8 | 461.0 |

| Source: OLED-A | |||||||

Future Predictions – TVs

LG will remain the only OLED TV supplier this year, with shipment volume growing to around 1.1 million units. Prices for 55″ and 65″ units should become competitive with LCD high-end units, with a panel cost premium of 10%-15%. The company must also decide on a substrate size for its Paju facility.

Samsung is expected to maintain its R&D efforts, but will not announce an OLED TV in 2016. The company is currently very focused on LCD TVs, and will not weaken this market until it is completely ready to begin selling OLED sets. The OLED-A expects an introduction in 2017, with 8k resolutions and HDR. This is expected to be enabled through ‘some form of transparent graphene-based electrodes and a top emission architecture using IGZO and RGBW, with phosphorescent yellow and fluorescent blue materials’. Samsung will work on soluble material, but it is unlikely that these will have lifetimes to be competitive in TVs.

BOE will deliver a sample of 55″ OLED TVs to an unnamed Chinese brand. The results of this will be used to decide whether BOE is ready to commit to a G8.5 OLED facility. The OLED-A expects BOE’s TV to use metal oxide TFTs (probably IGZO) and RGBW.

No other Chinese maker will be ready to commit to OLED TVs. However, a big indicator will be how successful Skyworth is in selling the 200,000 55″ and 65″ OLED TVs from LG.

Other Predictions

- LGD, SDC and possibly AUO will introduce OLED panels for automobiles. These will need to demonstrate the ability to operate at high temperatures (higher than 100°) and long lifetimes. However, design wins are unlikely to be announced.

- New applications, such as transparent monitors, VR, video walls, rollable displays and notebook/tablet combinations, will emerge.

- The threat of BOE and CSOT building G9 or G10 fabs for 65″ TVs will cause OLED TV makers to reconsider their fab sizes.

- JOLED will announce that it is ready to produce tablet-size OLED panels by the end of 2016.

Analyst Comment

CES saw announcements from Lenovo, HP and Samsung on OLED notebooks and from Dell on monitors. Check this article for more. OLEDs Reach an Inflection Point at CES (Due for publication 5:00pm 14th Jan 2016) (BR)