Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and device today from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables.

New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter-it is the humane-machine interface.

The fourth quarter is typically flat to up in the seasonality cycles of the past and was below the ten-year average of 6.86%.

Quick highlights:

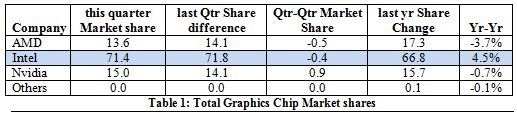

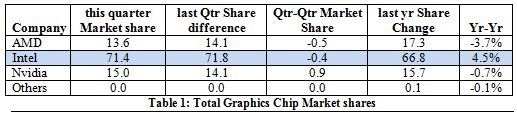

AMD’s overall unit shipments decreased -6.95% quarter-to-quarter, Intel’s total shipments decreased -3.98% from last quarter, and Nvidia’s increased 2.88%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs for the quarter was 142.75% down -10.44% and 30.18% of PCs had discrete GPUs, which is down -2.16%.

- The overall PC market increased 3.53% quarter-to-quarter, and decreased -0.72% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs decreased -0.68% from last quarter.

Q4 is, on average, usually flat or down from the previous quarter. There was an abnormal spike in 2009 after the massive market decline.

GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it is shipped, and most of the PC vendors are guiding cautiously for Q1’15.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in the quarter. Nvidia’s Maxwell GPUs continued to show strong sales, lifting the ASPs for the discrete GPU market.

Q4 2014 saw a jump in tablets from the first slowdown in tablet sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is 1.5%. We expect the total shipments of graphics chips in 2017 to be 483 million units. In 2013, 454 million GPUs were shipped and the forecast for 2015 is 470 million.

The quarter in general

AMD’s shipments of desktop heterogeneous GPU/CPUs, i.e., APUs decreased -30.0% from the previous quarter, but were up 4.6% in notebooks. AMD’s discrete desktop shipments decreased -15.97% and notebook discrete shipments decreased -16.6%. The company’s overall PC graphics shipments decreased -7.0%.

Intel’s desktop processor embedded graphics (EPGs) shipments decreased from last quarter by -4.4%, and notebooks decreased by -4.1%. The company’s overall PC graphics shipments decreased -4.0%.

Nvidia’s desktop discrete shipments were up 5.51% from last quarter; and the company’s notebook discrete shipments increased 0.1%. The company’s overall PC graphics shipment increased 2.9%.

Total discrete GPU (desktop and notebook) shipments from the last quarter decreased -3.38% and decreased -12.06% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the CAGR for PC graphics from 2014 to 2017 is now 1.5%.

Ninety nine percent of Intel’s non-server processors have graphics, and over 66% of AMD’s non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.55 GPUs per PC.

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In thishis detailed 50-page data-based report , JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it’s headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets),or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

The report contains the following content:

- Major suppliers: Detailed data-on the shipments of AMD, Intel, Nvidia, and others.

- Financial results for the leading suppliers: Analysis of the quarterly results of the leading GPU suppliers

- Market Forecasts: You will also be able to download a detailed spreadsheet and supporting charts that project the supplier’s shipments over the period 2001 to 2018. Projections are split into platforms and GPU type.

- GPUs: History, Status, and Analysis.

- Financial History from for the last nine quarter: Based on historic SEC filings, you can see current and historical sales and profit results of the leading suppliers.

- A Vision of the future: Building upon a solid foundation of facts, data and sober analysis, this section pulls together all of the report’s findings and paints a vivid picture of where the PC graphics market is headed.

- Charts, graphics, tables and more: Included with this report is an Excel workbook. It contains the data we used to create the charts in this report. The workbook has the charts and supplemental information.

Pricing and Availability

The Jon Peddie Research’s Market Watch is available now in both electronic and hard copy editions, and sells for $2,500. Included with this report is an Excel workbook with the data used to create the charts, the charts themselves, and supplemental information. The annual subscription price for JPR’s Market Watch is $4,000 and includes four quarterly issues. Full subscribers to JPR services receive Tech Watch (the company’s bi-weekly report) and a copy of Market Watch as part of their subscription.