UBI Research is reporting that the volume of emitting material used in 2024 was 130 tons, with Korean and Chinese panel makers seeing an uptick in business, up nearly 30% from 2023.

Samsung Display leads with the largest share driven by its rigid OLED shipments. the company accounted for 42% of the total OLED emission materials market by volume, followed by LG Display at 20% and BOE at 13.2%.

In China, OLED shipments for smartphones from BOE, TCL CSOT, Tianma, Visionox, and EDO grew at an astonishing CAGR of 51% from 114 million units in 2021 to 394 million units in 2024. Chinese panel makers have also recently started shipping IT OLED panels, driving steep volume increases for companies like BOE and EDO.

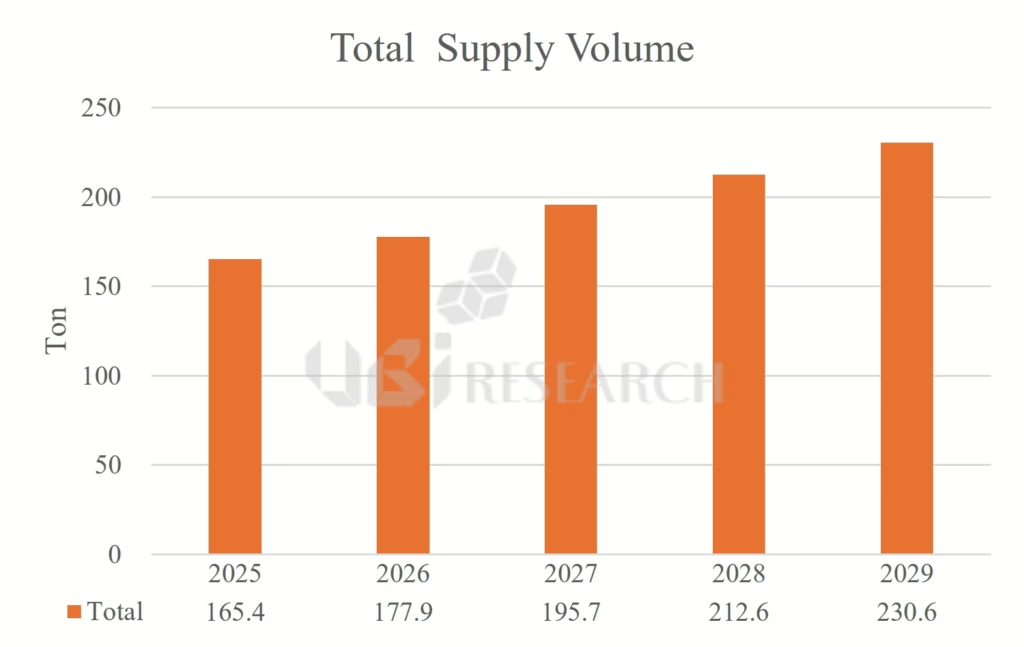

“In 2025, Samsung Display and LG Display are expected to ship more panels for iPhones than in 2024, and the overall shipments of IT devices such as tablet PCs, notebooks, and monitors are expected to increase significantly compared to 2024, so the growth of the luminescent material market is expected to continue for a while,” said Dr. Changho Noh of Ubi Research. “Additionally, with the expansion of mass production of OLEDs for IT by Chinese panel companies, the luminescent material market is expected to exceed 200 tons by 2028.”